Nov 24 Midday Update and Trending Stock Scan

We continue to see “more of the same” action and the simplest play is to “go with it.” Yet so few traders actually do that it seems.

Nevertheless, let’s update our mid-day information and highlight our trending stock candidates for today’s session.

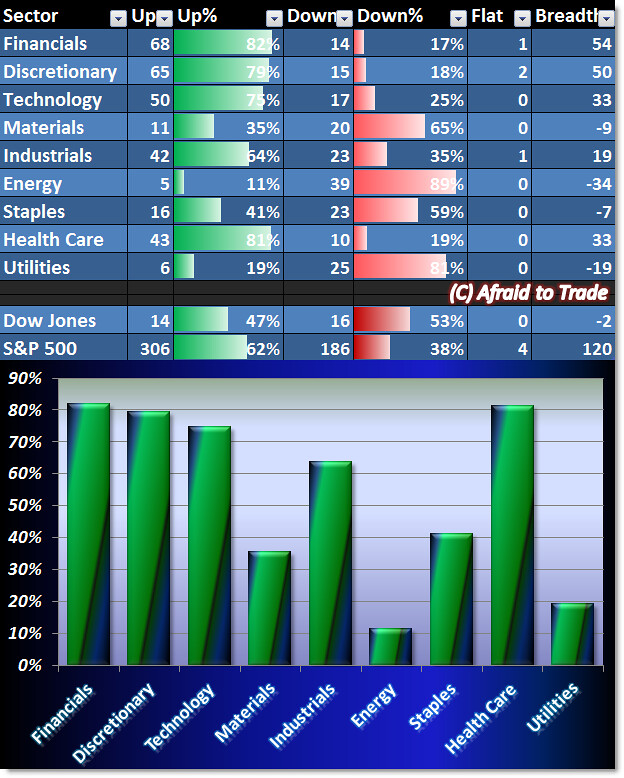

We’ll actually start with Sector Breadth which is MIXED BULLISH today:

On today’s bullish session (the NASDAQ and Russell are actually showing relative strength with big bullish moves today), our top sectors include the offensive (risk-on) Financials, Discretionary, and Technology sectors.

That’s a good sign as it suggests confidence in terms of broader money flow into the offensive/bullish segments of the market.

While not very bearish, we’re seeing strength also appear in Health Care.

It’s generally a bullish sign to see Energy and Utilities showing relative weakness on a session (along with Staples).

We have potential bullish trend continuation plays in the following stocks:

Well Care Health Plans (WCG), Kate Spade (KATE), Wyndham Worldwide (WYN), and Infosys (INFY).

Potential downtrending candidates exist in stocks showing relative weakness today:

Potash (POT), Jarden (JAH), Ultra Petro (UPL), and Transcanada Corporation (TRP).

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).