The Bullish Creep Continues Market Update and Scan March 22

The never-ending Bull Market Rally continued today with a new swing high occurring in the S&P 500.

Let’s update our levels for the S&P 500 Index and note the big trending stocks today:

Logic and negative divergences suggested a downside (bearish) bias going into today’s session – this was confirmed with the initial downside opening gap.

That was all the bearish action we’d see – a swing down toward 2,040 – as buyers rushed in to support the market, generating a reversal and trend day higher.

Respect the range that’s taking the shape of a “Megaphone” or widening range trendline pattern as highlighted.

Receive daily updates, planning, and education by joining the Afraid to Trade Premium Membership.

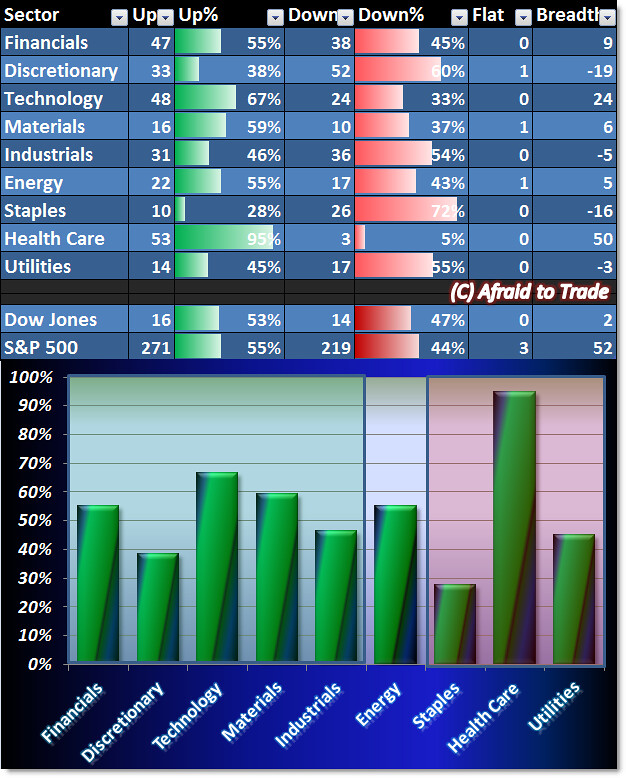

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Much like yesterday, despite the bullish price action we’re seeing caution signs from Breadth/Money Flow.

The strongest sector is Health Care and all other sectors trade near their 50% ‘halfway’ breadth levels.

Here’s a top-level or full-perspective view of today’s S&P 500 stock performance (courtesy of FinViz.com).

