July 23 Breakout Impulse Update and Stock Scan

Once again we ask the question, “How high can this market go?”

Today saw a new all-time intraday ‘breakout’ high for the S&P 500 and we focus our attention – and trading plans – on the breakout level and potential for additional upside continuation via a short-squeeze.

Let’s update our S&P 500 chart from the week and highlight the trending stocks of the day:

For additional planning, be sure to view the broader picture updates from the past sessions:

SP500 Update for a Fibonacci Level Planning Grid

S&P 500 Update and Level Planning July 22

Simply stated, the buyers overtook the sellers and forced a short-squeeze breakout this morning. We’re trading bullishly above the breakout level as bears lose money to buyers which could fuel a continued breakout towards the simple 2,000 target.

Otherwise, we’ll be on guard for a “Bull Trap” outcome should we see a sudden failure and return under the 1,985 trendline resistance (now potential support/floor) level.

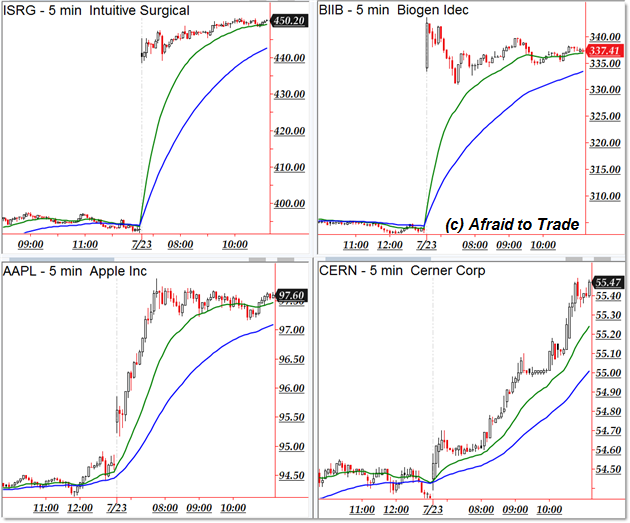

Now, let’s shift our attention to bullish-trending stocks for potential buy-trades the rest of the day:

Intuitive Surgical (ISRG), Biogen (BIIB), Apple (AAPL), and Cerner Corp (CERN).

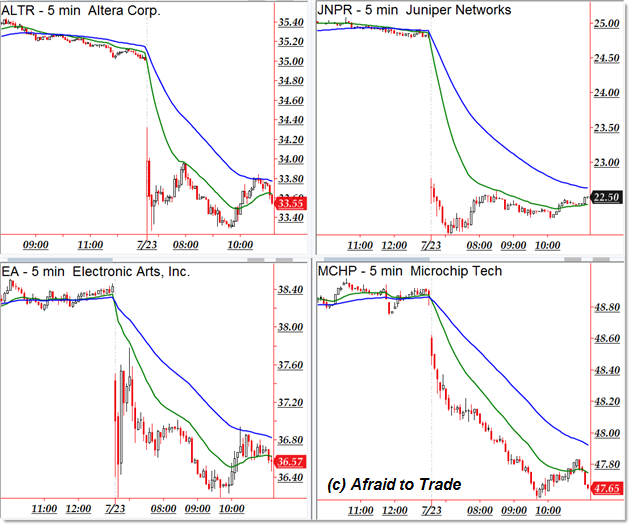

Bearish potential trend day continuity stocks include the following candidates:

Altera Corp (ALTR), Juniper Networks (JNPR), Electronic Arts (EA), and Microchip Tech (MCHP).

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).