Three Simple Trends You Should Not Be Fighting

I’ve been discussing this ‘triple-play’ extensively in the Weekly Reports, but I wanted to pull the perspective back and show the pure price moves that seem to be tripping up a lot of traders right now.

I often show in blog posts and in member reports that the picture can become clearest without a myriad of indicators or complex methods. The last month has been a resounding victory for simple charting methods and a defeat for complex methods.

Let’s take a look at the three trends that have materialized and will continue indefinitely until price breaks respective trendlines.

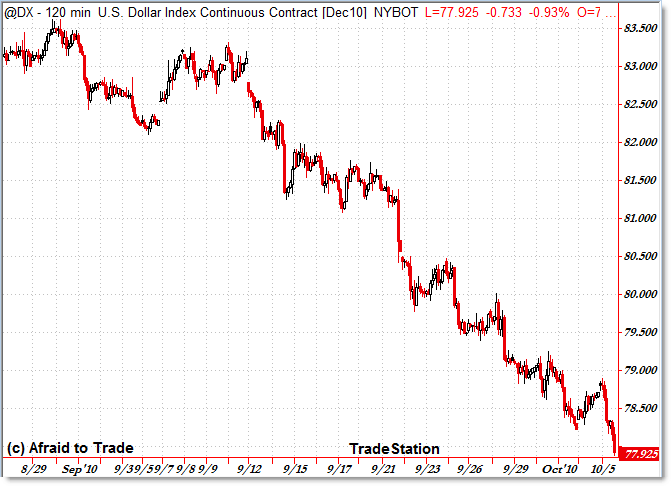

First, the “weakening” Dollar:

Next, the corresponding surge in Gold:

The relationship between these two has been stable – in that the Dollar has been steadily declining as Gold has been steadily rising.

In such environments, we return to simple Technical Analysis 101 principles that state:

“Trends, once established, have greater odds of continuing than of reversing.”

The over-arching explanation for the move seems logical and clear:

The Federal Reserve is all but guaranteeing additional quantitative easing for the economy, and now that strategy has gone beyond the United States to involve other countries, notably Japan, who are willingly weakening their currency to provide economic stimulus measures.

Currencies are in the cross-hairs, and gold is surging as a ‘consequence’ of currency weakening measures – measures designed to stimulate the economy.

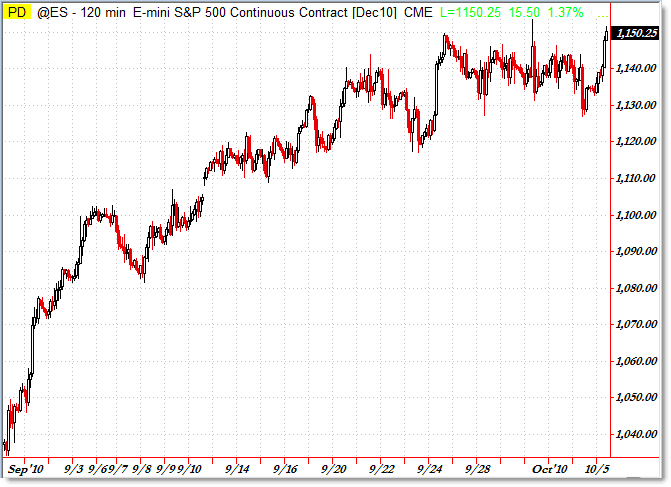

And what’s the final trend you shouldn’t be fighting?

If the Government/Federal Reserve is successful at saving a weakening economy, then we would expect the economy to recover/strengthen, and thus stock prices will rise (even though the Fed is looking to add Treasuries to its balance sheet to keep yields low).

Cue the S&P 500 chart:

Sometimes you have to take a chart purism – or specifically price purism – viewpoint and go with that.

It looks like the last couple of months – and perhaps going into the near future – will be a potential continuation of these moves.

And as long as these markets remain above or beneath their respective short-term trendlines, you fight the trends at your peril.

Trends can’t persist forever, but they often persist longer than most people think they will.

If you feel absolutely compelled to fight these trends, do so on confirmed trendline breaks – not until.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

I disagree. These three trades are overcrowded and will come tumbling down very soon. Good luck however.

I'm not saying you're required to participate in them, just don't fight them while they persist. When they reverse – and they all will – it will do so on a price trendline break, but trying to call tops and bottoms in such powerful moves will probably be more costly than beneficial in this environment.