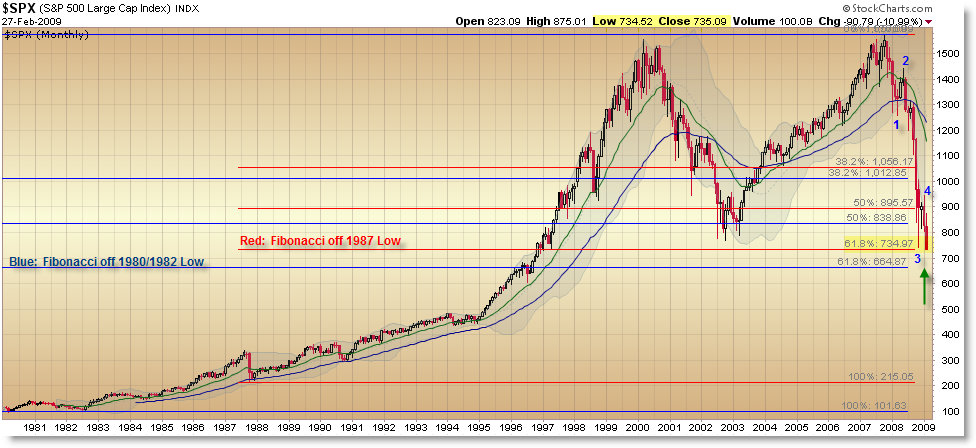

SP500 Support and Fibonacci off 1980s Low

It’s on the chart permanently now – the S&P 500 officially closed February beneath the 2002 Bear Market lows – but let’s look beyond that. Did you know the S&P 500 is at a very critical potential long-term Fibonacci support level? Let’s see it on a Monthly chart that dates back to 1980.

(You’ll definitely need to click on the chart to see the larger file)

Do you see something rather interesting?

Taken off the 1987 price low, a Fibonacci grid drawn from that level to the 2007 high price of 1,570 shows that the deep 61.8% Fibonacci Retracement comes in at roughly 735. Today’s (and the month’s) closing Low? 735.

Perhaps there’s absolutely no significance whatsoever with that number, but it’s certainly worth observing and being aware of the possibility that buyers might swoop in at this level simply because of this development that might be taking many traders unawares.

Also, note the November lows found support 6 points above this level that formed the floor for a rally that took the index back to the 950 level.

If this Fibonacci support zone fails, then it’s likely the next possible zone of (Fibonacci) support would come in at 665, which would be the 61.8% Retracement of the Beginning of the Bull Market in 1980/1982 (when the S&P index was near 100).

Should this level fail, all bets are off.

Combining basic Elliott Wave and Fibonacci Retracements, we could certainly see a compelling argument for price to end Wave 5 and find support at the 655 level and finish off this bear market, or at least the ABC Retracement (with 2000-2003 being A; 2003-2007 being B; and 2007 – 2009 being C).

If you look objectively at the wave structure, you’ll see that we’re missing a little more room on the downside to complete the expected 5-Wave Downward Impulse that began in 2007… although technically with today’s new closing low, the expected 5-Wave structure has met the conditions to be considered ‘complete’ if price does begin to rally (which is perhaps why Mr. Robert Prechter, founder of Elliott Wave International, is doing the Speaking Circuit, encouraging investors to cover short positions immediately – links to CNBC Video).

Remember, although 5th Waves can ‘truncate,’ or find support at the 3rd Wave Low (November 2008), more often than not, 5th Waves make lows slightly beyond the end of Wave 3. I’m not making the argument that stocks will fall to 665, but doing so would satisfy this requirement and the significance of the 1980/82 Fibonacci retracement.

My prior post this morning takes us deeper in the current structure, which seems to imply we’re missing at least one more swing to the downside to finish off the larger impulse.

Either way, at least according to the Wave Principle (as I understand it) and a potential Fibonacci support zone beneath us (or exactly upon us right now), we seem to be perhaps in the 8th or 9th inning of the initial downward move from 2007’s market peak.

Corey Rosenbloom

Afraid to Trade.com

Corey, you are amazing.

Interesting interview with Prechter. I have not seen anything from his service but it sounds like he has the same count presented here. Apparently he expects that fifth wave down to end soon and be followed by a large enough rally to want to cover shorts. The really big question is whether that rally is the start of the next bull market or just an X wave before the next A-B-C down. He is obviously expecting the latter but what is interesting to me is that his book clearly states complex corrections which begin with a flat, which this certainly was, are much more horizontal in nature than those that start with a zig-zag. Accordingly, even if he is correct, the ultimate end of this bear market may not be too much beyond the bottom of this unfolding 5 of C which he is labeling W.

Excellent observation and post, Corey.

But other then Fibo, I don’t see much support would come at 650s, the real support should be around 500 which is where 1995 break out occurs. And if we experience a 1930s style (which I think with current adminstration we will be lucky if we only be as bad as 1930s) crash, we should go to 100s…

Also, even if the current bear market low is at 600s, I don’t see a new bull market or even go back to 1500s ANYTIME SOON… America has simply rack too much debt… Look what happen to Japan… we are in this bear market for at least another 5-10 years… Unless of course, miracle happens and America invented something that ONLY American can build and everyone is the whole world wants and be able to afford…

To get an idea what the fifth wave down looks like take a look at the November 1937 though March 1938 Dow chart.Which I feel was the fifth wave down that year. The patten looks very similar to today. We got a sharp rally that lasted 6 months. Only to fall to the ultimate lows in 1942.

