Relentless Selling Market Update and Trending Stock Scan Jan 15

Can buyers catch a break? Or better yet, catch a falling knife? Not yet it seems.

Yesterday’s big rally was completely erased with this morning’s opening gap – and the selling continued.

Let’s update our levels for the S&P 500 Index and note the big trending stocks today:

As I highlighted last weekend to our Intermarket Strategy Members, we took a bearish turn going into 2016.

Study yesterday’s update which highlighted the importance of 1,900 and the likely rally building above 1,900.

Also, compare the Daily Chart with the new Weekly Chart Planning and Analysis from this morning.

Receive daily updates, planning, and education by joining the Afraid to Trade Premium Membership.

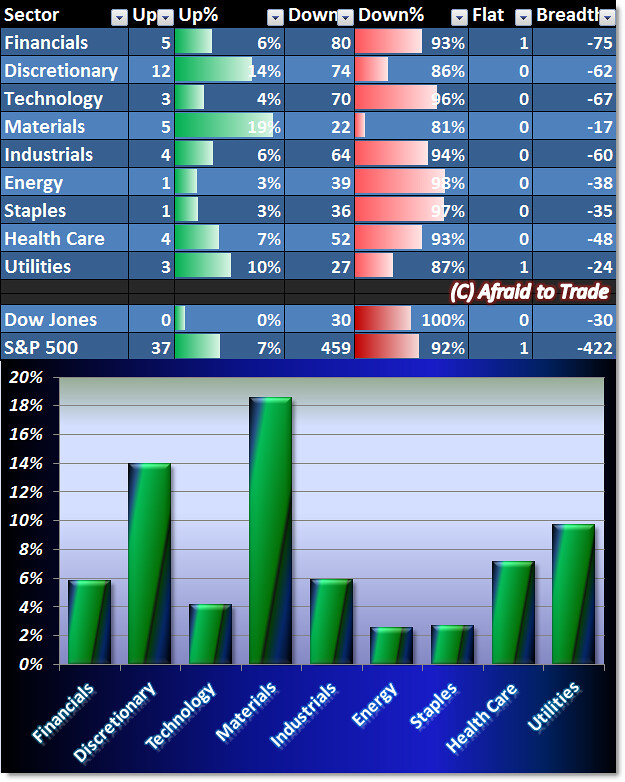

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Yesterday saw strong money flow into all sectors; today shows strong money flow OUT OF all sectors.

In fact, the strongest sector right now is Materials with 19% of stocks trading higher at the moment.

100% of Dow Jones stocks are negative along with 92% of those in the S&P 500. Bears dominate today.

Here’s a top-level or full-perspective view of today’s S&P 500 stock performance (courtesy of FinViz.com).

