Oct 26 Flat Market Update with Big Trending Stock Scan

Today’s session is a low volatility compression Range Day in the S&P 500, but there are trending stocks to play.

Let’s update our levels for the S&P 500 Index:

In-depth analysis is always provided to members of the Premium Daily Reports – I hope you’ll join and benefit.

With Friday’s breakout surge above the 2,060 bull/bear pivot level, price stalled above 2,070 and has formed a clear Magnet or Midpoint Price at the current level of 2,071.

Note the visual symmetrical triangle or compression trendlines developing into this spot.

Look to play bullishly for a breakout beyond 2,075 or bearishly under 2,065 for a possible impulse swing.

Receive daily updates, planning, and education by joining the Afraid to Trade Premium Membership.

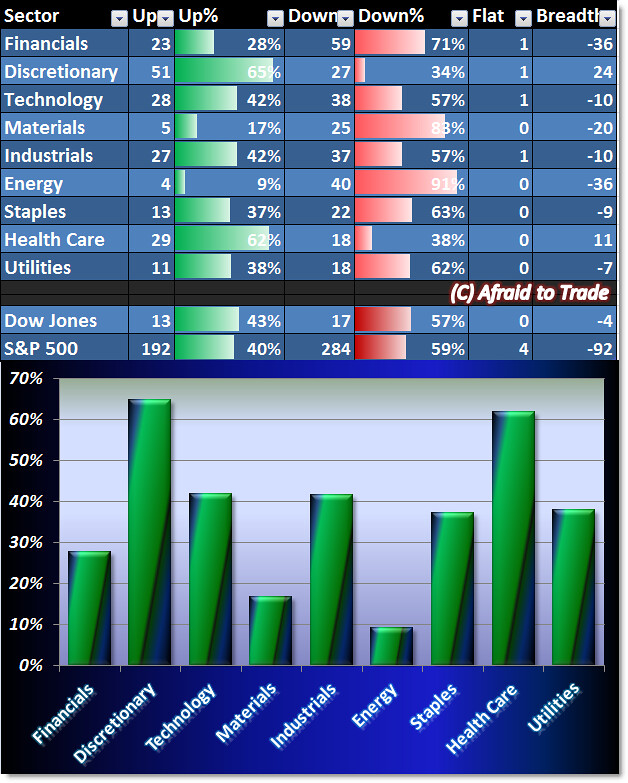

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

As is often the case on Range Days, we’re seeing a mixed signal from Money Flow or Sector Breadth.

The strongest two sectors are Discretionary and Health Care, one from an Offensive and one from a Defensive group.

Otherwise breadth is flat (under 50%) while Materials and Energy are today’s weakest sectors.

With no clear signal, price is left to dwindle into a sideways compression without direction.

Here’s a top-level or full-perspective view of today’s S&P 500 stock performance (courtesy of FinViz.com).

