April 4th Reversal Day Breadth and Trending Stocks

What a day this has been so far! Let’s get right to our intraday Sector Breadth update and trend day trading candidates (hint – there’s far more bearish stocks trending down today than those trending up).

Here’s our SP500 Breadth Chart:

A quick glance shows a huge spike (bullish money flow) into “Risk-Off” or Defensive Utilities (along with some flow into Energy and Staples).

However, across the board, money is clearly flowing out of the Stock Market in today’s session. Short-sellers may want to concentrate their attention on the weakest sector, Technology ($XLK) and perhaps Consumer Discretionary ($XLY).

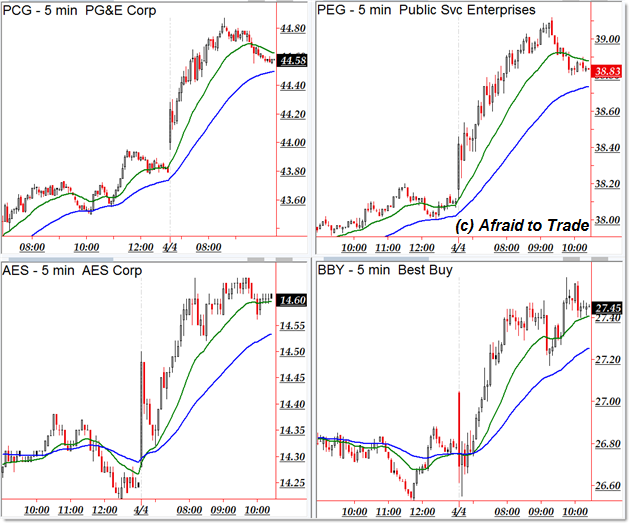

Beyond the broader picture of Sector Strength/Weakness, here are our top uptrending candidates:

I would consider staying away from the long side as long as the broader US Equity Market trends lower. There’s no point in trying to find the diamond in the rough (finding the few stocks fighting the trend) when the tide of money flow is so strong.

But if you must fight a trend, consider PG&E (PCG), Public Service Enterprises (PEG), AES Corp (AES) and perhaps Best Buy (BBY) which is a rare gem of consumer discretionary strength on a broad sell-off day.

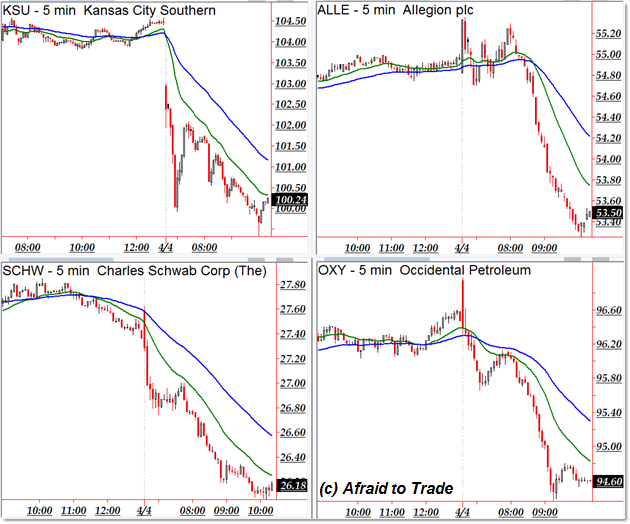

Otherwise, here are our strongest downtrending candidates (and the scan revealed far more than four):

Kansas City Southern (KSU), Allegion (ALLE), Charles Schwab (SCHW – which is interesting), and Occidental Petroleum (OXY).

With a bull trap sprung, bears have their opportunity to wreck havoc today (and they already have).

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s new book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

2 Comments

Comments are closed.