Post Fed Money Flow and Dollar Flash Crash Update

Markets today retraced part of the sudden movement following yesterday’s Federal Reserve announcement.

Let’s take a quick fly-by glance at the cross-market money flow reaction, today’s retracement, and something you missed if you weren’t watching the Dollar Index last night.

With the Fed dropping the word “patient” from its forecast, the Fed counteracted that hawkish comment with a reminder that recent economic conditions have deteriorated and thus a rake hike is not imminent.

Buyers flooded back into stocks, bursting them higher at the same time the Dollar stalled then collapsed.

On the heels of the collapsing Dollar, Gold and Oil caught a big and rallied sharply off support lows.

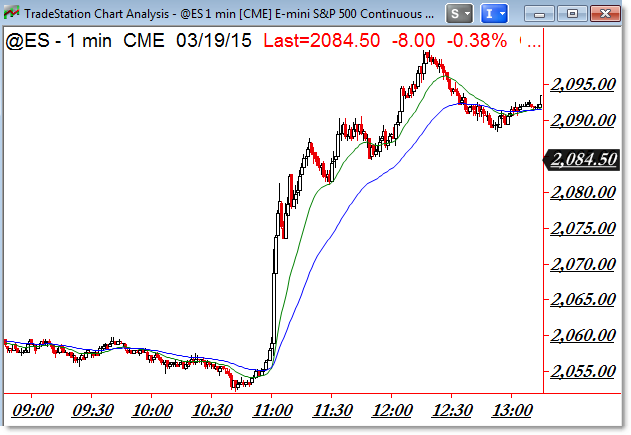

Here’s a closer view of the 1-min S&P 500 mega-reaction:

There really wasn’t a counter-reaction once the news was released, and the bullish pressure continued through Chair Yellen’s press conference that followed.

Price has pulled back (retraced) today after the snap-reaction and we’ll be monitoring higher frame levels.

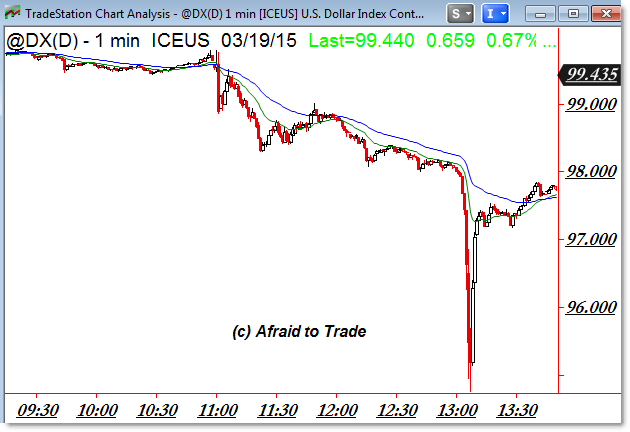

There’s something fascinating you missed if you didn’t watch the Dollar after yesterday’s close:

Look closely at the timestamp which is from the Pacific Time (PST).

The stock market closed at 1:00pm PST and the Federal Reserve policy announcement was at 11:00am PST.

The Dollar – as would be expected – initially fell but stabilized into the 98.00 level (@DX Futures Contract).

What happened next was instant – a mini-Flash Crash Collapse shocked the market and broke the price from 98.00 to 95 in about five minutes.

Just like the prior Flash Crash, this was a one-off, temporary move where price rebalanced and recovered, but it still reminds us of the risk inherent in these markets.

Continue monitoring these impulse moves and reactions (retracements) in the post-Fed activity.

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

The kind of confusion and debate dollar has created in recent months is really unseen and I can say it easily that even masters are not sure. I am no expert or master, but I do trade on dollar and it’s not easy, but thanks to OctaFX broker, it has really become easy and that’s with their outstanding rebate service, where I am able to earn 15 USD per lot size trade and that is included if I lose the trade at any time.