December 4 VSpike Reversal Intraday Update and Scan

Can this market actually go down? It seems like the answer is no – at least not for long.

Buyers swooped in once again to thrust the market higher on the hint of a possible decline in the market, using the retracement as a knee-jerk reaction to buy.

Let’s update our levels and highlight the strongest trending stocks to trade for the moment:

The morning retracement was reversed violently – another “V-Spike” Pattern – off the 2,063 level and the index short-squeezed its way to another all-time high.

Our pivot point continues to be the 2,075 level where the market is “ignore it all” breakout bullish (short-squeeze) above 2,076 and otherwise cautious as price fills out the range between the 2,063 and 2,075 level.

Stay with price and avoid bias and expectations in this market environment.

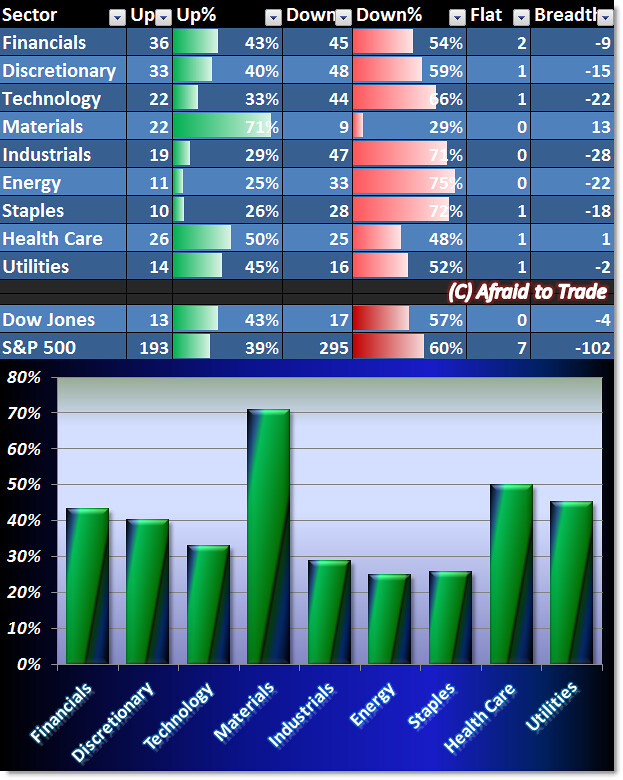

Sector Breadth can be deemed cautious or bearish at the moment:

All sectors except Materials are trading beneath their 50% Breadth line, meaning more stocks are negative than positive for the session.

The pockets of strength include two of the three Defensive Sectors: Health Care and Utilities.

Otherwise, the weakest pockets include the middle of the chart – Industrials, Energy and Staples.

We have potential bullish trend continuation plays in the following stocks:

Hawaiian Electric (HE), Salix (SLXP), Enbridge (ENB), and Avago Tech (AVGO).

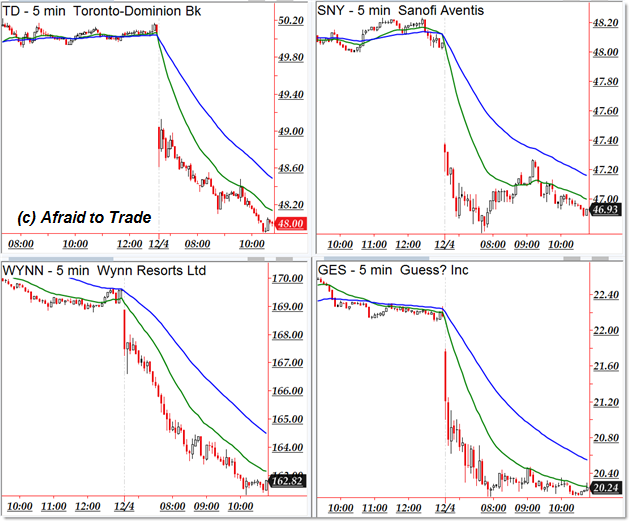

Potential downtrending candidates exist in stocks showing relative weakness today:

Toronto-Dominion Bank (TD), Sanofi Aventis (SNY), Wynn Resorts (back again – WYNN), and Guess (GES).

It may go against everything you believe in to stay with this bullish trend, but doing anything else has dashed may trading accounts.

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).