Power Bounce Market Update and June 30 Stock Scan

What goes down must come up… right?

After an initial bounce in the morning, price retested the low on positive (stretched) divergences ahead of our logical snap-back rally we’re seeing mid-day.

What’s going on now and what levels are important? Let’s see:

Here’s a key strategy planning quote from last night’s members-only update:

“…be ready to buy a support bounce that boosts the market “up away from” the 200 day SMA pivot near 2,055/2,060.”

Continue to receive real-time, detailed strategy planning by joining as an Afraid to Trade full member.

Again, our key pivot target was the 2,060 level which was retested midday ahead of the clear positive TICK and Momentum divergence.

We’re now seeing our expected (dominant thesis) short-term bounce/reversal “up away from” this level toward the 2,075 pivot or higher.

Always compare price with Internals or Momentum and be on the lookout for divergences like these.

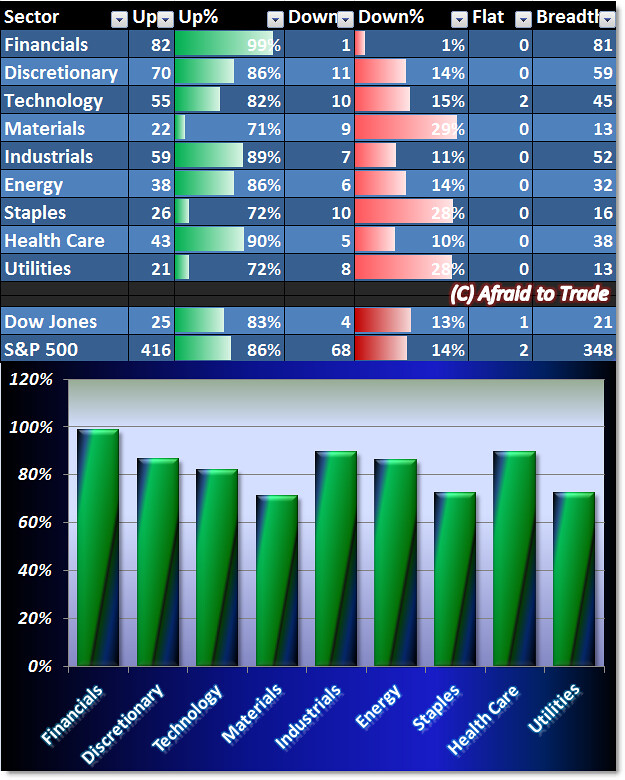

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

While yesterday saw almost total sell domination (few stocks were positive), today’s session shows bullishness but not outright bullish domination.

All sectors are balanced near the 70% to 80% Breadth level so there aren’t any obvious standouts.

It’s a sign of across-the-board bullishness at least as a counter-balance to yesterday’s selling.

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Fitbit (FIT), Las Vegas Sands (LVS), Valero (VLO), and Wynn Resorts

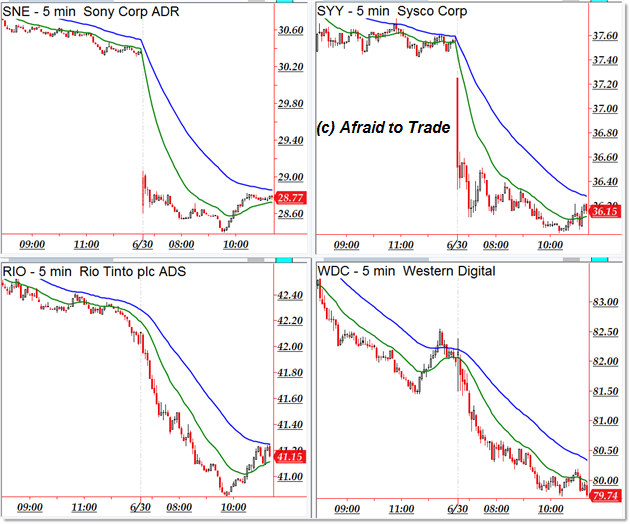

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Sony (SNE), Sysco (SYY), Rio Tinto (RIO), and Western Digital (WDC)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

This might be the case in most cases, but here this might not exactly work since the trend is looking like down towards heavily, so that’s why it is important that we care careful in how we trade. I am careful but what boosts my chance is the broker that I use OctaFX, it has handsome options including the terrific swap free account. We are able to trade nicely using this and even there are no charges on overnight trades, so that works all so much better for all.

We need to be extremely careful with these levels, as they

can easily break through; I am working with OctaFX broker where I get massive

benefits especially with the cTrader platform which is highly upgraded with

advance charts also available, it really makes trading pretty simple and

straight forward for me while I can also analysis so much easier given so much

options present as compare to the usual platform we use with not much technique

there to get benefits.