Apple AAPL Shatters the 600 per Share Mark – Trade Planning

With Apple breaking above the $600 per share level this morning, let’s take a look at this new bullish development and plan potential targets should the breakout continue higher.

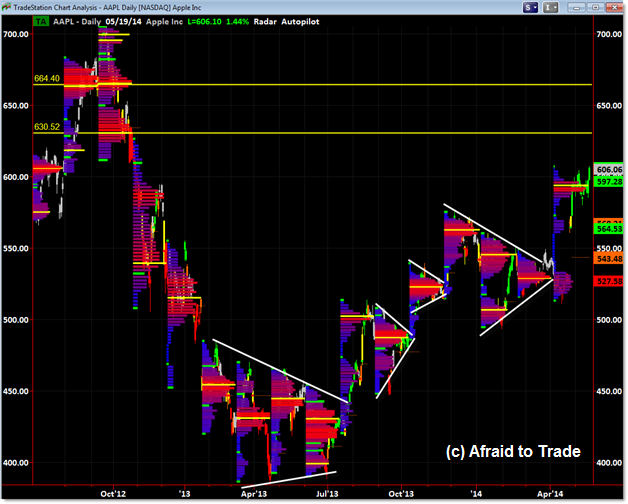

We’ll start with a quick glimpse of the breakout currently in motion:

Apple shares broke a falling trendline or triangle pattern above $530 per share which instantly propelled price – on a gap – toward the prior high near $570 per share in late April.

The breakthrough above $570 – notice the big white candle on the breakout – continued price all the way to the $600 per share ’round number’ reference level.

Price stalled in a tight range with a clear ceiling of resistance at the easy-to-remember $600 level and this morning we’re seeing another impulsive breakout free of the resistance and into “Open Air.”

To see the “Open Air Pocket” and plan the next stage of potential upside targets, let’s view a clear chart:

This time you can see the Symmetrical Triangle pattern that developed from October to April – and of course the breakout that is in motion at the moment.

Of educational importance, note the lengthy positive momentum divergence through the beginning of 2013 that preceded the current bullish trend reversal.

Apple shares are in a confirmed short-term uptrend from the $400 per share low to the present $600 breakout.

We also note the spike higher in momentum – along with the clear increase in buy/bullish volume – on the breakthrough above the triangle trendlines.

Now, what levels serve as potential targets and where should stops be placed if the breakout morphs (fails) into a Bull Trap?

The stop-loss levels are easier to pinpoint. A return under the $600 per share “prior resistance/ceiling” level triggers a likely “Bull Trap” and we would want to take stops that trigger on any price movement down away from the $600 per share breakout level.

As for targets, price has entered an “Open Air” pocket above the 61.8% Fibonacci Retracement ($583.00) and prior swing high from December 2013 ($575).

Simple level planning targets the next “easy” reference level of $650 per share and above that extends to $700 again.

If we want to take it a step beyond “easy” targets, we can use a Volume Profile Chart for sophisticated targeting:

Using the “Radar” or Color Volume Profile Chart from TriggerCharts (indicator for TradeStation), we can see at least two additional “hidden” upside target areas:

The $630 level served as a Volume Profile Level from October 2012

The $665 level also served as a more important “double profile” level from September and October 2012.

These would be potential ‘magnets’ or levels to target from a “Price at Volume” or profile type of logic.

For now, we’ll monitor price with respect to the $600 level for the potential of bullish trend continuity and another upward impulse that could develop quickly above $600 (in the event buyers step in aggressively and short-sellers similarly buy-to-cover losing positions).

Initial targets suggest a move toward $630, a pause/consolidation, and potential ‘wave’ movement toward $650 and even the $665 levels ahead of a future pathway that could extend toward $700 per share in the future (as long as the short-term uptrend continues without a future reversal).

For now, study the interaction at $600 with respect to the potential “Bull Trap” outcome against the odds of a continued push at least toward the $630 level.

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

3 Comments

Comments are closed.