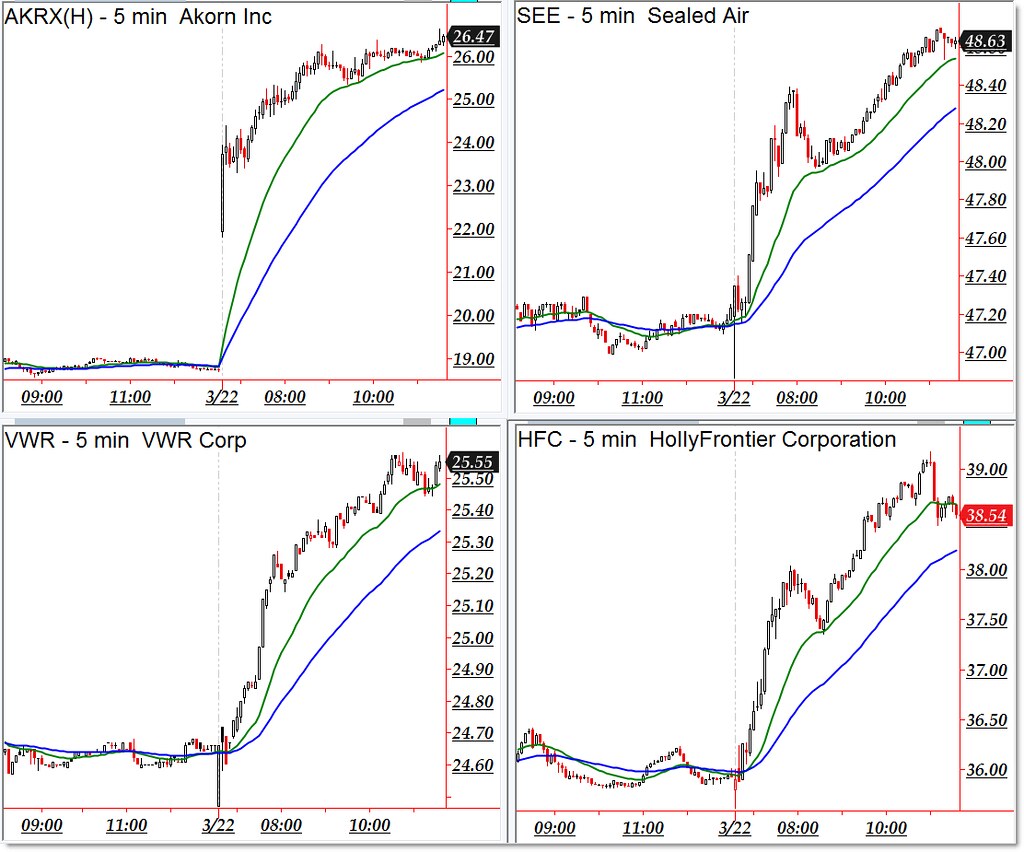

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Akorn (AKRX), Sealed Air (SEE), VWR Corp, and Holly Frontier Corp (HFC)

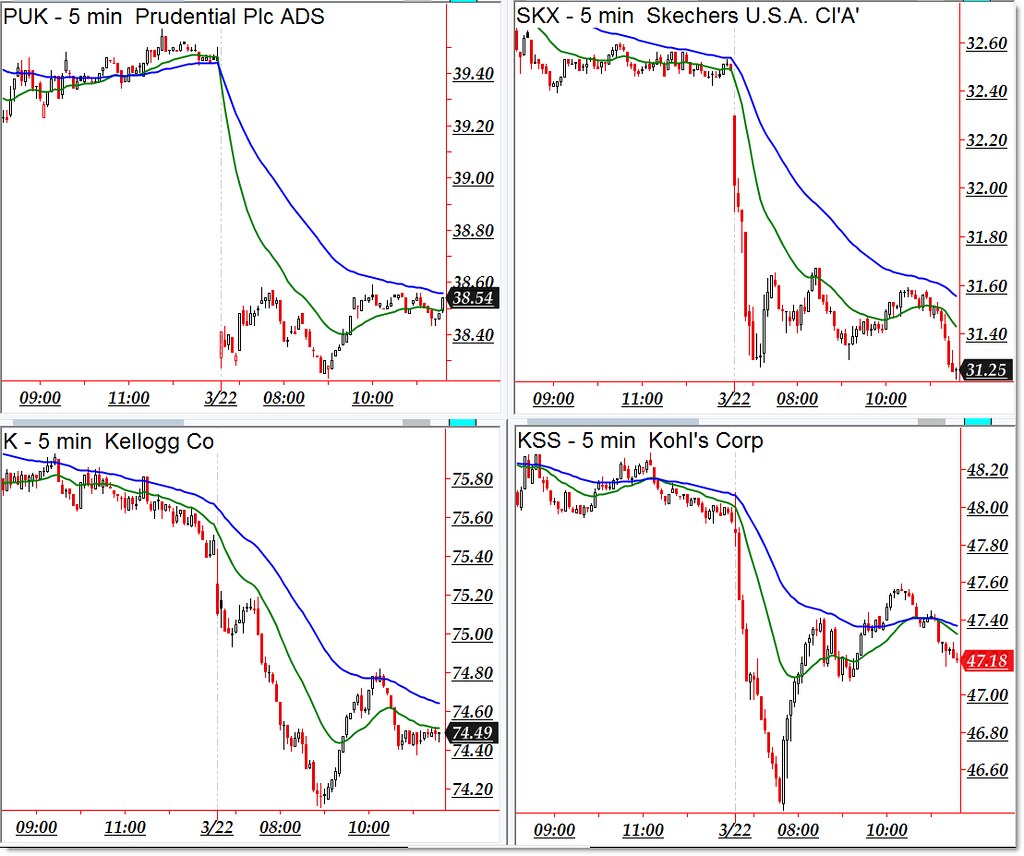

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Prudential (PUK), Skechers (SKX), Kellogg (K), and Kohl’s (KSS)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

One Comment

Comments are closed.