Nov 13 Big Retracement Market Update and Stock Scan

The steep sell swing continued in the S&P 500 as price moved toward the 2,025 target.

Let’s update our levels for the S&P 500 Index and note the big trending stocks today:

In-depth analysis is always provided to members of the Premium Daily Reports – I hope you’ll join and benefit.

Thursday’s breakdown under the 2,075 support level set in motion the current sell-swing that took price first toward the 2,060/2,065 pivot level and then today toward the 2,025 target.

Buyers are stepping in (at least intraday) at the 2,030 index level with positive divergences so update your charts to reflect this higher timeframe pivot.

Receive daily updates, planning, and education by joining the Afraid to Trade Premium Membership.

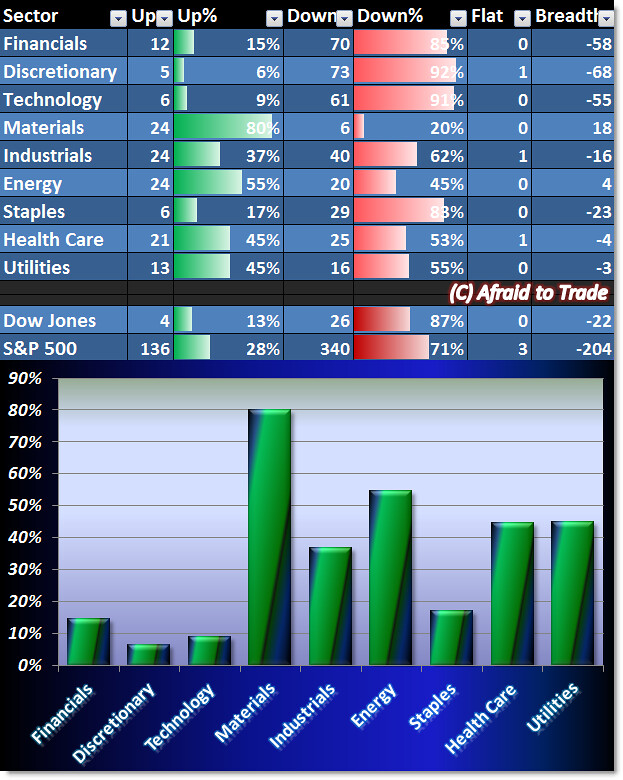

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

A strange thing is happening with Materials, our strongest sector today (80% of stocks are positive).

That’s the one bright spot in an otherwise sea of red (selling pressure).

We’re seeing the expected relative strength in defensive groups (Health Care and Utilities) and weakness in offensive groups (Financials, Tech, and Discretionary).

We’ll be cautious unless price instantly rebounds off the current 2,030 level.

Here’s a top-level or full-perspective view of today’s S&P 500 stock performance (courtesy of FinViz.com).

