April 7 Collapsing Sector Breadth and Intraday Trending Stocks Scan

At the halfway point of an extended sell-off in the Stock Market, what message does our “Sector Breadth” chart send and which stocks may be intraday “trend day” trading candidates?

Here’s our April 7th sell-off intraday update:

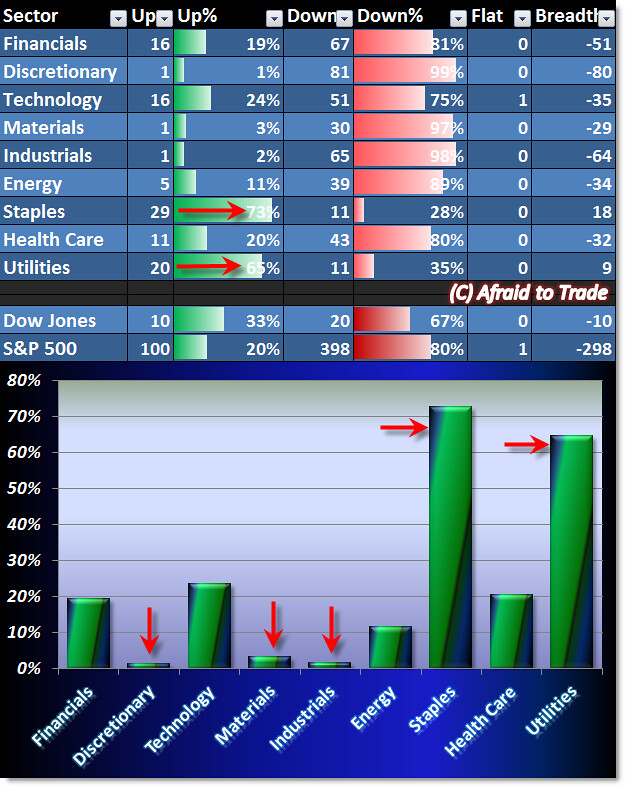

Just like Friday’s “Market Collapse” update where Sector Breadth was clearly negative, today’s session shows similar “collapse” parameters.

First, almost all S&P 500 Consumer Discretionary ($XLY), Materials ($XLB), and Industrials ($XLI) stocks are positive mid-day. Roughly 20% of Financial ($XLF) and Technology ($XLK) stocks are positive at this moment while 10% of Energy ($XLE) stocks are up.

Contrast this with 73% of Consumer Staples “Risk-Off” ($XLP) and 65% of Utilities ($XLU) stocks are positive at mid-day.

This would be a clear picture of “Risk-off” bearish/defensive money flow in a broader scope as money flows out of US Equities at the moment.

We’ll start first with four potential “trend day” sell-off stock candidates (and there are many):

Our scan includes the ADT Group (ADT), Lincoln National Corp (LNC), the CME Group (CME), and Time Warner Cable (TWX).

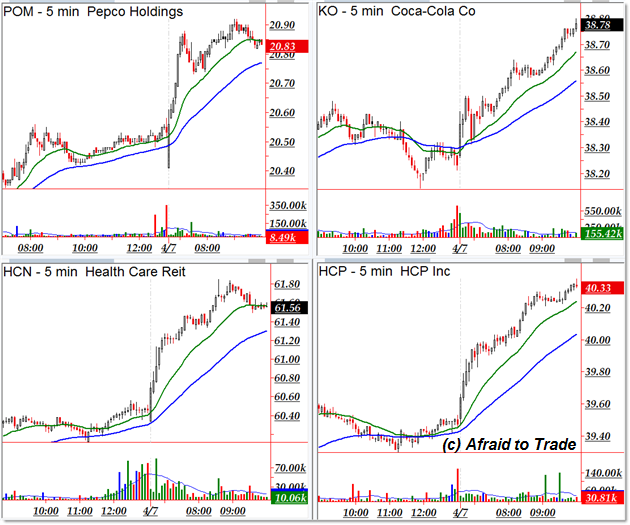

For those brave enough to fight money flow in the braoder market, here are potential uptrending “trend fighters”

Pepco Holdings (POM), Coca-Cola Co (KO), Health Care Reit (HCN), and HCP Inc (HCP). With the exception of Coca-Cola, most traders probably have never heard of the other top uptrending candiates.

Interestingly enough, Pepco Holdings is a Utility Company while Health Care REIT (HCN) and HCP are both real estate investment trusts (REITs), both of which invest in health care real estate.

Continue monitoring the remainder of the session for any sign of reversal and barring that, continue shorting weak stock candidates.

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s new book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

6 Comments

Comments are closed.