Rounded Arc Pattern Update and Stock Scan April 28

As April rushes to an end, let’s take a look at our current levels, today’s reversal, and big stocks of the day.

Let’s update our levels for the S&P 500 Index and note the big trending stocks today:

Yesterday’s Fed Day was a typical big up, retracement, big up outcome which took the index back to 2,100.

However, sellers stepped into the close, crushing the market back to our 2,086 support pivot target.

This morning’s bounce took us back to the high – on negative divergences – and we’re now seeing a sell-off straight back to our 2,086 pivot.

Focus on these levels – particularly the interplay between 2,086 and 2,100 right now.

Receive daily updates, planning, and education by joining the Afraid to Trade Premium Membership.

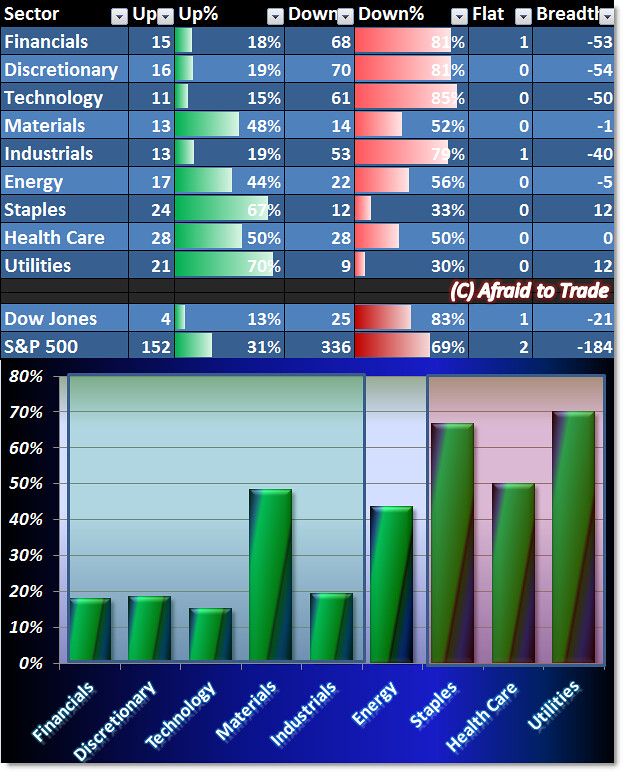

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

With the current money flow grid, we’re seeing BEARISH and Defensive plays.

Our strongest sectors today clearly are the “Risk-Off” groups – Staples, Health Care, and Utilities.

All other sectors are weak and four are under the 20% Positive Breadth threshold. That’s not bullish.

Here’s a top-level or full-perspective view of today’s S&P 500 stock performance (courtesy of FinViz.com).

