SP500 Decided to Break On Through to the Other Side

Not to be spooked by a little retracement in the market, the buyers (bulls) decided to break price higher to the “other side” of the 20/50 EMA resistance.

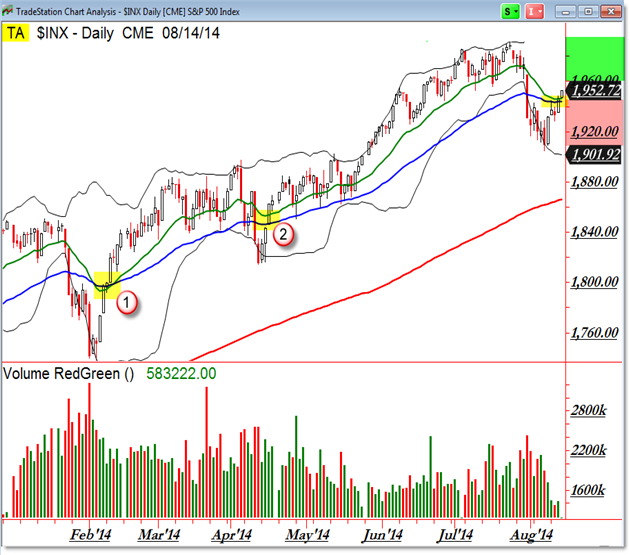

Let’s update our chart and note the “Open Air” as price completes another repeat pattern:

First, take a moment to study my prior update from August 11 entitled “Planning a S&P 500 Breakout from a Repeat Pattern.”

I highlighted two similar retracements under the rising 50 day EMA (February and April) and then showed what happened next when price traded up into the resistance – and then beyond it.

It’s very possible we’re seeing the same thing happen in August.

In other words, price is breaking through the 20/50 EMA reference level (1,945) and could complete a run toward the prior high just shy of 2,000.

If so, the movement would be fueled by bears (short-sellers) buying-back to cover stop-losses as buyers continue to flood money into the market (breakout buy orders above 1,950 and beyond).

We’ll monitor the “Open Air” closely and be on guard for any failure outcome (a reversal back under 1,945).

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

5 Comments

Comments are closed.