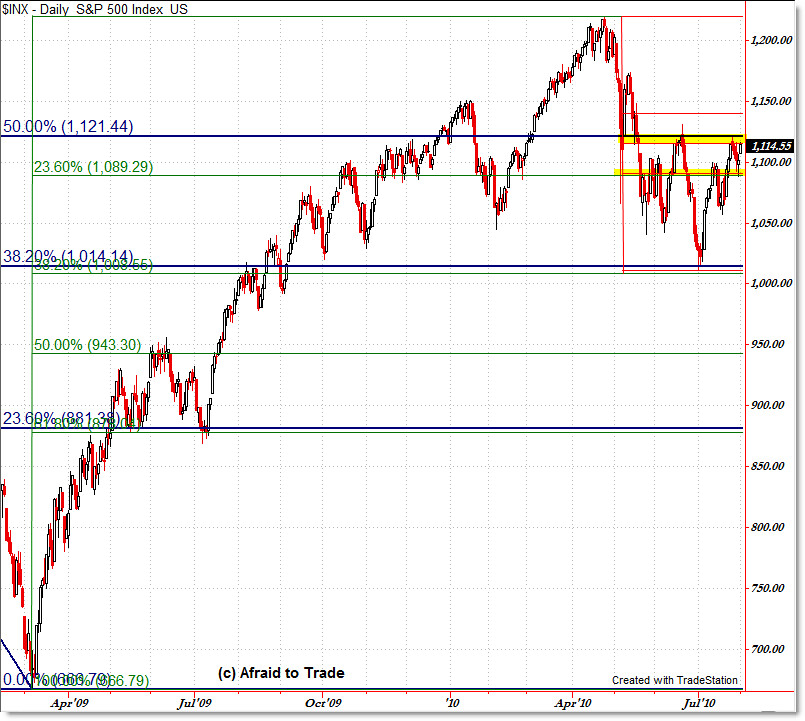

Triple Fibonacci Confluence Reveals Trapped SP500 – Key Levels to Watch for Breakout

Are you confused as to why the S&P 500 has been trapped in a tight range the last few weeks?

Perhaps a look at key long and short-term Fibonacci retracements can help – in fact, looking at the recent Fibonacci grid can give you one of those “A-Ha!” moments.

Let’s take a look at the grid and I’ll explain where the retracements come from and how they’ve converged right here right now:

(Click for full-size image)

To draw a Fibonacci Retracement grid, start with a major high, draw to a major low (or vice versa) and the computer software auto-generates the 38.2%, 50.0%, and 61.8% retracements.

That’s what I’ve drawn in the chart above, only adding the 23.6% ratio to the chart.

Here are the levels from which I drew the key Fibonacci retracement grids you see above:

BLUE GRID:

From the 1,576 high in October 2007 to the 666 low in March 2009 (shows retracements on the way up):

23.6%: 881

38.2%: 1,014

50.0%: 1,121

61.8%: 1,228

GREEN GRID:

From the 666 low in March 2009 to the 1,219 high in April 2010 (shows retracements on the way down):

23.6%: 1,089

38.2%: 1,008

50.0%: 943

61.8%: 878

RED GRID

From the 1,219 high in April 2010 to the 1,010 low in July 2010 (shows retracements on the way up):

23.6%: 1,060

38.2%: 1,090

50.0%: 1,115

61.8%: 1,140

I’ll let the chart speak for itself, but the main idea is that we have a dual Fibonacci confluence at the 1,115 area along with a dual confluence support at 1,090.

The big number to watch today is the 1,121 retracement level (blue) from the 50% line of the “Entire Bear Market” retracement.

A break outside of either one of these areas – 1,120 as upside resistance and 1,090 as downside support – likely results in a move to the next level, which would be 1,140 to the upside and 1,060 to the downside.

A break beyond that, however, changes the game and breaks the market out of this really weird confluence of so many timeframe Fibonacci levels and would argue for a continuation move – upwards to the 1,200 level if above 1,140 and back down to 1,010 if under 1,060.

As traders, we don’t try to predict, but instead take opportunities and manage risk – Fibonacci grids like this can help you set up the contingency plans using “IF/THEN” statements (in terms of entries and targets).

Keep this reference grid handy and watch price as it tests these levels.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey, have you done wave analysis on 60 minute time frame? It looks like current move is wave 5, with both wave 2 and 4 retracing 50% of previous impulse waves. It will be great if you could comment/post about that.

Thanks for a great blog.

SA