July 21 Stock Scan and Sell Swing Market Update

The logical and expected sell-swing (retracement) developed against a background of resistance and divergences.

However, we’re bouncing up off a support level at the moment, so let’s update our key levels and stocks in play.

Let’s scratch the surface and look beyond the headlines to what’s trending today:

For a bit more context than the chart above, be sure to see this morning’s update on the “Retracement in the @YM and @ES” levels.

For the moment, monitor the positive divergence bounce up away from the 2,115 level.

There’s a great educational example in planning and divergences with today’s bearish outcome.

Follow along with members for more precise daily planning, analysis, and education.

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

With the stock market pulling back (retracing) from the highs, all sectors except Energy are negative today.

Most sectors are clustered around the 25% to 30% Breadth level except for Utilities where no stock is positive.

Yesterday saw divergences and distribution – a bearish sign – and today we’re seeing the logical outcome.

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Sanmina (SANM), Harley-Davidson (HOG), CH Robinson (CHRW), and Expeditors (EXPD)

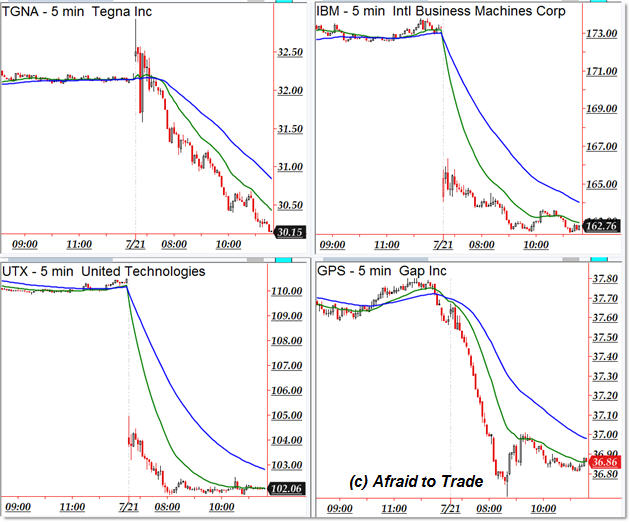

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Tenga (TGNA), IBM, United Technologies (UTX), and Gap (GPS)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

One Comment

Comments are closed.