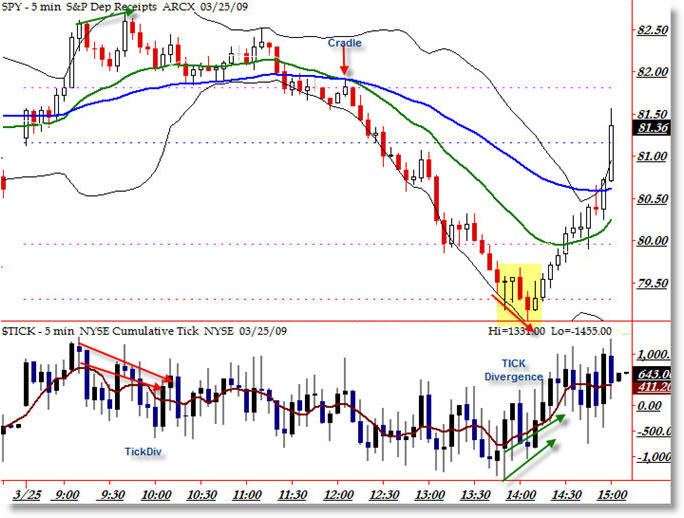

TICK Divergence forms Intraday High and Low

On my end-of-day summary of the ‘idealized’ intraday trades (a practice or journal I encourage all day traders to keep), I noticed something interesting – the intraday SPY (and DIA) high and low of March 25th formed on momentum and NYSE TICK Divergences. I thought I’d focus this post on those TICK divergences.

SPY 5-min:

Price rallied sharply off an opening gap to new intraday highs, and price swung back down to test support above the 20 EMA then rallied up to make a fresh intraday high… but it did so on a TICK divergence both in absolute terms and via a 5-period simple moving average of the 5-min closing bars on the TICK.

I’m displaying the NYSE TICK ($TICK in TradeStation) in the bottom chart on a 5-minute scale using candle charts (bar charts or even line charts would be fine) and then taking a 5-period moving average.

Price floundered around key EMA support before breaking beneath these levels before noon and then the 20 EMA crossed beneath the 50 EMA to form the “Cradle,” and then price simultaneously rallied up into this confluence resistance zone (which also happened to include yesterday’s closing price) to set-up my favorite “Cradle Trade.”

This allows you to place a relatively tight stop beyond the EMA confluence crossover and play for a Large Target, namely a potential trend reversal which is exactly what we got out of price until…

Price formed a Positive TICK (and momentum oscillator – not shown) divergence as price made a new low at 2:00, yet both the TICK and the Moving Average of the TICK formed a higher low (thus creating the divergence).

I’ve said many times that intraday highs and lows sometimes form powerful divergences, and it just so happened today that both the high and low were formed on dual types of Divergences, which serves as an educational example for reference.

Corey Rosenbloom

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Travel to the LA Trader’s Expo in June to hear Corey speak on “Idealized Trades for Intraday Traders”

sp came back to retest 50 day MA ….. then strong rally

It was also the 200 period SMA on the 15-min chart. That level had some confluence there.

Holding support is good for the higher-timeframe bulls.

The NYSE-TICK is one of the main indicators I use. I really consider it a window into exactly what the market is doing. I don’t know why you wouldn’t utilize it – it’s very valuable. Good post!