Updating TICK Volatility Charts to Start 2013

If you use the NYSE TICK (or related Market Internal) in your trading decisions or analysis, it’s important to note changes in the indicator that occur as a result of volatility.

In other words, a registered TICK reading of plus or minus 1,000 (a popular level) means one thing in a low volatility environment and another thing in a high volatility environment.

Let’s take a moment to update the current TICK Volatility levels and note how TICK levels change with volatility.

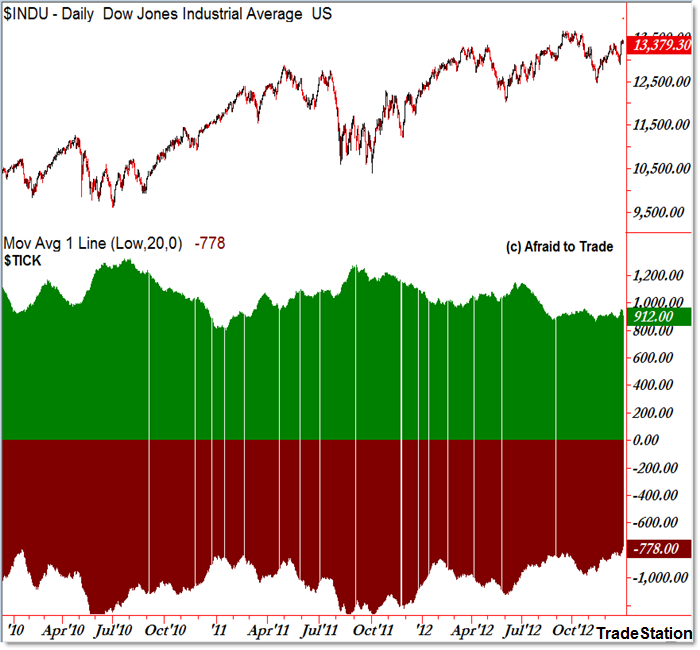

Here’s the updated chart of the Dow Jones Index with the NYSE TICK from 2010 to present:

Let me take a moment to explain what we’re seeing in the chart above.

The Dow Jones index is on the top level but it could just as easily be the S&P 500, NASDAQ, or Russell.

The indicator below is not the NYSE TICK itself ($TICK), but a 20 period (20 day) simple moving average of the session HIGH of the TICK (green) and another 20 day simple moving average of the session LOW of the TICK.

In other words, one bar on the histogram represents about one month of price action in the index.

The key take-away is that average intraday TICK highs and lows change as a factor of market volatility – average intraday highs and lows move under the 1,000 threshold during low volatile (‘creeper rallies’) periods and increase above 1,000 during high volatile (sharp/sudden sell-off) phases.

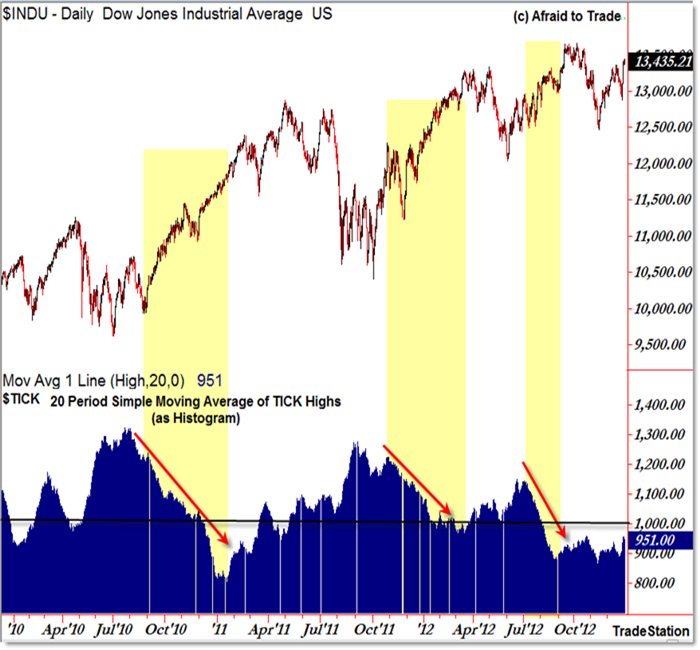

We can see this much clearer if we take an isolated look at NYSE TICK Highs (20d average)…