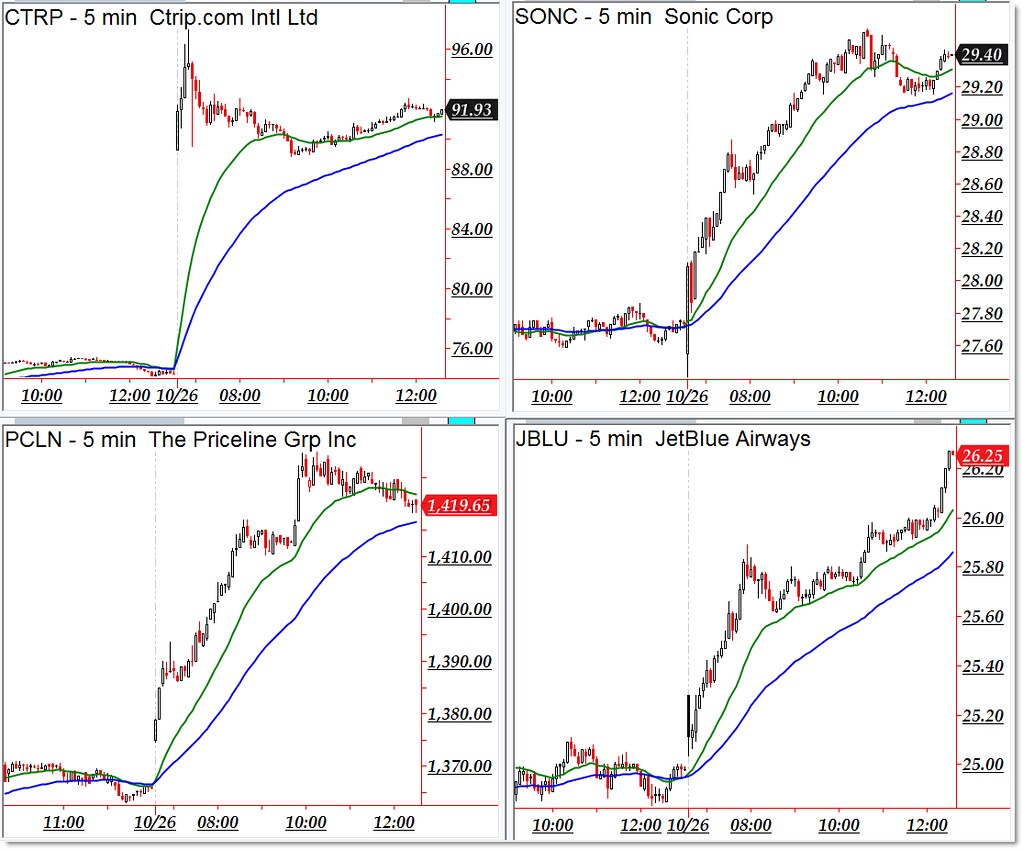

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Ctrip.com (CTRP), Sonic (SONC), Priceline (PCLN), and JetBlue Airways (JBLU)

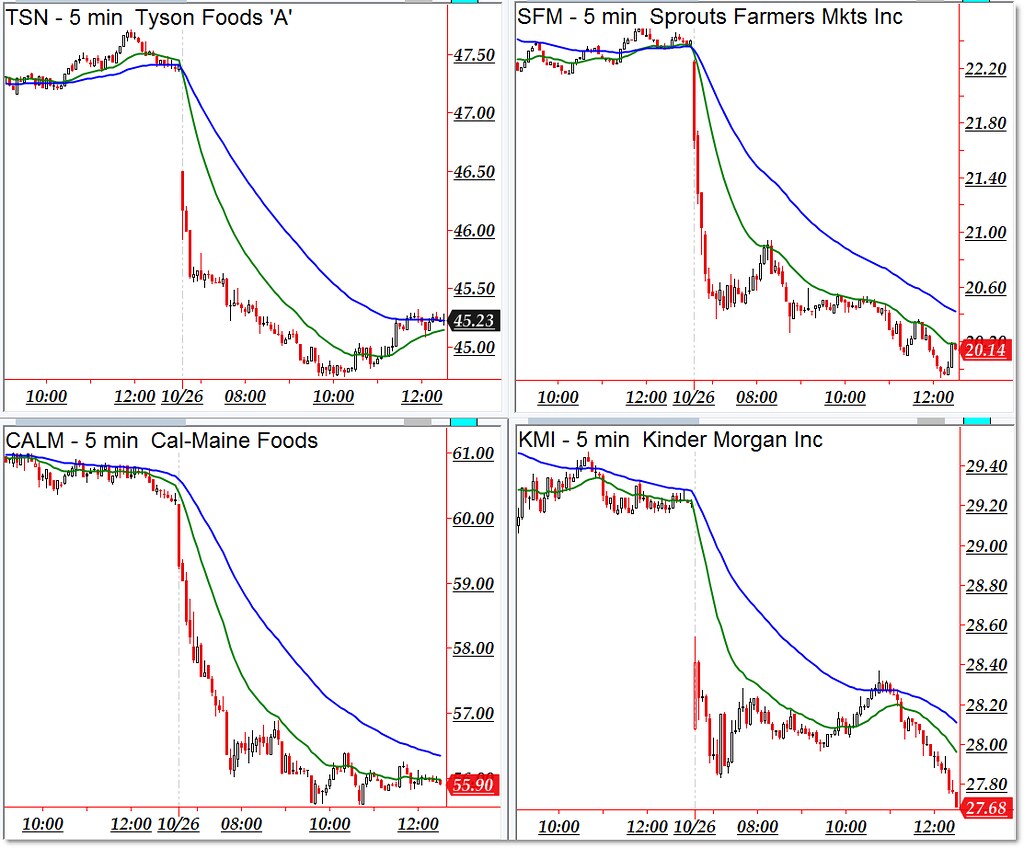

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Tyson Foods (TSN), Sprouts Farmers Markets (SFM), Cal-Maine Foods (CALM), and Kinder Morgan (KMI)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

Going with the trend seems to be the best thing, but it is obviously harder to figure out the right trend, so that’s why we need to be careful about things. I usually use MA and few other indicators in order to check out the trend. At the moment, I am trading with OctaFX broker and they have brilliant cTrader platform, it is extra-ordinary with allowing us to analysis things well without much difficulty at all and always keep me performing at my best.