On the monthly chart wave 2 was a sharp so wave 4 should be complex. If so then it may be an ongoing flat that carries back to the 900s in wave C of 4 before wave 5 even begins.

Andrew,

I’m just glad Prechter is publicizing the Elliott Wave principle to the public – and that it is being seen in a positive light.

If you look closer at Prechter’s work, he is certainly not calling for a new bull market to begin off these levels. I’m uncertain but I believe he sees this first 5-wave decline from 2007 to 2009 as a Wave 1 of C. Read that again. Wave 1 of C. I certainly reject that level of bearishness. I’ll have to read up on that more though.

Blues,

There are likely Fibonacci Price Projections/Extensions underneath these levels – I may try to do a post on that at some point but you’re right – not much in the way of long-term retracement support.

I don’t see us in any scenario going to S&P value of 100 but if it happens, it happens. I just can’t wrap my mind or my trading around that concept.

Anon and Terrance,

Thank you for reading and for commenting!

Blues,

We’ll need to consolidate/digest these losses at these levels. A bear market doesn’t necessarily have to go down – it can just go sideways which probably is the most likely scenario after all this carnage since 2007. There will need to be a major base-building phase most likely.

You never know.

Couns,

Excellent, Excellent observation. I will look into this further and perhaps do a post on it. At first glance, it is a fascinating and eerie pattern that formed during that time. It’s almost like looking at the present with few exceptions. Very haunting. History does repeat itself indeed.

Andrew,

That’s possible as well.

There’s no reason to abandon the count that we are *STILL* in Wave 3. Both counts are at work – the preferred and alternate. This might not be 5 yet indeed. I’m not willing to talk about that too much publicly because of the bearishness it entails but we’re not out of the woods yet.

We’ll likely have an up move soon and then will need to reassess at that time what structure is developing.

It’s sort of like, both counts give us a retracement up and it’s buying time to figure out the development as to which count is playing out.

Corey, yes, that’s what I was saying, the best senario I see is going side way for a LOOOONG TIME… I don’t see we will have a new bull market anytime soon… As far as going back to 100-200 level, that’s only 1980s… Do you think overall as American, we have a better saving rate then 1980s? Do you think American is more productive then 1980s? AND MOST IMPORTANT, do you think American has a competitive edge against other country job productivity or do they have something that other country can not build and want?! I DON’T THINK SO! Manufactory wise, other country can build stuff cheaper, their labor cost is waaay cheaper. Country such as China, Mexico, Vietnam, south America countries, they all can build things that we need much cheaper then America. American has been PAMPER TOO LONG! They’ve been living in a “protective” enviroment for TOO LONG! They become lazy, they want things quick and easy! While other country is starving for money, they have motivation, American don’t. All they want is to sit there like an LAZY PIG and want things infront of them. Government has been TOO PROTECTIVE OF THEIR CITIZEN. Anyway, that’s how I see it. So if American is not competitive as labor, then what?! They need something that other country need and can only be built by American. What?! Manby only military stuff… but other then that, I don’t see any. Either way, I only see down hill for western power and the power will be transfer to the east…

By the way, our government is not doing any to help… look at the current policies, all policies are to reward the crook and punish the good. They are taking money from the responsible people and give it to the irresponsible… How long can this empire last with this type of policies? I’m surprise there is not MASS REVOLT! I WOULD REALLY LIKE TO SEE THE CURRENT POWER GET OVERTHROW!

check this out, you’ve probalby seen this, this guy is a bit crazy, but he is RIGHT!

http://www.youtube.com/watch?v=A7nnshUBdxY

I’m mean what our government is doing is to push every “responsible” person to become “irresponsible”! I mean with all the bail out of the banks, which is money from us tax payers, why should I continue to pay for my mortgage?! If bank are getting 750 Billion, maybe I should just stop paying my mortgage! I mean goverment will pay it with my current and future tax money anyway! WTF?!

I know that in irregular flats, wave C goes substantially beyond the extreme of wave A but if this is only wave 1 of C then it would be a VERY unusual Flat; not impossible but also not the thing to bet on. My second comment just says this may not be wave 5 yet, wave 4 could still in effect; it does however look like a safe bet that wave 3 IS over. A helpful hint I heard years ago is that if you are totally confused about the count then it’s likely you are dealing with a fourth wave; that is certainly true today!

Cory,

Take a look at this.

http://i270.photobucket.com/albums/jj112/kimmichaelp/Mike12345.jpg

Blues,

Certainly a possibility – I don’t discount anything nowadays. Warren Buffett always says “Never sell America Short” but a 50% S&P 500 stock price plunge in just over a year… but to be fair the whole world is suffering and fell as much if not more than the S&P 500.

I’m not one to speak on economic/manufacturing situations but it would seem the US is in danger of falling behind.

Andrew,

Excellent observation! The corrective waves always get us, don’t they?! Everyone can count to 5 (impulse) but it’s the detail and chop of the corrective waves that divide the superb Elliotticians from the rest. Takes a while to get there and I’m still on the journey.

That was my thinking too – in that we’re seeing an Expanded Flat (S&P and Dow made new highs in 2007 in B)so we should expect a break of the 2002 lows which we got. I’ve been expecting this for some time now. At this point, the analysis becomes more difficult, as we’ve both met and exceeded my target.

One could target the 665 Fibonacci retracement support but if we fail there, target definition becomes much more difficult.

As for the larger structure, I’m content focusing on the short-term waves and letting the larger structure develop with me having a vague impression of what’s likely to happen, juggling various alternate counts/possibilities.

Couns,

Excellent resource. Helpful as serving as a reference point for what is likely developing.

I encourage all readers to view the link.