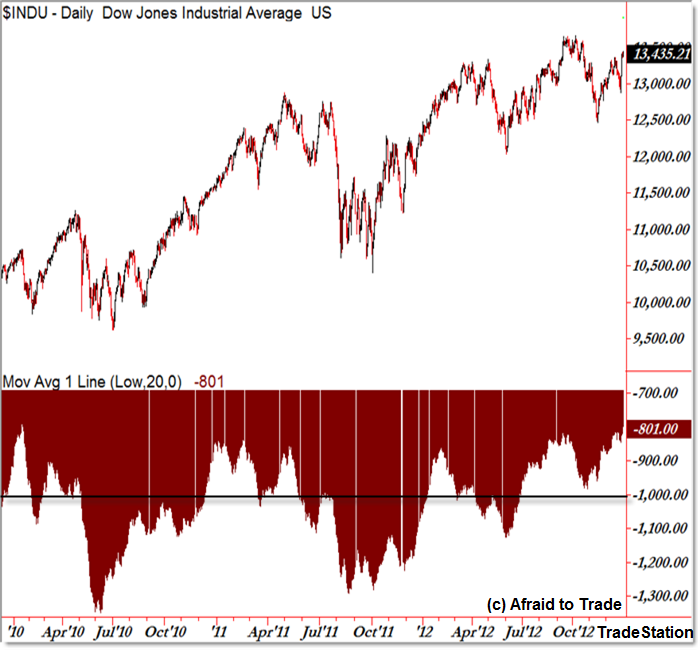

And then TICK Lows (20d SMA):

Getting straight to the point – what’s the purpose of charts like these?

Let’s assume you use absolute readings in the TICK to make (or assist) intraday trading decisions.

A popular strategy would be applying one of the following tactics:

- Taking profits on a long position when the NYSE TICK reaches +1,000

- Selling short/fading a rally when the NYSE TICK reaches +1,000

- Taking profits on a short position when the NYSE TICK reaches -1,000

- Going long (buying)/fading a sell-off when the NYSE TICK reaches -1,000

One can also – as I do – use the NYSE TICK or similar market internal indicator to identify divergences with price.

As the 20 day moving average of NYSE TICK highs and lows reveal, a reading of plus or minus 1,000 means one thing in a high volatility environment and another in a low volatility environment.

Let’s assume a low volatility environment where a trader makes decisions based on a low volatility TICK environment, such as what we have now.

On average, a +1,000 intraday TICK reading will be rare, and may not occur for a few days in a row.

If so, a trader in a long/buy position will not receive an exit signal (TICK will rarely reach +1,000). Similarly, a trader who uses a +1,000 TICK signal as a short-sell signal will not receive many sell-short entries.

On the contrary, let’s now assume a high volatility TICK environment (we don’t have this at the moment but we may be seeing this occur in the next month or so):

A trader who uses a +1,000 TICK as a sell (profit) signal will leave money on the table as price – and the TICK – continue to push higher through the session.

Even worse, a trader who short-sells when a +1,000 TICK registers will lose money as the market – and TICK – continue to push higher toward the 20 day average or norm.

The main idea is that if we use TICK in any capacity as an intraday or short-term trader, we must be aware of cyclical changes in average intraday TICK readings as a factor of market volatility.

At the moment, the 20 day average TICK high is +951 and the 20 day average TICK low is -801.

It only takes a moment to adjust intraday TICK levels to volatility and it can make a huge difference for those who do so.

For additional insights on the topic of TICK Volatility, visit my prior posts at:

- October 2012: “Updating TICK Volatility for Intraday Traders“

- December 2011: “Updating TICK Extremes for Trading Reference“

- Updating TICK Extremes for Intraday Traders (June 28, 2011)

- “Why You MUST Consider Volatility When Trading with the TICK”

- “Research in Behavioral Changes in the TICK Over the Last 10 Years”

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s new book The Complete Trading Course (Wiley Finance) is now available!

4 Comments

Comments are closed.