Today’s Midday Update is Very Different from Yesterday’s Aug 25

While yesterday was another powerful sell (liquidation) session in the market, today sparks a sudden relief rally up away from the 1,900 target.

Is price headed back to test the lows?

And what levels are we focusing on now in the high volatility? Let’s chart them:

Again, please take a moment to review the prior “What Two Breadth Charts are Saying about the S&P 500.”

Also, compare that with the real-time expected sell-off we’re seeing in today’s morning update: Weekly Chart Perspective of the Steep Stock Sell-Off

From positive divergences at the 1,880 index level (1,900 is our simple reference line), stock prices rallied sharply in the morning but stalled mid-day ahead of yet another bearish swing down from the 1,945 and 1,940 resistance levels.

I drew a short-term triangle connecting the compressing highs and lows – price trades near the 1,920 level (the Midpoint) currently which will be our intraday reference between 1,900 and 1,940.

Receive daily updates, planning, and education by joining fellow members of the Afraid to Trade Premium Membership (before subscription prices rise).

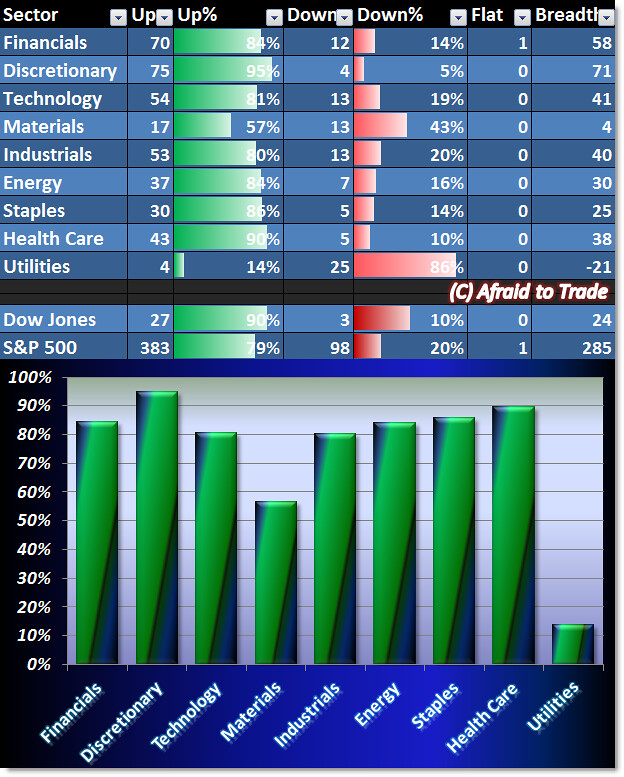

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Yesterday’s large sell-session saw over 95% of stocks negative on the day – across all sectors.

Today reveals almost the opposite, though Utility Sector stocks are the weakest group today.

All other sectors – this time except Materials – trade above the 80% bullish breadth level.

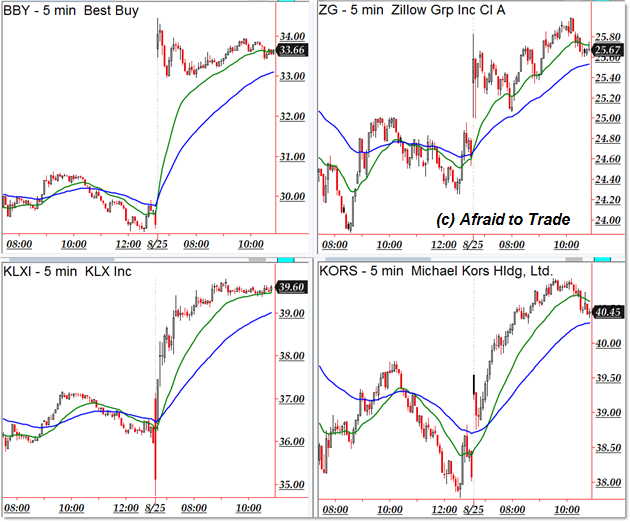

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Best Buy (BBY), Zillow (ZG), KLX Inc (KLXI), and Michael Kors (KORS)

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Pepco (POM), DSW, CMS Energy, and DTE Energy

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

Such drops are good opportunity to enter into long trade, but at the same time, it is crucial that we are careful with how we work, it can be one mistake that can cost destruction, so that’s why every step is crucial. I am working with OctaFX broker where every step for me is really picture perfect due to quality conditions which includes low spread of 0.2 pips, high leverage up to 1.500 plus much more which helps me work easily.