Might the Financial Stock Surge Stall Today after Huge Rally

After the surprise US Election outcome, we’re seeing a flood of money into Financials, presumably on the expectation the new Republican administration will ease regulation and provide tax cuts that a Democratic administration would not have provided.

Whatever the logic, the reality is that funds have flooded into Financials, crashing the sector to the upside.

Here’s the XLF ETF and we’ll take a moment to look at individual components next:

The XLF tracks financial/bank stocks and is a popular index to track the health of the broader financial industry.

After a dip and reversal low in June, shares resumed the larger uptrend of higher highs and higher lows amid a rising moving average (how we define uptrends).

With the surprise election outcome, shares surged on Wednesday and traded higher every day… until now.

First, it’s an important lesson in how politics and markets intersect, often with explosive results.

Second, it’s a chance to profit from surprise outcomes.

Here’s the lead-up and surge in a few of the big financial stocks:

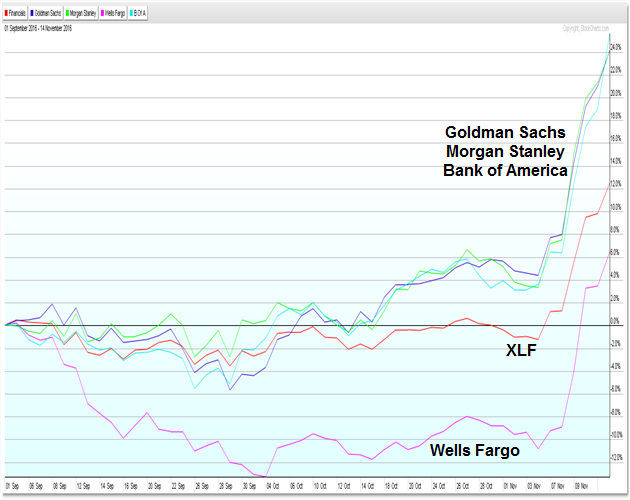

I’m starting this percentage chart on September 1st and tracking through November 15th, 2016.

We know that Wells Fargo came under investor pressure (selling) due to their fraud allegations in September.

Wells Fargo (WFC) trailed the pack of large, similar financial stocks (purple line at the bottom).

Goldman Sachs (GS), Morgan Stanley, (MS), and Bank of America (BAC) performed similarly through this period.

What’s striking is again the surge after the election in ALL stocks, Wells Fargo (WFC) included.

Markets – and stocks – are forward-looking vehicles. They price in all available information about the future. Price – buying and selling pressure – is a result of these complex calculations and assumptions.

The message is clear – “the market” (Wall Street/Funds, etc) expects financial companies to benefit from the new administration.

While we may see a pullback or retracement against the post-election surge, continue following this sector and the new money flow into this key sector of the market and economy.

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).” alt=”” width=”630″ height=”518″ />

Negative momentum and Breadth (Market Internal) divergences INTO this resistance give us pause.

Ultimately price reversed down away from the 2,170 target (discussed with members last night).

We’re seeing three retracement swings down away from 2,170 toward the 2,150 level.

At this moment, we’re seeing another bounce. Use 2,150 and 2,170 as short-term pivots in the new range.

Want these levels and additional strategy planning in advance each evening?

Get these levels in advance with in-depth planning and trading opportunities by joining the Daily Membership.

I really love this blog for all reasons with getting so many updates quite regularly and that’s something which brings easiness to all working. I love long term trading and it’s ever easy with OctaFX broker using their Islamic Account option which is very cool and I never have to worry about paying overnight charges and that really keeps me entirely comfortable and relaxed with doing everything, so I feel very comfortable and enables me to perform at best of my ability!