Year to Date Sector Rotation Insights August 2016

Bull? Bear? Top forming? What’s the message from the Sector Rotation Model at the moment?

Here we go!

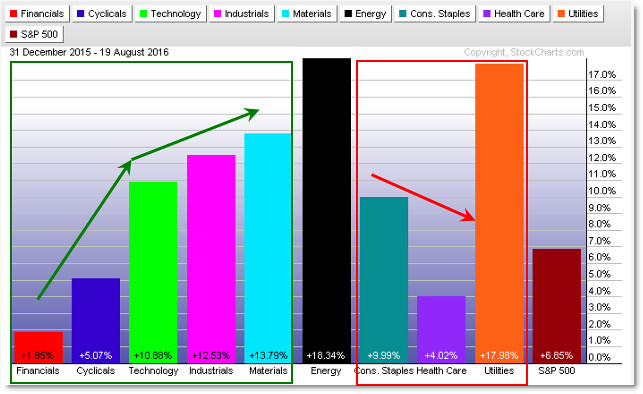

Under the Sector Rotation Model, we compare and contrast money flow – via relative strength – between the Offensive Groups (green above) and the Defensive Groups (red).

In general, if insiders and large funds are bullish or optimistic about the future of the economy and thus the stock market, they’ll deploy capital into stocks and sectors like Financials and Technology.

If they feel the future is less bright, they may remain invested but will increase exposure to defensive stocks (high yield, low volatility) and groups like Consumer Staples and Health Care.

That being said, what’s the message?

Energy is the #1 group so far in 2016 (at the moment) followed closely by Utilities.

Both rose about 18% so far in 2016.

Is that bullish? No, it’s not.

It suggests a Late Cycle environment where money is not boosting Financials or Consumer Discretionary stocks (the left side of the chart) but instead are playing more defensively.

The strength in Industrials and Materials suggests funds are not overwhelmingly bearish – they’re simply not – but that they’re playing more protectively and guarding profits as opposed to attempting to expand profits aggressively.

The strong performance in Utilities further paints a bearish or defensive/risk-averse environment.

It can be helpful to follow this model to get a sense of where money is flowing and whether the big players are aggressive/offensive (Risk-ON) or – as seems to be the case now – are more protective/defensive (Risk-OFF).

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

I don’t think it’s easy to say this, but things are looking shaky for some of these. I mostly prefer to trade with keeping long targets because that’s how we are able to gain benefits and achieving profit is also possible easier. I trade with OctaFX broker where I get everything done relatively easier which is through to do with the minor spread that they have starting from 0.1 pips for all major pairs while they also have smooth trading platform in cTrader, it’s all super cool.

It’s true that insiders and huge funds area unit optimistic or optimistic concerning the long run of the economy and so the stock market; they’ll deploy capital into stocks and sectors like Financials and Technology. It’s likeable to trade with keeping long targets as a result of that’s however we have a tendency to area unit ready to gain edges and achieving profit is additionally attainable easier.