Oct 29 Choppy Range at the Highs Update and Stock Scan

Following a post-Federal Reserve rally, stocks consolidated at the highs during today’s session.

Let’s update our levels for the S&P 500 Index:

In-depth analysis is always provided to members of the Premium Daily Reports – I hope you’ll join and benefit.

With the Fed not raising rates as was overwhelmingly expected, stocks fell then stabbed higher toward 2,090.

Today’s session gives us a logical compression or Range Day session to work off yesterday’s excess.

Focus on the 2,090 level (if above, target 2,100) and the current support near 2,084.

Receive daily updates, planning, and education by joining the Afraid to Trade Premium Membership.

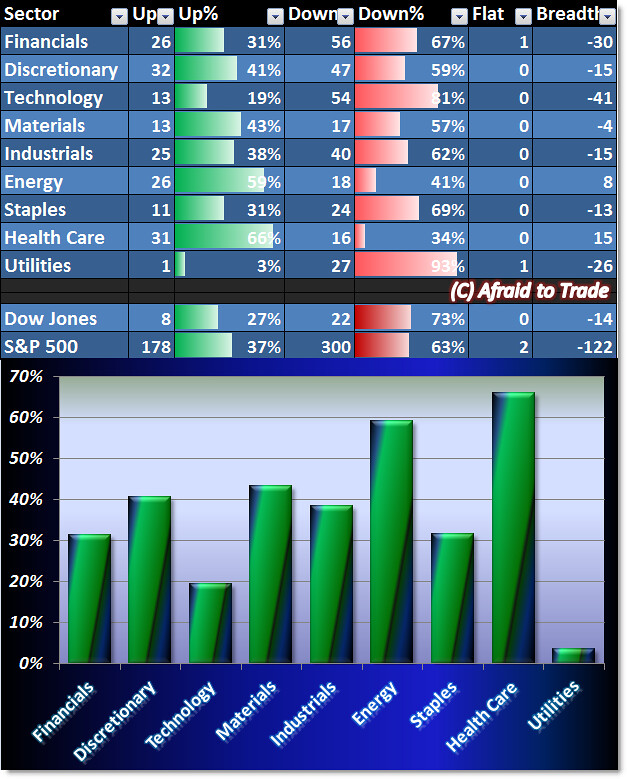

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Sector Breadth is moderate today which reflects the similar consolidation or chop in price.

Health Care and Energy are the strongest sectors today while Technology and Utilities are the weakest.

Here’s a top-level or full-perspective view of today’s S&P 500 stock performance (courtesy of FinViz.com).

