Corey’s Feb 9 Chaotic Market Update and Stock Scan of the Day

Up, back down, up, back to a new low, and now off to a new high – that’s today’s session in a nutshell.

Let’s update our levels for the S&P 500 Index and note the big trending stocks today:

Our 1,835 SP500 target was achieved yesterday and price rallied up into the close on positive clear divergences.

However, we were welcomed with a sharp down-gap BACK to our 1,835 support target and a sudden boost up away from it again.

More swings too price back down toward, then up away from, and finally back toward 1,835 on a huge positive divergence.

Like yesterday – almost exactly at the same time – we have our big end-of-day rally up through to new highs.

Receive daily updates, planning, and education by joining the Afraid to Trade Premium Membership.

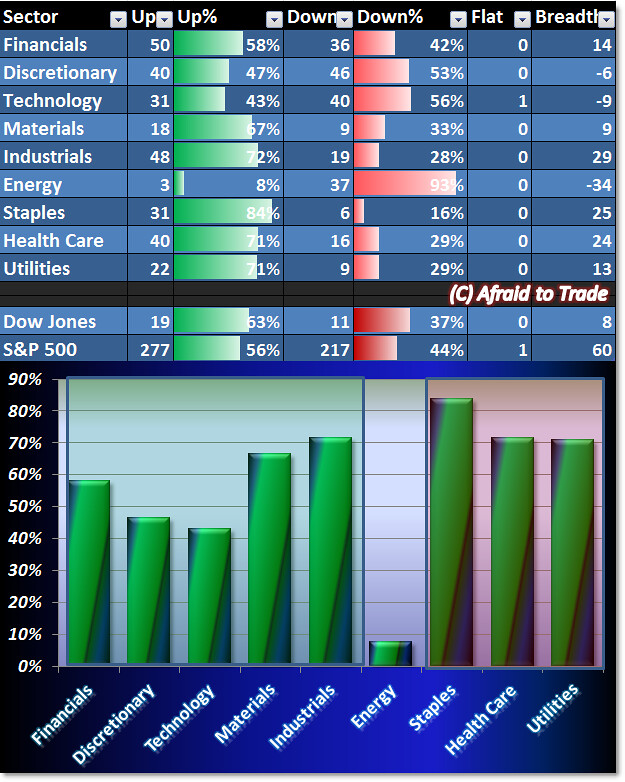

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Despite the second day of bullish price action, the strongest sectors are the Defensive names (Staples and Utilities).

Materials and Industrials are also strong while Energy – once again – is the weakest sector of the day.

Take a moment to pull the perspective up – view this morning’s “Sector Strength/Weaknesss” Post.

Here’s a top-level or full-perspective view of today’s S&P 500 stock performance (courtesy of FinViz.com).

