New Month June 1 Stock Scan and Flat Market Update

Stocks continued a sideways range, though we’re just now seeing a potential bullish breakout.

Let’s take a look at the current picture and plan the next swing in the market:

Price initially continued the intraday downtrend (falling trendline channel) but reversed up off another positive divergence at the session low.

From there, we saw a sharp rally take price above the 2,114 level – the falling trendline.

We’re monitoring the rest of the session for additional bullish action on an “Open Air” movement higher… and will balance that approach with a bearish/cautious stance IF price falls back under 2,112 and the trendline pattern.

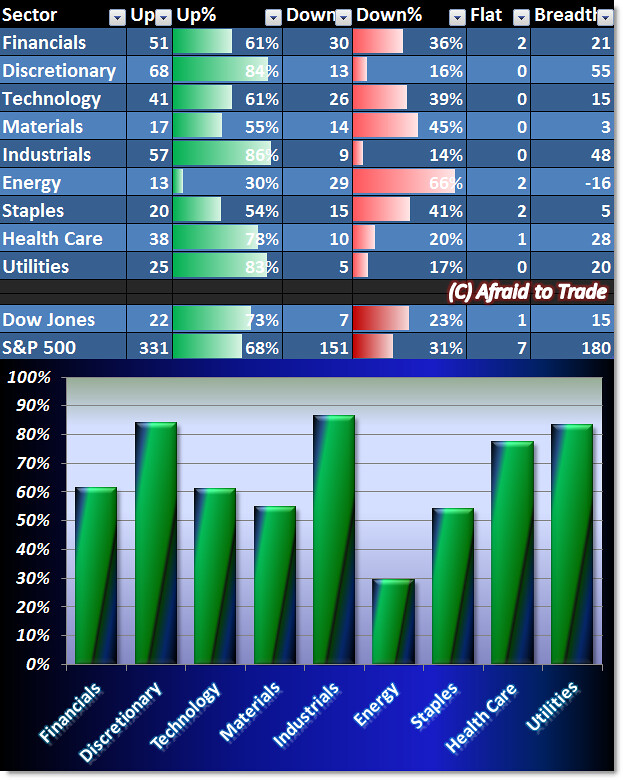

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Today’s Breadth Chart favors the BULLS as all sectors (except Energy) are above the 50% line.

Our strongest sectors are Industrials and Discretionary, followed by the defensive Health Care and Utilities.

Until proven otherwise, we’ll continue to hear a bullish message from Sector Breadth so far.

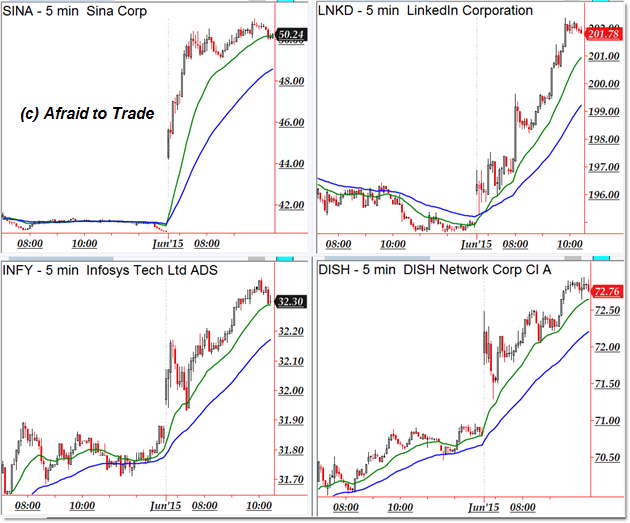

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

SINA Corp, Linked In (LNKD), Infosys (INFY), and DISH network.

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Puma Biotech (PBYI), Jumei (JMEI), BHP Billiton (BBL), and WYNN Resorts.

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

2 Comments

Comments are closed.