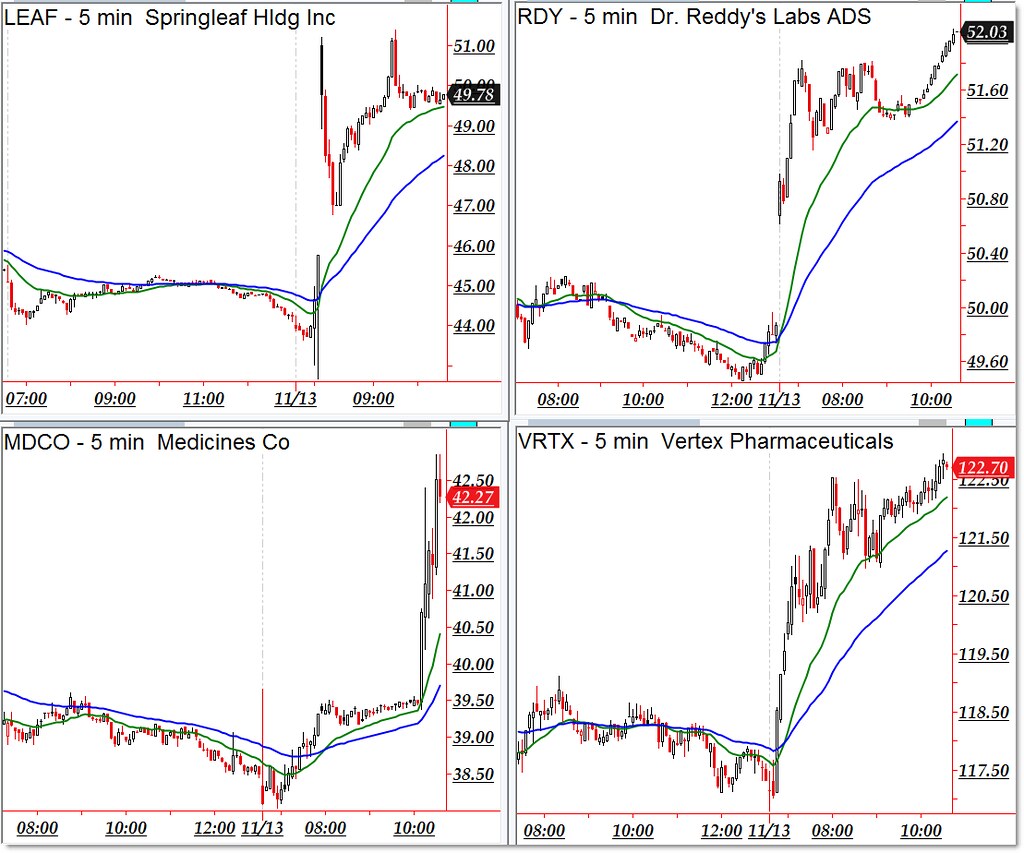

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Springleaf (LEAF), Dr. Reddy’s Labs (RDY), Medicines (MDCO), and Vertex Pharma (VRTX)

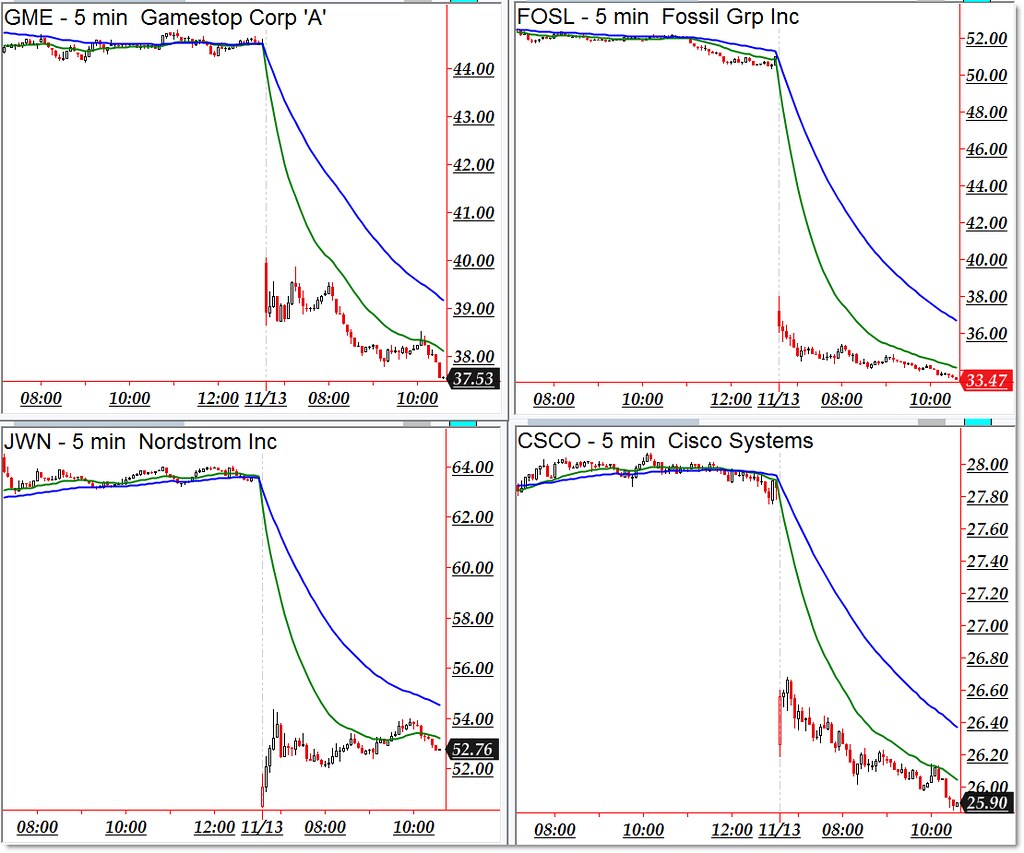

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Retail names Gamestop (GME), Fossil Group (FOSL), Nordstrom (JWN), and Cisco Systems (CSCO)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).