Pure Price Update on the Range in Crude Oil Daily

I often advocate taking a pure price look at a market in order to get information on the recent “character” and “behavior” that you might miss if you have too many indicators on your chart – something we all have done at one time.

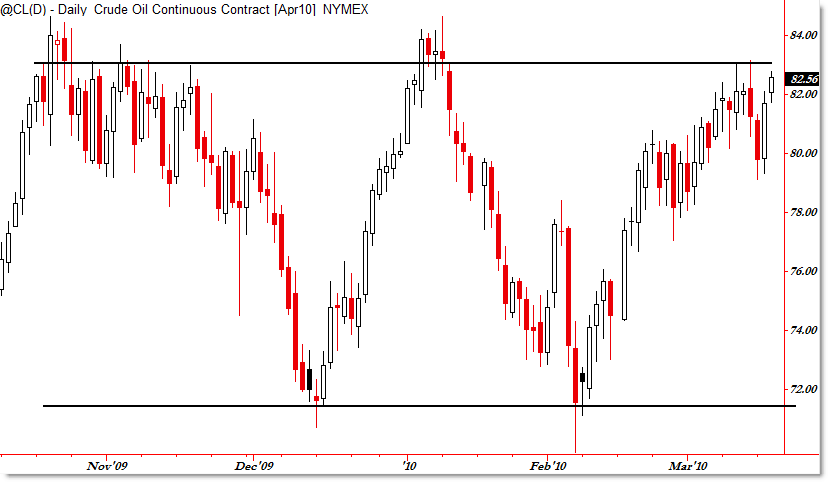

Here is the ‘price purism’ chart of the @CL crude oil futures contract (TradeStation):

You don’t need indicators to tell you the current structure of the crude oil market since November – it’s clearly a trading range with an upper boundary at the $83.00 level and lower boundary just under $72.00.

That gives a $10.00 trading range that has contained price over the last few months with a mean or average ‘midpoint’ price about the $77.00 level.

Astute traders would also identify this as a potential “Head and Shoulders” price pattern, which would be confirmed with a downward break under the ‘neckline’ at the $72.00 level, or disconfirmed with a break to new highs above $85.00 per barrel.

Why is focusing on ‘character’ important?

If the ‘character’ – that of a trading range – continues, then we can assume crude oil’s next move will be to move lower off of resistance, after making a potential swing to $84.00 as the ‘last line in the sand.’

And then if price break solidly above $85.00, we could say that the ‘character’ changed, and would thus expect a trend continuity move higher, perhaps to the $92.00 level.

As long as the ‘characteristics’ remain the same, then we would be taking profits here and getting ready to see if buyers can thrust price to new highs, triggering a breakout trade, or if sellers can contain price under $83.00, which would set-up a short-sale opportunity depending on your aggression level, or how much confirmation you need (such as waiting for a break back under $80.00).

Indicators are wonderful – but sometimes it’s very helpful for seeing potential ‘pathways ahead’ in price (often called “IF/THEN” statements) by viewing price in its purest form.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade