Nov 9 Sell Swing Market Update and Trending Stock Scan

Price extended the sell-swing (retracement) today as the reality sets in that the Fed is more likely than not to raise interest rates at their December meeting.

Let’s update our levels for the S&P 500 Index (seen here as the @ES futures):

In-depth analysis is always provided to members of the Premium Daily Reports – I hope you’ll join and benefit.

A lengthy short-term uptrend broke temporarily today with the breakdown away from 2,090 (@ES) after a period of lengthy short-term negative divergences into the 2,110 target.

Receive daily updates, planning, and education by joining the Afraid to Trade Premium Membership.

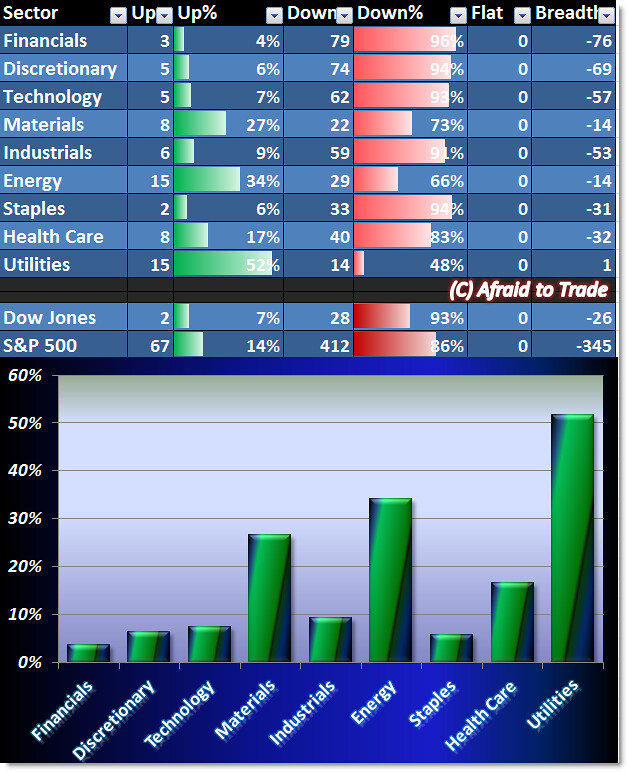

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Our Sector Money Flow chart shows a defensive or clear “Risk-Off” landscape as Utilities are the top performing sector in a “sea of red” (or selling pressure).

With all sectors down, the market is to be avoided or short-sold (don’t look for diamonds in the rough).

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Plum Creek Timber (PCL), GoPro (GPRO), Apache (APA), and Isis Pharma (ISIS)

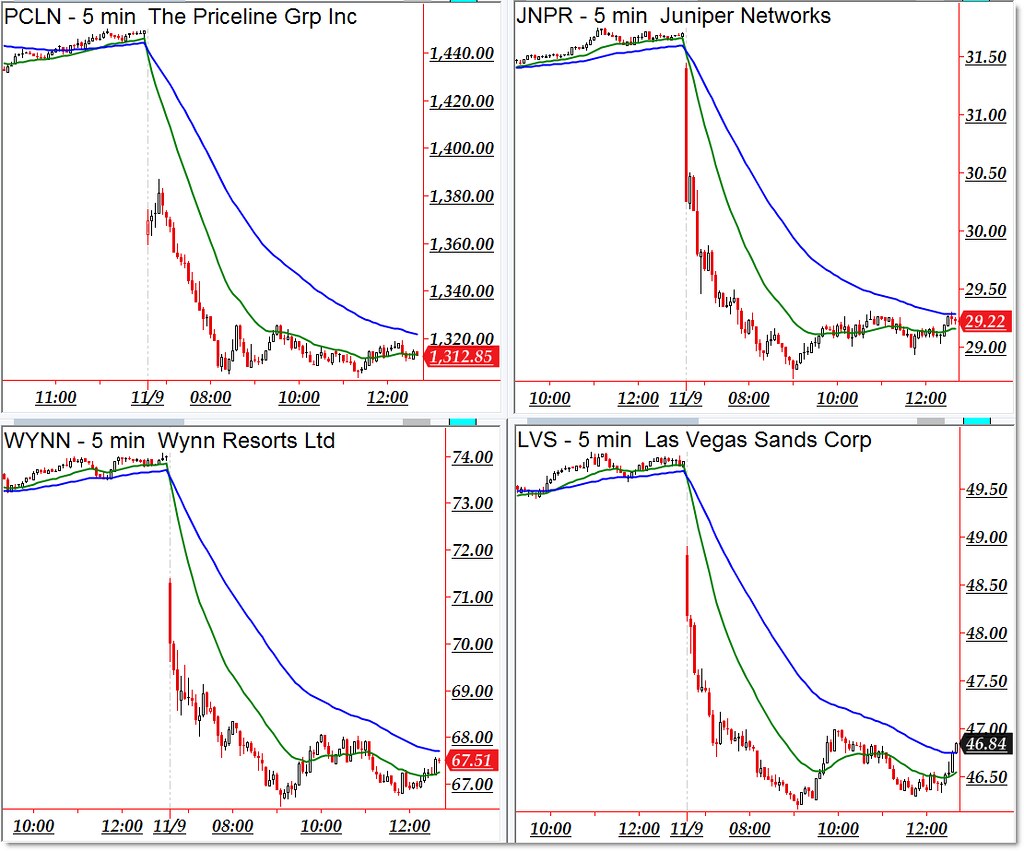

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Priceline (PCLN), Juniper (JNPR), Wynn Resorts (WYNN), and Las Vegas Sands (LVS)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).