Nov 10 More Bullishness Market Update and Stock Scan for the Day

We have “more of the same” upside action in the stock market, defying bears all the way to even more new highs.

The short-squeeze continues and we have a repetitive morning pattern to study on the intraday frame (as seen Friday) which continued today.

Here’s our updated levels as the S&P trades through more all-time highs:

Our key pattern is the highlighted region where price traded down in the morning session, only to see a surge of impulsive, intervention buying that helped propel the market higher and trigger the stop-losses of the bears (short-sellers) at each breakout to new highs.

Patterns repeat and we continue to observe this pattern propelling price to new highs.

It’s difficult to buy a grossly extended market, but this ‘creeper trend’ has become the norm lately, so keep that in mind (we have to apply different tactics to impulsive movements like this).

When the market keeps doing the same thing, we’ll keep analyzing and trading it the exact same way.

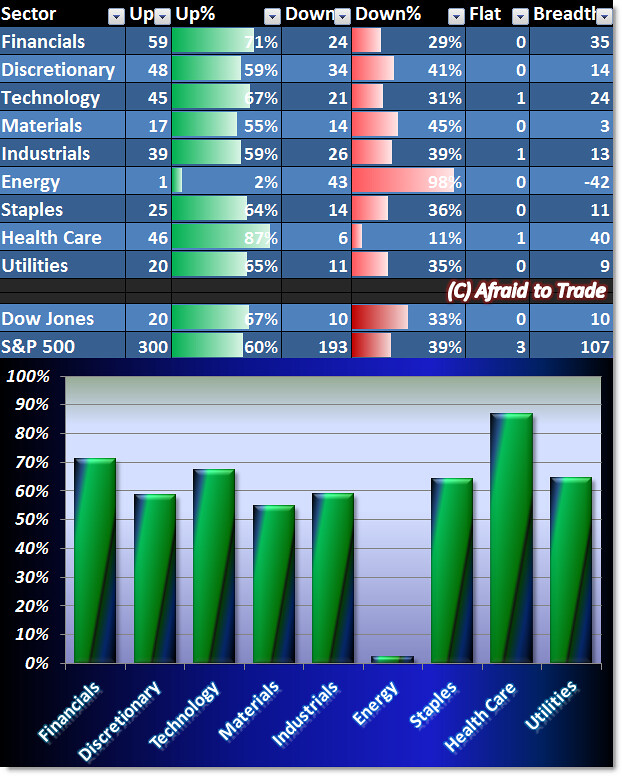

Breadth is slightly mixed – much like the market at the moment:

Money flow – as seen by Sector Strength today – is strongest in the DEFENSIVE Sectors of Staples, Health Care, and Utilities although there’s a bright spot in Financials and Technology.

Our worst performing sector again is Energy as oil prices continue to struggle to reverse off a low.

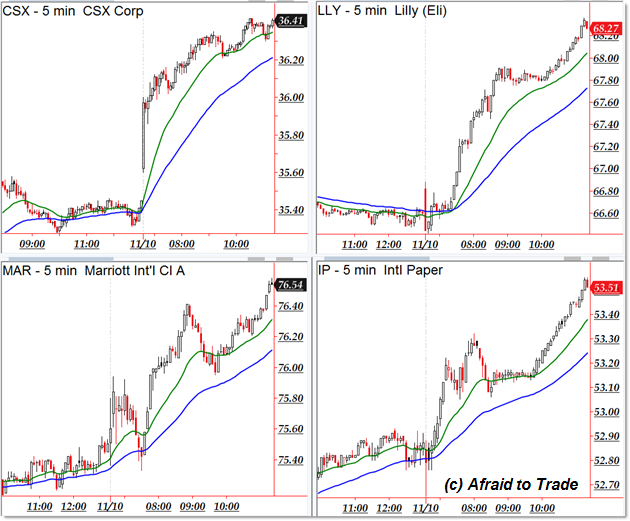

We have potential bullish trend continuation plays in the following stocks:

CSX, Eli Lilly (LLY), Marriott (MAR), and International Paper (IP).

Potential downtrending candidates exist in stocks showing relative weakness today:

Grainger (GWW), Time Warner Cable (TWC), Gamestop (GME), and Michael Kors (KORS).

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).