April 16 Bullish Sector Breadth and Trending Stocks

We finally have broad bullish sector breadth for today’s bullish bounce session.

Let’s take a look at S&P 500 Sector Breadth and the current trending stock candidates:

In the previous bullish bounce sessions, we’ve seen “caution” signs coming from sector strength in Utilities and Energy.

This time, we see broad bullish breadth where Industrials ($XLI) lead the pack along with Staples.

However, all sectors are showing dominance today except Health Care ($XLV) where 44% of stocks are up on today’s session.

The broad participation suggests likely additional upside price action (that’s the hope at least).

With that in mind, let’s scan for leading stocks that may continue in the trending session:

General Mills (GIS – a Consumer Staples stock), Eastman Chemical (EMN), Valero Energy (VLO), and PraxAir Inc (PX) provide potential trend day continuation candidates.

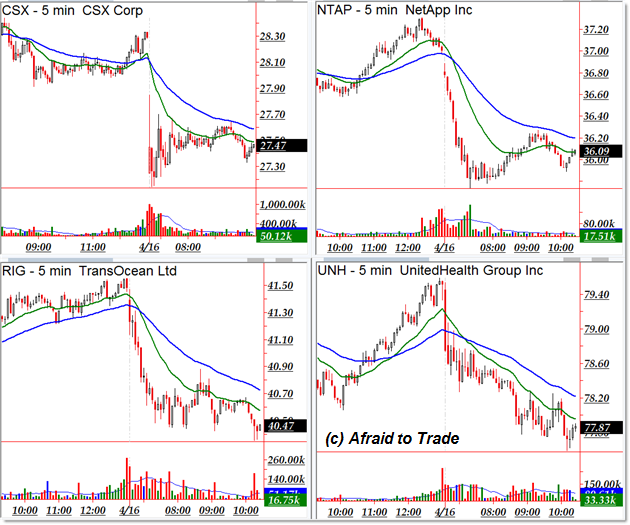

Today’s “trend fighting” downtrending stock candidates – for those who like to fight the tide – include CSX Corp (CSX), NetApp Inc (NTAP), TransOcean (RIG), and United Health Group (UNH – remember Health Care is the worst performing sector today).

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).