June 26 Bear Flag Stock Market Update and Scan

Today’s session resulted in another sharp sell-off and “flag” style retracement for the S&P 500.

Let’s again highlight the updated structure and pay close attention to the key levels in play:

Notice the three yellow highlights I’ve drawn.

The first was the sideways (rectangle) consolidation and the most recent highlights are “Bear Flag” style patterns.

Yesterday’s session forms a great educational lesson of the Bear Flag price pathway (rising parallel trendline) and the short-sale signal that triggered straight off today’s open from divergences into the 1,960 resistance level (the lower edge of the prior rectangle).

For now, we’ll plan bearish/sell trades under 1,950; will be neutral between 1,950 and 1,952; and otherwise will be “alternate thesis/short-squeeze” breakout bullish on a trigger-break above the 1,953 level.

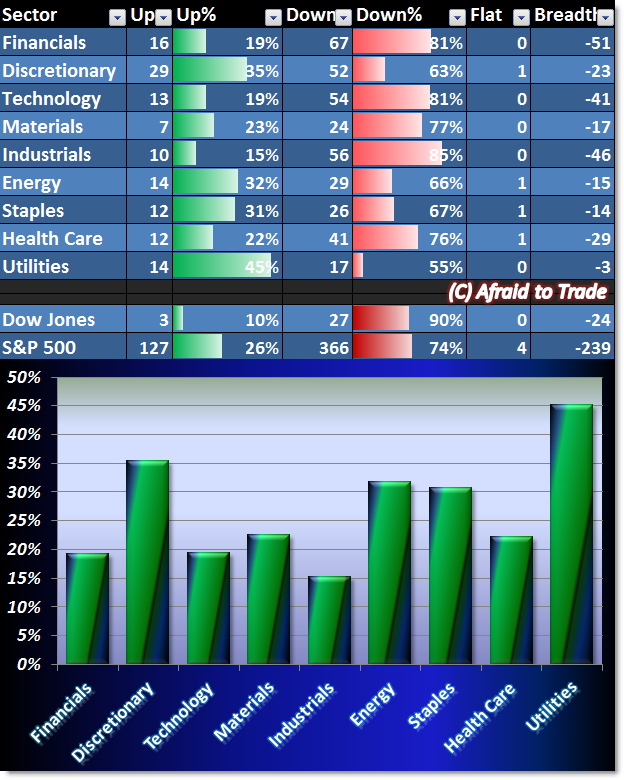

Our Sector Breadth Chart is not-surprisingly bearish during today’s flag session:

Utilities – a defensive sector – tops today’s bearish price action where 10% of Dow Jones stocks are positive on the session (26% of the S&P 500 stocks).

Defensive Staples and Energy also show relative strength.

The odd-sector (in terms of today’s bearish price action) is the XLY Consumer Discretionary sector where 35% of stocks are positive.

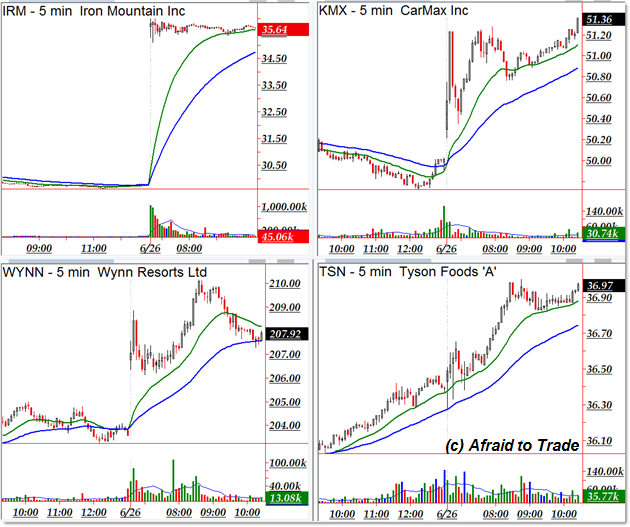

Despite the mixed signal, there are always bullish candidates to trade from our scans:

Iron Mountain gaps up (IRM), CarMax returns (KMX), Wynn Resorts (WYNN), and Tyson Foods (TSN).

Bearish candidates include the following:

Retail names Wal-Mart (WMT) and Target (TGT – not shown here) appear as downtrending intraday stocks along with TransOcean (RIG) and Oracle (ORCL).

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).