Tax Day Bearish Sector Breadth and Stock Scan

April 15th brings a lunar eclipse (blood moon) and “tax day.”

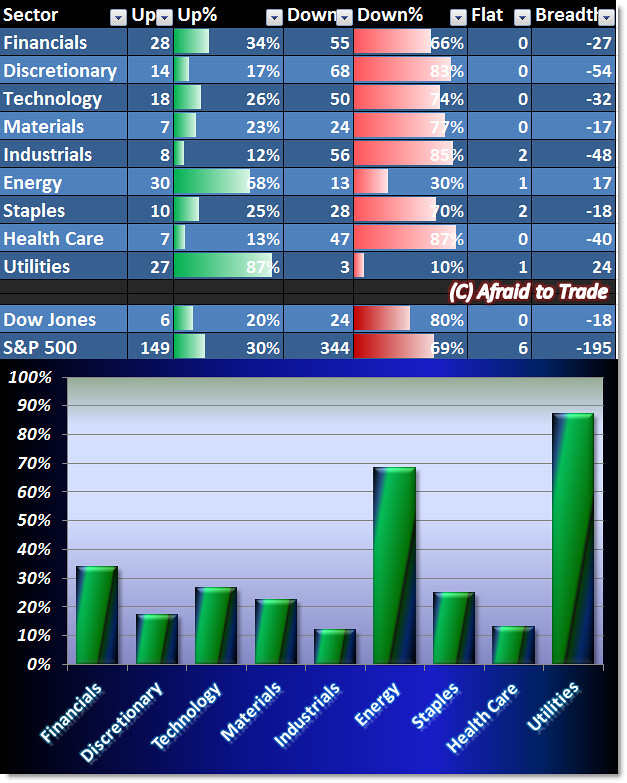

Putting those things behind us, let’s take a look at our intraday update for S&P 500 Sector Breadth and identify which stocks may provide trend day trading candidates in the event we see a similar session to yesterday’s trading day.

For yesterday’s update, I titled it “Bullish Sector Breadth with Caution” because sector strength revealed Utilities and Energy topping the otherwise bullish session.

The caution was correct, as we saw a mid-day reversal which was the same situation we saw with this morning’s “cautious” sector breadth.

The mid-day graph paints another bearish picture of money flowing into defensive sectors such as Utilities and Energy with our third place finish going to Financials.

At the moment, 80% of Dow Jones stocks are down on the session while 70% of S&P 500 stocks are negative at this moment.

We’ll turn now to our potential bearish trend day continuation candidates first:

We continue to see an appearance by Intuitive Surgical (ISRG) which I highlighted on a “trap and gap” educational post last week. The trap triggered and price continued to collapse lower.

ISRG is joined by downtrending candidates Stryker Corp (SYK), Petsmart Inc (PETM), and Wynn Resorts (WYNN).

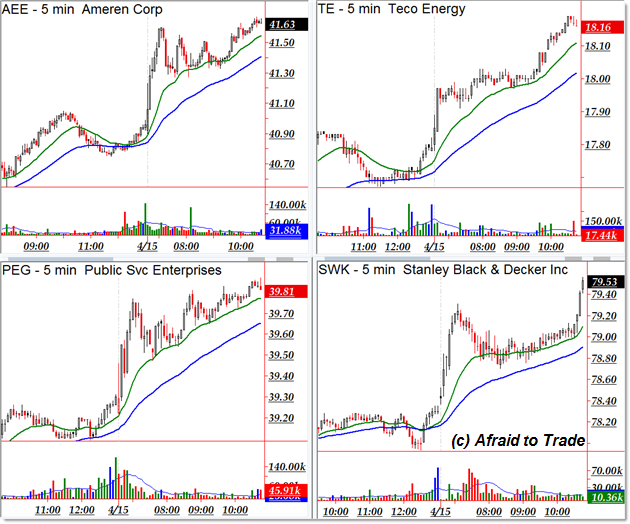

Should the market stage an end-of-day magical reversal like yesterday, you may want to concentrate on the top intraday trending stocks at the moment which include Ameren Corp (AEE), Teco Energy (TE), Public Services (PEG – back again), and a name you don’t see often – Stanley Black & Decker (SWK).

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).