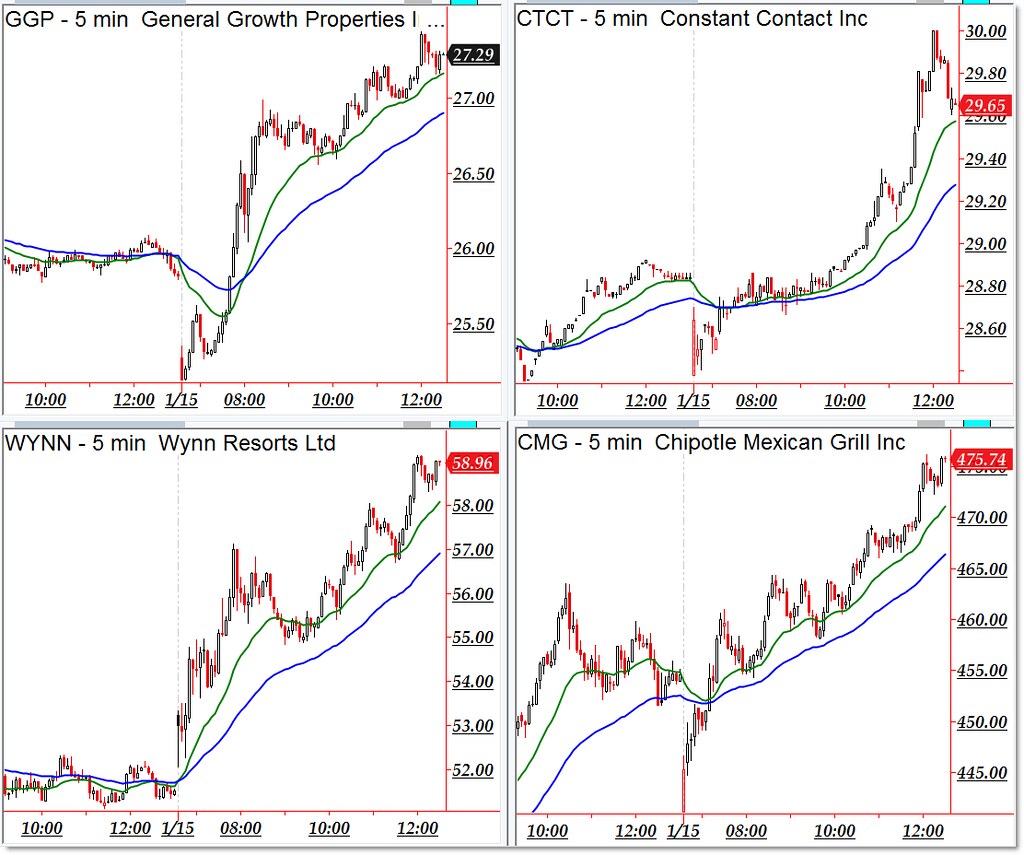

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

General Growth (GGP), Constant Contact (CTCT), WYNN Resorts, and Chipotle (CMG)

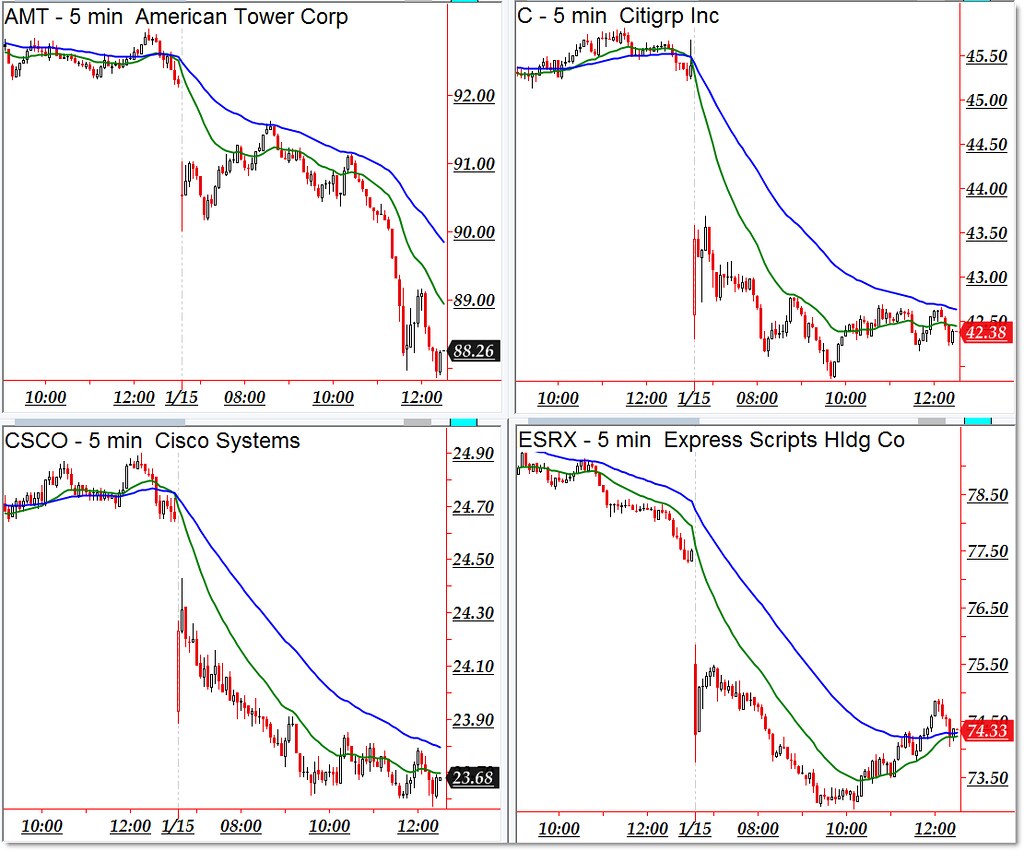

Bearish downtrending candidates include the following stocks from our “weakness” scan:

American Tower (AMT), Citigroup (C), Cisco (CSCO), and Express Scripts back again (ESRX)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).