Quick Sector Rotation Insights from the September Low

The S&P 500 bottomed (recent swing low) at the 1,040 level at the end of August/start of September and has rallied almost non-stop to the 1,230 area.

Two quick questions come to mind – how have the individual sectors performed, and what does this say about the broader market?

Let’s take a look:

When doing any sort of Sector Comparison, it’s best to start with a grouping of sectors into two categories – the OFFENSIVE (or aggressive) sectors and the DEFENSIVE sectors.

I always make that distinction when I do Sector Rotation updates.

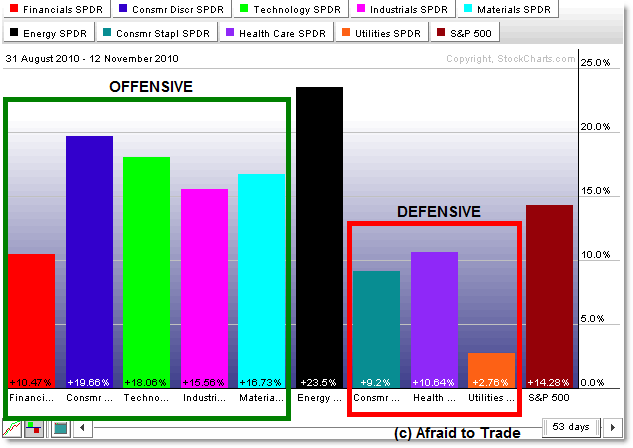

Offensive Sectors – as shown through AMEX Sector SPDRs – include Financials, Consumer Discretionary, Technology, Industrials, and Materials.

As you can see from the grid above (via StockCharts), the Offensive Sectors have in some case almost doubled the percentage gains of the Defensive Sectors (Consumer Staples, Health Care, and Utilities).

That’s what you’d expect, and it suggests bullish strength for the broader market – as in, according to the model, this is what you would expect to see from a broad Bullish Expansion phase.

Of course, there is one little outlier and it’s the Energy (XLE) sector, which is up 23% from the late September lows (to present).

According to the Sector Rotation Model, when energy is the best performer, it’s usually a danger or caution sign, as energy prices start to ‘overheat’ in the midst of a broad expansion which serves almost as a tax on consumers and businesses.

It’s something to keep an eye on, but for the moment – or at least looking at the early September to mid-November rally – the Model is showing bullish confirming strength.

It suggests that – as long as the rally continues – investors would look to be positioned in the Offensive Sectors, though what happens at the key resistance at 1,230 is key.

A firm break above 1,230 is a call for repositioning bullishly (according to the model), given that price could stall at the key 1,230 level. It’s an example of how to combine index expectations and key levels with the Sector Rotation Model (which gives a broader look at the S&P 500 Index).

Keep a watch on Energy and the Offensive Sectors – and leading stocks in those sectors – until proven otherwise.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

One Comment

Comments are closed.