Six Power Trending Stocks to Start the Week

As we begin this holiday week fresh from our vacation, let’s highlight six “Power Trending” stocks from our scan.

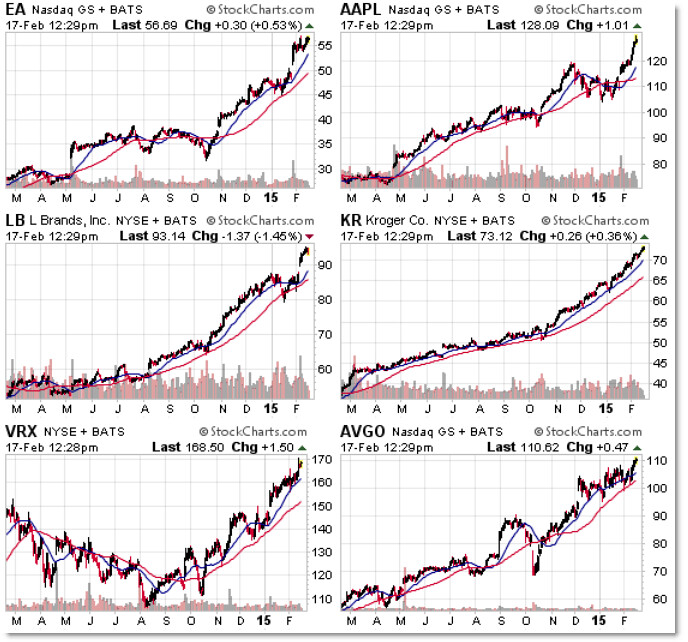

We’ll start with the Six Stock Grid:

A quick scan for strongly trending stocks returns these candidates in no particular order.

The main idea is that stocks which are strong tend to get stronger, thus we look to trade in the direction of the trending action.

We accomplish this through buying pullbacks (retracements) or breakouts as the trend continues.

While these are simple scans, it’s important to do your own work to discover your own trading opportunities.

Here’s a focus on three names in particular from the scan, starting with Apple (AAPL):

Apple gave two breakout opportunities – both on breakaway gaps – in October and now January.

While the stock is clearly overextended, the next play would be to enter on a future pullback.

Though you may never consider trading it, Kroger (KR) is a stable, uptrending stock with a “Creeper” Trend that doesn’t allow for clean retracement entries.

Nevertheless, Kroger serves as an example of the power and simplicity of trading with a trend.

Finally, retail stock L Brands (LBR) similarly displays a stable uptrend like Kroger, bu it too broke above the $90.00 level to continue its trend (breakout opportunity).

See my recent post on Amazon (AMZN) for another example of a “Gap, Buy, Trend” opportunity.

Again, use these names as candidates for additional analysis and possible trading candidates.

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

Trend is always the key so spotting that at the right moment is basically the difference between a winner and loser but to spot this we need to have serious analysis ability and that comes only with knowledge regular practice. I am lucky that I got best education from Baby pips and for practice I got the perfect broker OctaFX as they have incredible demo contest cTrader, it’s a weekly contest with thrilling prizes up to 400 USD so it is exactly what I need for practice.

Following the trend correctly can be seriously useful, but of course we need to be careful that we don’t do anything silly or else we could lose badly. I usually prefer to go with Currency pairs trading and with OctaFX broker, it helps a lot given their daily market news and analysis service, it’s provided by highly qualified team of experts plus it’s free as well and so far in last 4-5 months of using this, I have gained incredibly 80% results.