April 11 Breakdown Sector Breadth and Trending Update

With the broader market breaking a key support level this morning, let’s take a quick look at mid-day Sector Breadth and view the results of our Trending Stock Scan candidates.

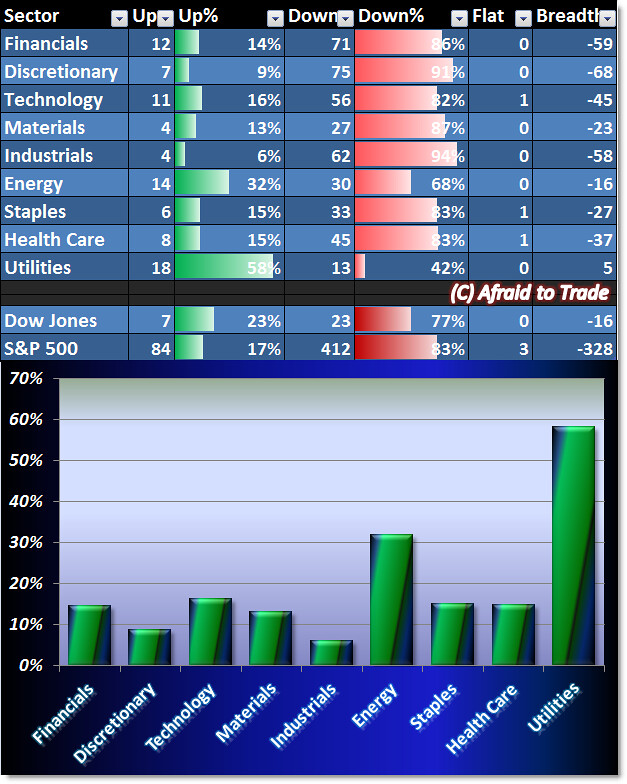

Here’s current Bearish/Breakdown Sector Breadth:

We’re seeing another clear example of Bearish Breadth where the strongest sector is Utilities ($XLU) followed by Energy ($XLE).

All other sector breadth readings show roughly 15% of each sector’s stocks are positive on the session.

In fact, 83% of all stocks in the S&P 500 are negative on the session mid-day.

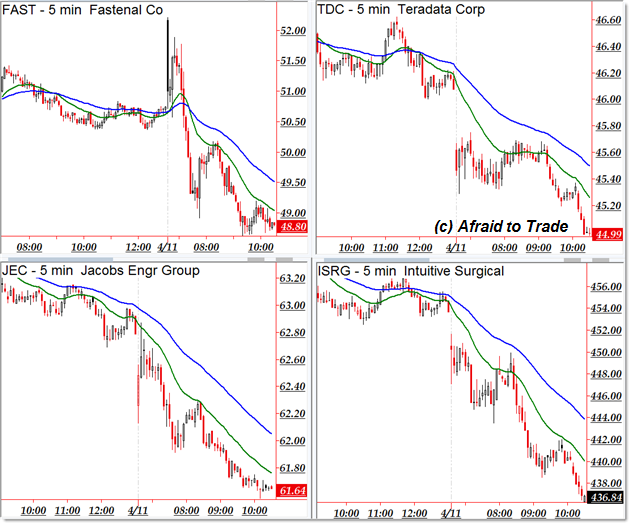

This brings us to our bearish intraday trending stock candidates for additional short-selling opportunities:

Fastenal Co (FAST), Teradata Corp (TDC), Jacobs Engineering (JEC) and a stock I highlighted on Wednesday – Intuitive Surgical (“Gaps and Traps with Breaks and Fakes for ISRG“) top our downtrending list.

I was unable to find four clean uptrending stocks today, so I narrowed the list to these two:

If you simply can’t resist going against the trend of intraday money flow, then C.H. Robinson (CHRW) and ConocoPhillips (COP) are showing relative strength and intraday uptrends at the moment.

Unless we see another stellar intraday reversal, continue focusing on the relative weakness names and shorting them as the sell-off continues.

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

Time to sell the utilities?