Nov 6 Jobs Report Friday Update and Stock Scan

With a stronger than expected Jobs Report this morning, it increases the probability the Fed will raise rates in December.

That’s boosting the Dollar, initially sending stocks lower, collapsing Treasuries, and also weakening commodities.

Let’s update our levels for the S&P 500 Index:

In-depth analysis is always provided to members of the Premium Daily Reports – I hope you’ll join and benefit.

We see the short-term downtrend – a higher timeframe simple retracement – continue.

Price takes a bearish turn under 2,100 but so far has held support at the key 2,090 level from before.

Receive daily updates, planning, and education by joining the Afraid to Trade Premium Membership.

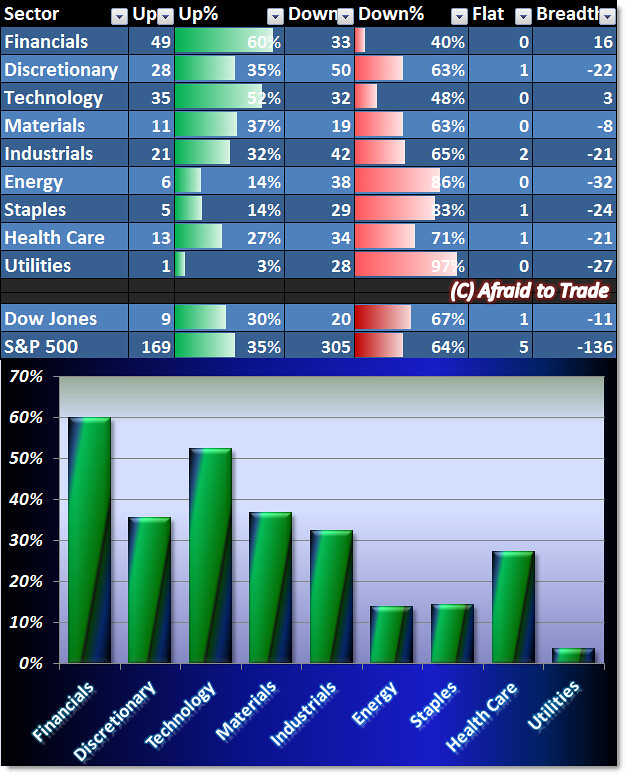

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Despite the selling or bearish pressure today, we’re actually seeing strong or bullish Money Flow.

Our strongest categories are the “Risk On” Offensive groups while the defensive names – with Energy – are today’s weakest groups.

This does suggest more bullish optimism than price would otherwise suggest (especially with Financials).

Here’s a top-level or full-perspective view of today’s S&P 500 stock performance (courtesy of FinViz.com).

