October 7 Stock Scanning and Market Update

Price continues its range between key boundary levels, making for relatively low volatility session into support.

Let’s start with our S&P 500 Chart then highlight the top trending stocks of the day:

Sellers ruled the immediate open this morning but buyers rushed to support the market and prevent a further sell-off by holding price up at the 1,950 index level.

The result is a short-term range pattern that continues as drawn, within the context of the broader Fibonacci Retracement Levels (see prior update).

We’re waiting for another “Repeat Pattern in the S&P 500″ or else a failure of this pattern which would likely set in motion a steep sell-off in shares.

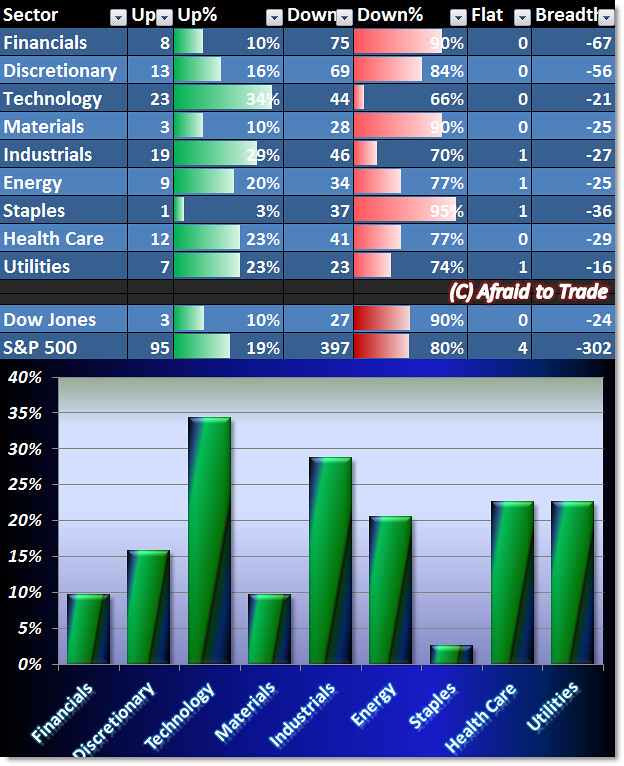

Sector Breadth sends a bit of a conflicting signal with today’s sell-swing:

One would assume sector strength would develop in the Defensive Sectors like Staples, Health Care, and Utilities but clearly this is not the case today.

Our two strongest sectors are the offensive or bullish Technology and Industrial stocks – not what you want to see if you are a market bear.

In fact, our worst sector today is the defensive Staples stocks – again, not a bear’s delight.

We can focus our attention on today’s big trending (bullish) stocks:

Keurig Green Mountain (GMCR), CF Industries, Ameren (AEE), and Coca-Cola (KO).

Alternately, we can focus on bearish downtrending candidates:

Cummins (CMI), Black and Decker (SWK), Mastercard (MA), and Ametek (AME)

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).