October 6 Stock Scanning and Market Update

Today’s session has been a reversal range session between clear boundaries.

Let’s start with our S&P 500 Chart and highlight the top trending stocks of the day:

Price rallied up into the key inflection (target) near 1,980 and turned sharply lower after the opening gap.

However, price found support as buyers rushed to support the market at the 1,960 pivot, creating a “neutral” zone between 1,960 and 1,980.

A clean breakthrough impulse above 1,980 continues our “Repeat Pattern” outcome, which you can learn more about from our morning update post.

At the moment, let’s continue our practice of market neutrality (range) or else a bearish breakdown bias under 1,960 (or breakout/higher timeframe trend continuity trigger above 1,980).

Sector Breadth confirms the Neutral Stance:

All sectors remain muted today with similar performance across the sectors (roughly 30% to 40% of stocks in each sector are positive).

However, the big leader of today is Energy, and not much can be gleaned from the pattern except for neutral money flow.

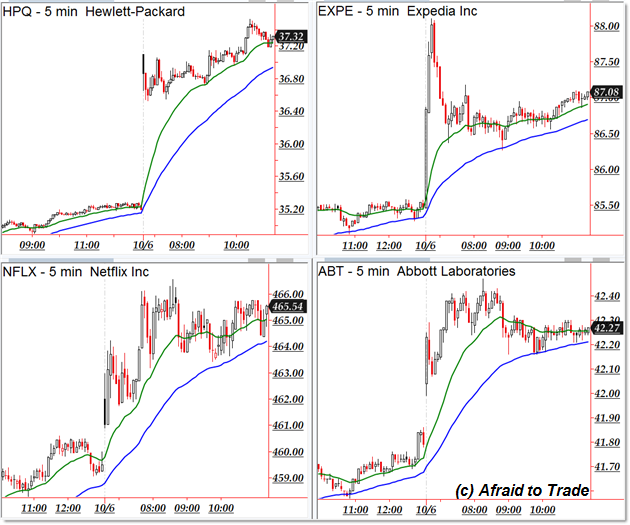

We can focus our attention on today’s trending (bullish) stocks:

Hewlett-Packard (HPQ), Expedia (EXPE), Netflix (NFLX), and Abbott Labs (ABT).

Alternately, we can focus on bearish downtrending candidates:

Micron Tech (MU), Kohl’s (KSS), Pitney Bowes (PBI), and Priceline (PCLN).

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).