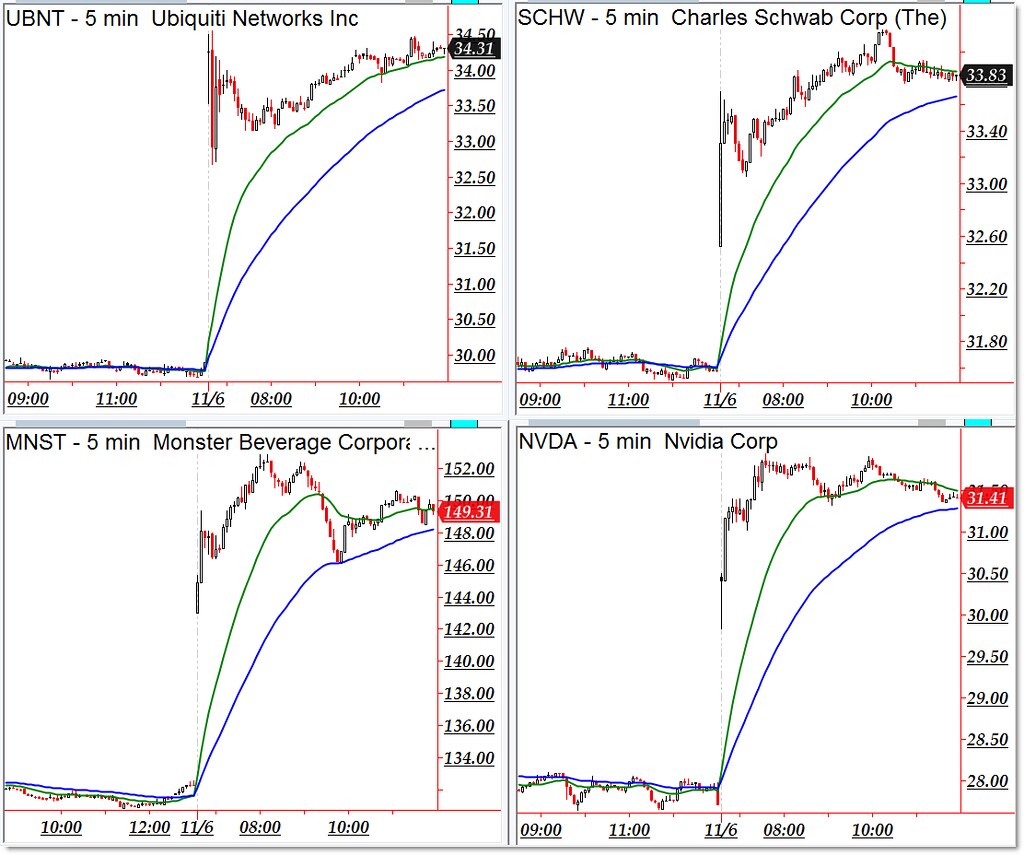

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Ubiquiti Networks (UBNT), Charles Schwab (SCHW), Monster Beverage (MNST), Nvidia (NVDA)

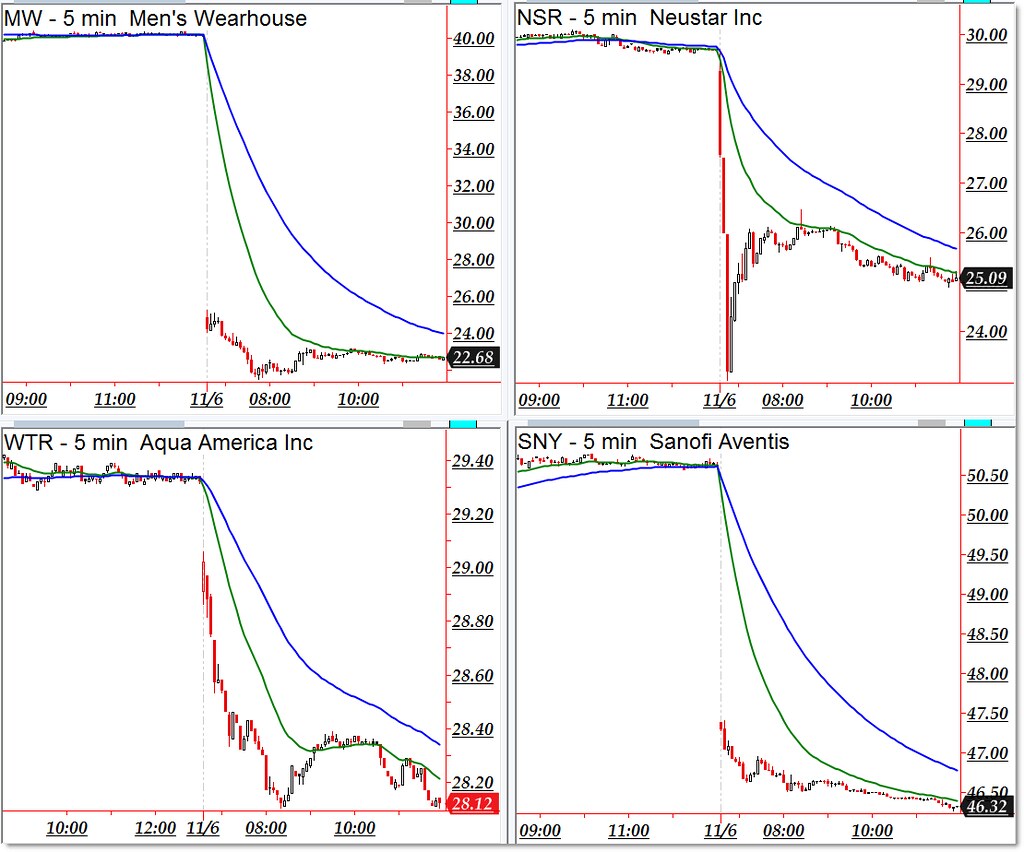

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Men’s Wearhouse (MW), Neustar (NSR), Aqua America (WTR), and Sanofi Aventis (SNY)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

It is always great boost to dollar with stronger than

expected report, but still we need to be very careful with everything. I

usually keep safe distance with over 500-600 pips, it is really helpful with

OctaFX broker’s giant benefit of 50% bonus, it is lovely given we can use the

bonus completely without any trouble at all while the minimum for starting this

is just 5 dollars, so that’s why it is so great to have this sort of bonus.