Reversal Intraday Market Update and Stock Scan for Oct 22

And now for something completely different (than this creeper trend we’ve seen)!

Here’s our S&P 500 update and trending stock scan for the day:

Price crept advanced with “Creeper” Trend Days into today’s session high of 1,950.

Note the lengthy negative TICK (Market Internal) Divergence along with the descending TICK Channel which occurred before the reversal.

Nevertheless, price currently trades into the 1,930 level, 20 points lower than today’s reversal high.

We’ll focus our attention here at the 1,925/1,930 price cluster target from a higher frame.

Sector Breadth clearly flipped bearish from a caution signal yesterday:

Our strongest sectors are the Defensive Staples and Utilities which are actually rallying on today’s reversal session.

Otherwise, all Risk-On Sectors are showing bearish breadth indications which confirms the reversal.

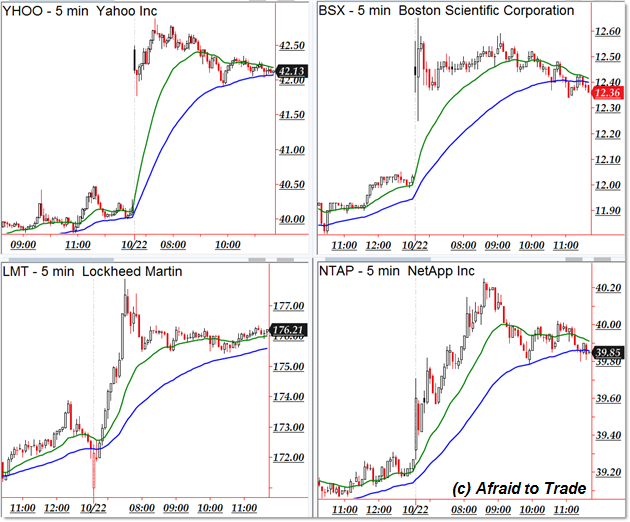

Uptrending bullish intraday candidates today include the following:

Yahoo (YHOO), Boston Scientific (BSX), Lockheed Martin (LMT), and NetApp Inc (NTAP).

Top bearish downtrending candidates include the following stocks:

Boeing (BA), Northern Trust (NTRS), Red Hat Inc (RHT), and Oracle (ORCL).

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).