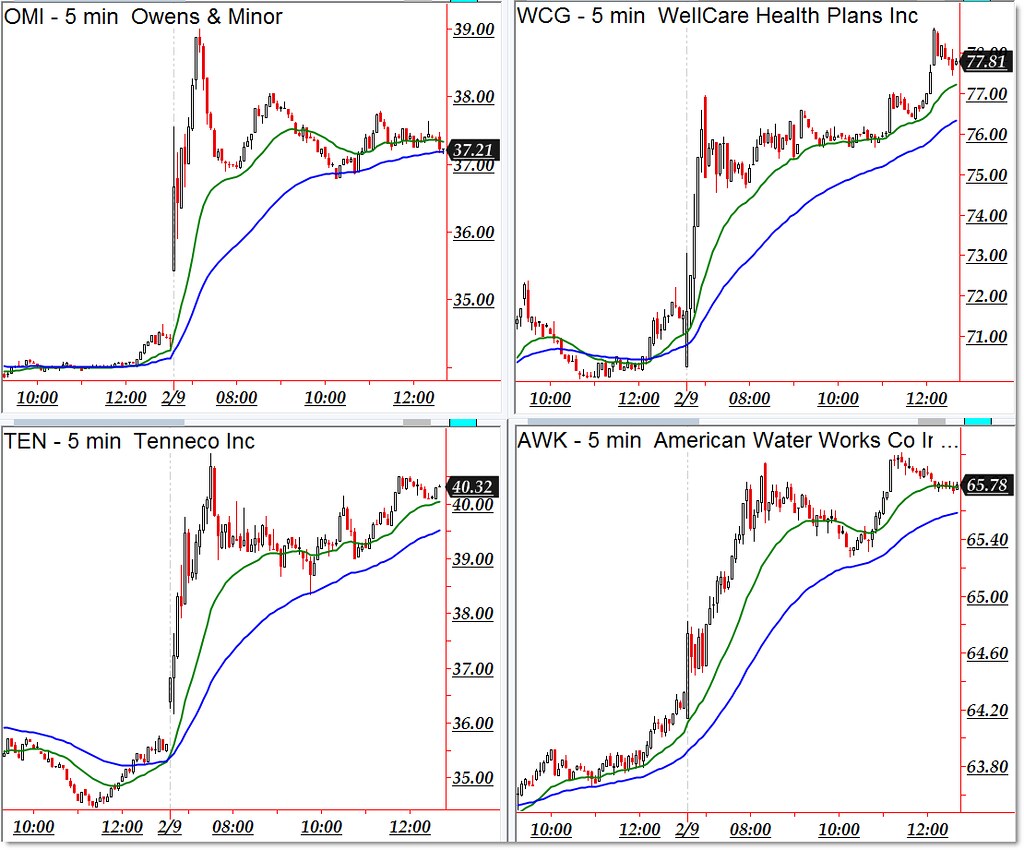

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Owens & Minor (OMI), WellCare Health (WCG), Tenneco (TEN), American Water Works (AWK)

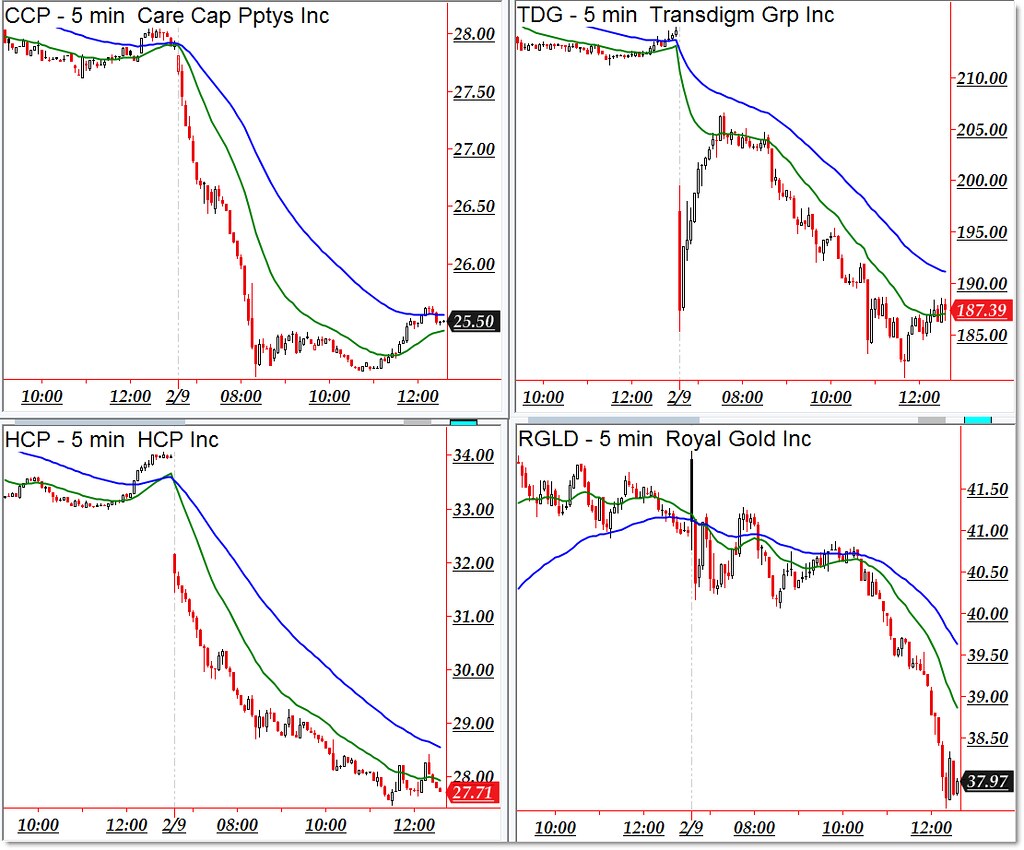

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Care Cap (CCP), Transdigm Group (TDG), HCP, Royal Gold (RGLD)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

This is why Forex is called unpredictable, we can never predict what is going to happen next, so we should always be ready to handle any situation and that’s the only way to succeed. I am lucky to be working with http://www.tradewisefx.com/ broker where they help me forever with their outstanding facilities like low spreads starting from 0, so that really helps me with the performance and allows me to be successful easily.