Steep Retracement Midday Update and Trending Stock Scan Sept 22

Well this is fun, isn’t it? The market actually traded lower after many days of straight-up price action.

It’s almost like the law of gravity actually applies again to the stock market!

That being said, let’s take a look at our S&P 500 intraday chart, note a stunning signal from Breadth, and then chart our top-trending stocks of the session.

I expanded more detail on this morning’s post “Planning the Pullback in the US Stock Market” so be sure to view the higher frame support/inflection level which happens to be near today’s session low at 1,994.

Simply stated, our focal point should be the 1,994/1,995 level where price may reverse. We’re seeing positive TICK (market internal) divergences here so don’t be super bearish on a bounce that may quickly develop at this level.

Otherwise, do continue your bearish plans on a breakdown under 1,993.

Sector Breadth shows us something remarkable:

Zero stocks (in the S&P) Consumer Discretionary and Energy sectors are positive today.

Our strongest sector (with ‘only’ 28% of sector stock positive) is the Staples sector followed by Materials.

All other sectors show lackluster performance, yet we still see relative strength in the defensive/cautious names.

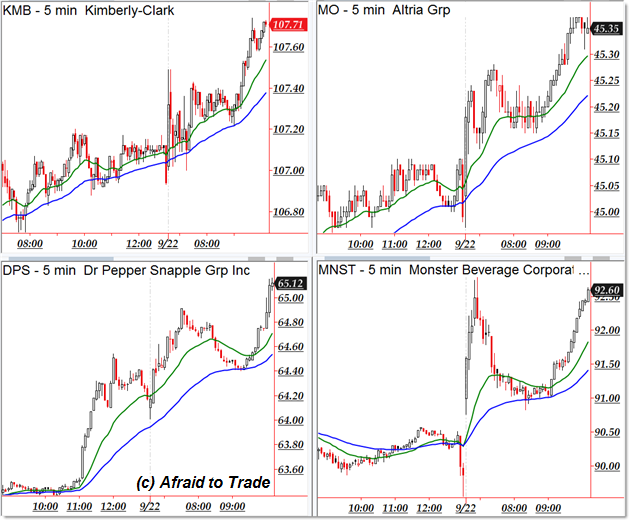

If you believe the market will reverse higher off support today, look to trade these bullish strength names:

Kimberly Clark (KMB), Altria (MO), Dr. Pepper (DPS – back again), and Monster Beverage (MNST).

If instead you believe the market will continue its sell-swing lower into the close, focus on these bear candidates:

Applied Materials (AMAT), Netflix (NFLX), Fluor (FLR), and Tiffany (TIF).

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).