The Five Surprising Downtrending Dow Jones Stocks at Fresh New 52 Week Lows

Are you ready to be surprised?

Five leading, well-known stocks in the Dow Jones Industrial Average (30 stocks) are near or just broke to fresh new 52-week lows in ongoing downtrends.

Simply stated, these stocks should be avoided.

Let’s chart these names, two of which may be very surprising to you:

Collectively, these are the five “weakest” stocks in the Dow given their ongoing downtrends (lower lows and lower highs) along with the new 52-week lows achieved.

I’ve known Caterpillar (CAT), American Express (AXP), and IBM have all been weak through 2015 (they appeared repeatedly on stock scans I posted), but I was surprised that two leading companies topped the list.

Goldman Sachs (GS) can do no wrong in the investment world, yet their stock has fallen 25% since the early 2015 peak.

The stock is in a free-fall collapse currently, having achieved a new 52-week low this morning.

Apple (AAPL) has struggled in 2015, creating a reversal or distribution pattern ahead of the August collapse.

Shares recovered and resumed the downtrend, collapsing under the $100 per share support level today.

Price has declined 28% from the early 2015 high above $130.

Again, Caterpillar, American Express, and IBM have been weak and downtrending.

Note the absolutely collapse (liquidation breakdown) for American Express (AXP) recently.

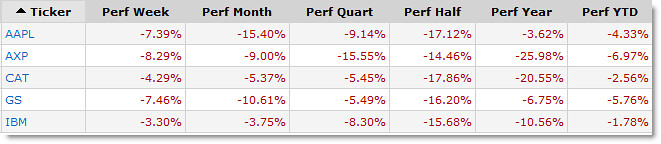

To summarize, here is a quick multi-timeframe comparison of performance:

Our strategies call for trading strong stocks in strong sectors in uptrends… and either avoiding or short-selling (hedging) weak stocks in weak sectors in downtrends.

That which is strong tends to get stronger; that which is weak tends to get weaker.

Study these trends and the likely weakness ahead for these downtrending and weak stock prices.

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

At the moment it is very tough to decide about the trend

that market is heading for, this is why we got to be well-aware of the

situation. I really appreciate the work that this blog does with providing

regular updates and info, it is so useful for me to have quality broker like

OctaFX since with them too, I am able to work out things with ease since they

also have quality daily market news and analysis service which is easier to

follow yet highly effective.