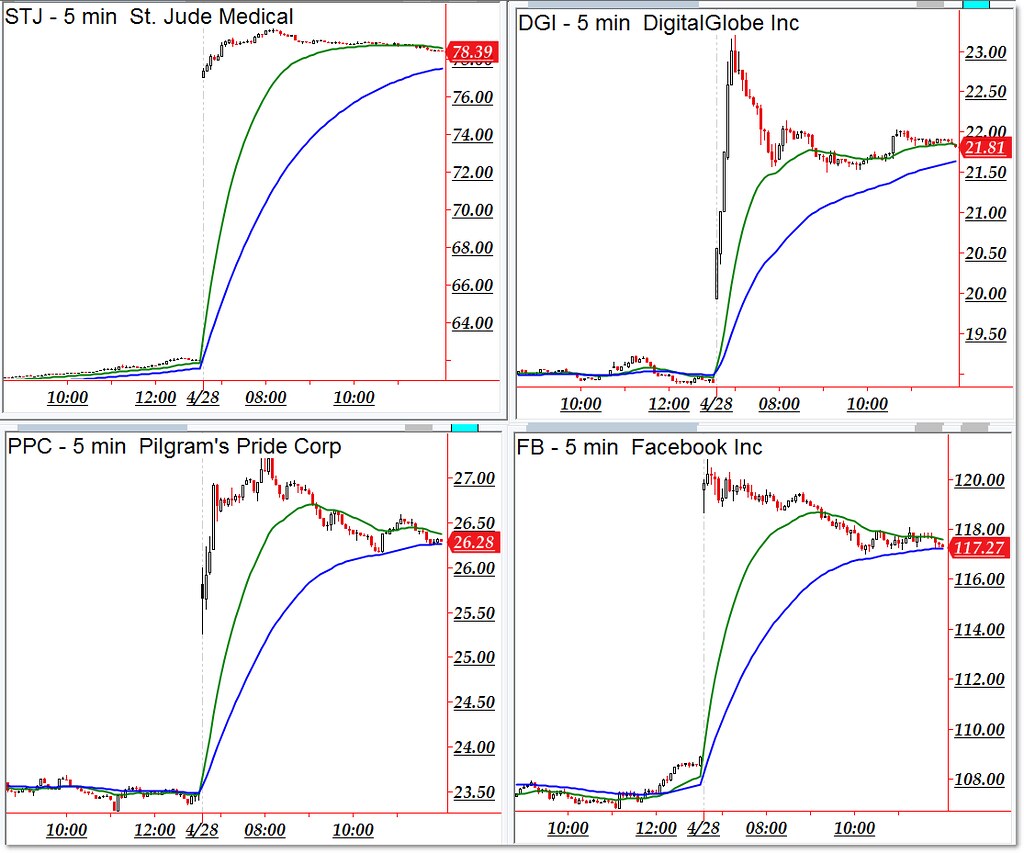

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

St. Jude (STJ), Digital Globe (DGI), Pilgram’s Pride (PPC), and Facebook (FB)

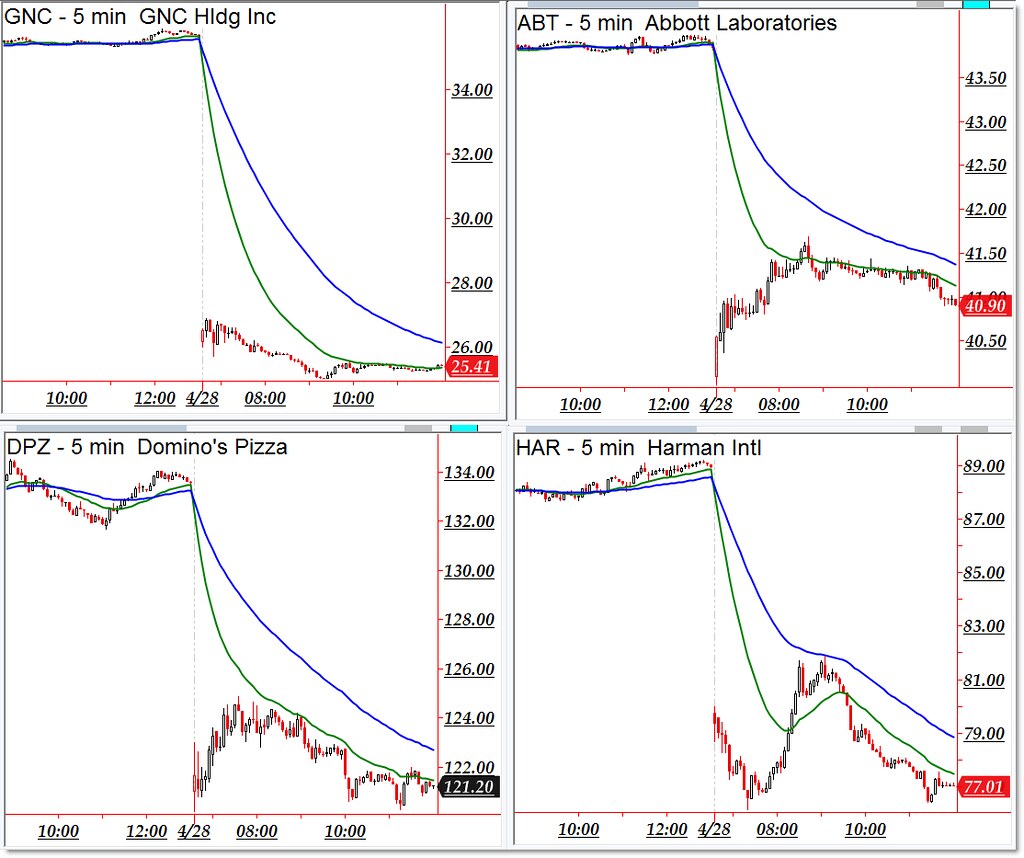

Bearish downtrending candidates include the following stocks from our “weakness” scan:

GNC Holdings, Abbott Labs (ABT), Domino’s Pizza (DPZ), and Harman Int’l (HAR)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

One Comment

Comments are closed.