Intraday Sector Breadth and Trending Stock Update for March 26

With a strong mid-day downside reversal, let’s update our current Sector Breadth Chart (the message is very clear) and highlight our uptrending and downtrending stock candidate list.

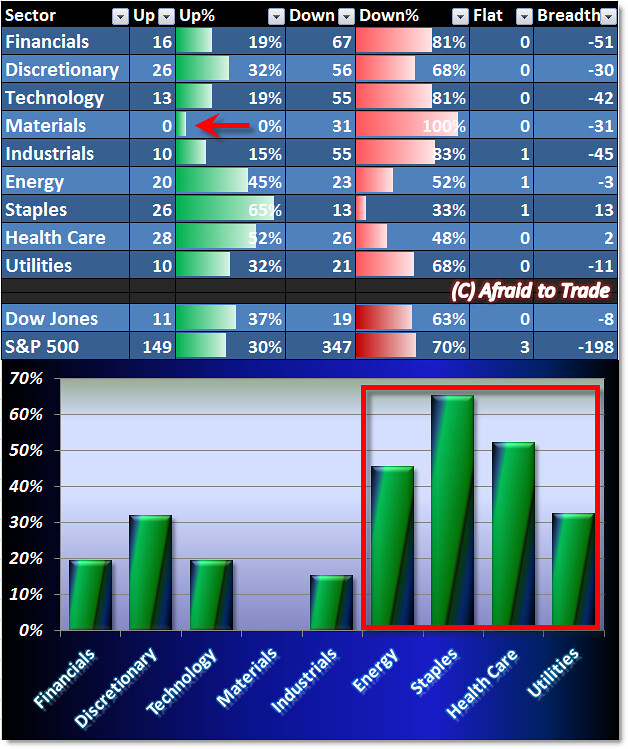

Let’s start with our broader S&P 500 Sector Breadth Chart:

A quick glance shows strength (money flow) entering the Defensive Names such as Staples ($XLP), Health Care ($XLV), Utilities ($XLU) along with Energy ($XLE).

Notice that zero Materials ($XLB) stocks in the S&P 500 are positive on the session right now.

Take a moment to review my prior posts “Bearish Signals from March Sector Performance” along with “Simple Repeating Top Pattern in the S&P 500.”

As for intraday trending stock candidates, let’s start with our top four candidates:

Our scan focuses on Lorillard (LO), Pepsico (PEP), Dr. Pepper/Snapple Group (DPS), and Baxter (BAX).

Finally, we’ll scan for key downtrending (down trend day) stocks active at the moment:

CME Group (CME) tops our downtrending list with a strong sell-off and is joined by Citrix Systems (CTXS), Allegion (ALLE) and big name Wynn Resorts (WYNN).

Continue focusing on the breadth of the market along with these trending candidates.

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s new book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).