Which Sectors Outperformed Last Week?

Let’s take a quick look at which key sectors outperformed all others last week – during a rally week where we saw all major sectors advance.

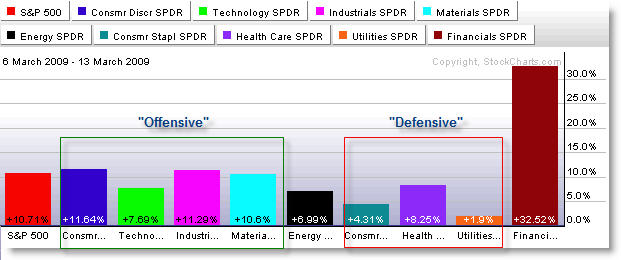

First, from StockCharts.com:

I separated the AMEX Sectors into traditionally “Offensive” or sectors that reflect market confidence and “Defensive” or sectors that generally hold their own during market pessimism and downturns.

The Financials should be grouped with the “Offensive Sectors” because strength there – and in Retail, Consumer Discretionary, Technology – show that investors and funds might be more confident in trying to put their money to work where they expect to get the biggest ‘bang for the buck.’

On the flip-side, investors try to ‘hide’ in Defensive Sectors like Health Care and Consumer Staples that should hold their own (though still decline slightly) during downturns. Strength here reflects investor pessimism.

Seeing the strongest advance – 30% – in the Financials is a wonderful and welcome sign for belagured investors. To envision any sort of Market Bottom, we would need to see continued strength in the Financial and “Offensive” (Discretionary/Retail) Sectors that have been punished the most. For now, investors can be encouraged.

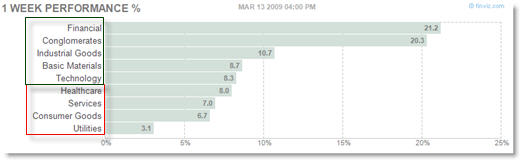

Let’s take a look at a similar chart on FinViz.com (Groups):

I also separated these by “Offensive” (green) and “Defensive” (red) Sectors (they classify things a little different than StockCharts.com).

Financials and (Large) Conglomerates were strongest, with Industrial goods advancing strongly as well. The broader S&P 500 Index rose 10% last week (for comparison).

Utilities and Consumer Goods/Staples underperformed the market and all other sectors – that’s what you’d want to see if the market has any hopes of a sustained recovery.

Keep checking ‘under the market hood’ for additional clues.

Oh, and Adam Hewison released a video update on the current rally entitled: “Bear Market Rally… or Serious Reversal” that goes into much more detail.

Corey Rosenbloom

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Register (free) for the Afraid to Trade.com Blog to stay updated

Corey, First thank you for your hard work, and your generosity to share this with everyone.

Humm.. .. finance sector went up so much last week!

After the massive injection of $ from Fed and use those fund to buy up some other financial institutions, plus the talks of nationalize the Financial institutions last two weeks. They are now profitable..

I would suggest that the Banks are trying to save their hide.. doing a bit of accounting gymnastics.. One would be interested to look behind the curtain for this one..

Henry

Thanks Henry!

I’m glad to see such a bullish move in Financials.

Well, you bring up a good point. Might be cooking the books again – I hadn’t thought of that.

I tend to over-focus on the charts to let them speak for themselves but there’s always things going on we don’t see.

I tend to over-focus on the charts to let them speak for themselves but there’s always things going on we don’t see.