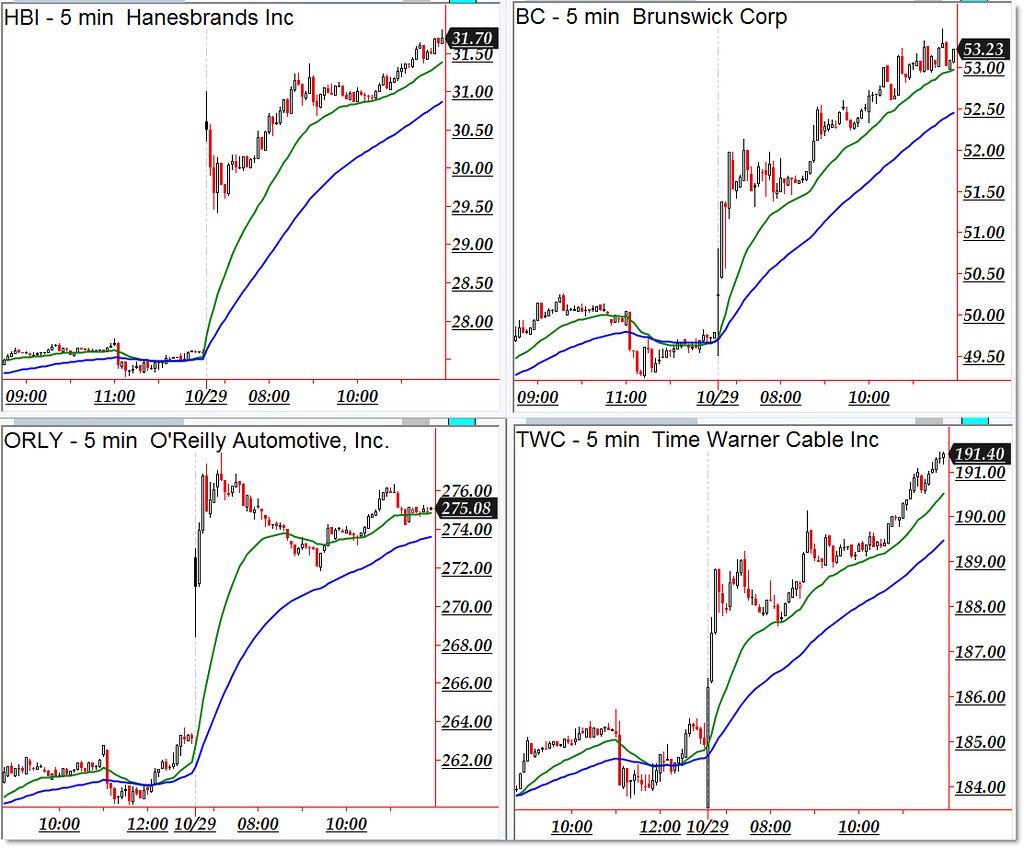

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Hanes Brands (HBI), Brunswick (BC), O’Reilly (ORLY), and Time Warner Cable (TWC)

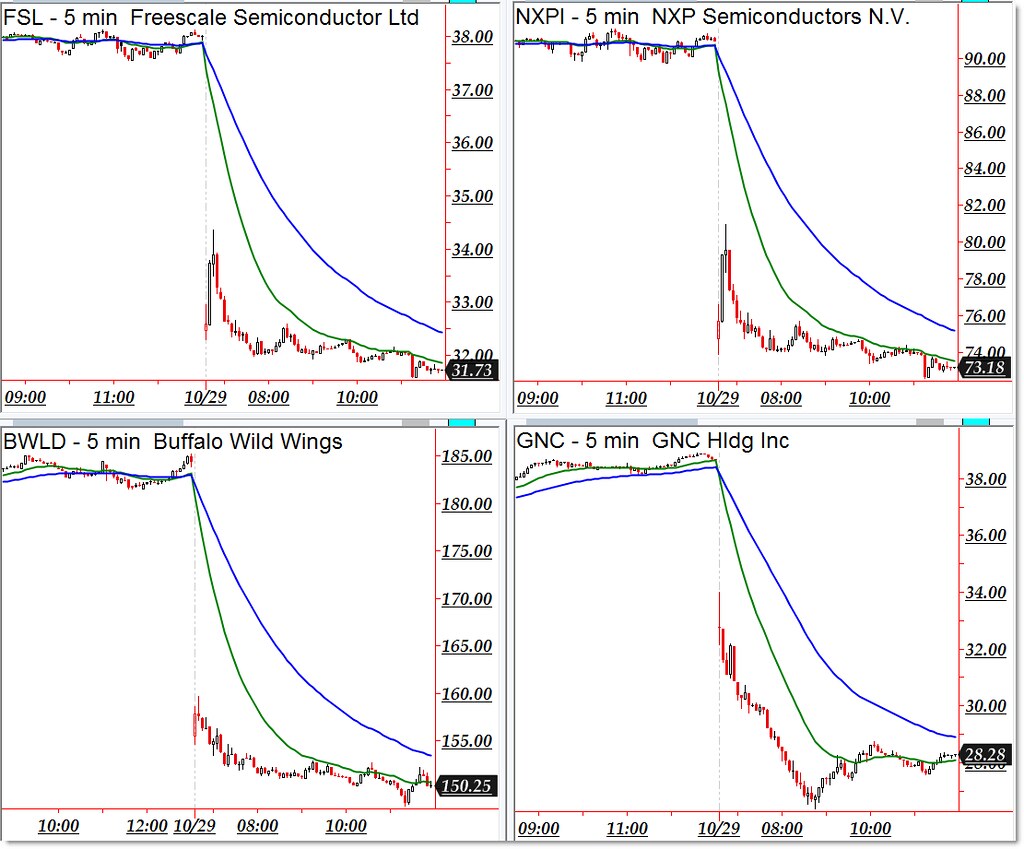

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Freescale Semi (FSL), NXP Semi (NXPI), Buffalo Wild Wings (BWLD), and GNC Holdings

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).