Bear Trap Trigger Puts Price on Path to All Time Highs for Apple AAPL

After springing a Bear Trap, Apple (AAPL) shares pivoted and trapped the short-sellers, placing price on a pathway straight up toward all-time highs.

Let’s update our Apple analysis, pinpoint the Trap Lesson, and plot what levels are most important now.

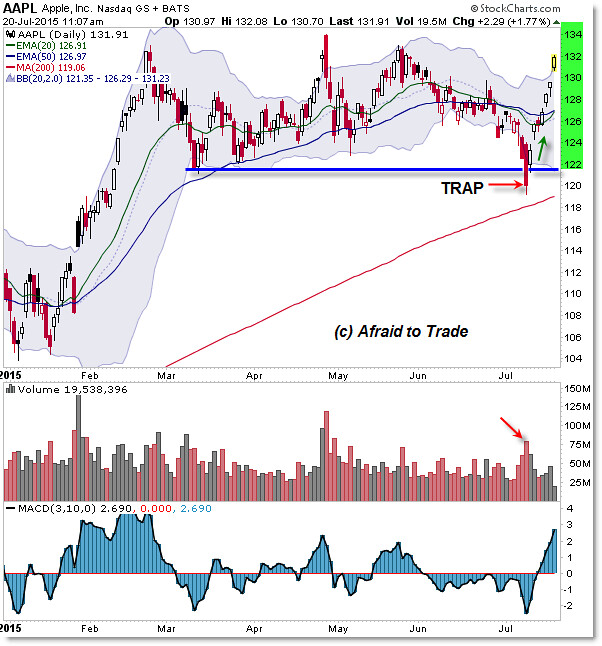

Here’s the Daily Chart Trap and Outcome:

For our prior update on Apple, see the post “Apple Breaking Down – New Level Planning.”

I wanted to update you on the trigger break, potential for a trap, and what to watch early in July.

Note the Daily Chart “Price Pathways” (color highlights) and target down toward the rising 200 day SMA in the prior post.

I wrote this:

“Ultimately, buyers can once again find value here and “bounce” the stock up away from this level for a fourth time, creating an aggressive buy opportunity (with a tight stop).”

What looked like a genuine sell-short opportunity (breaking under $122 and $121.50 as mentioned) was successful ONLY toward the $119 level which was actually just above the rising 200 day SMA.

Given that price broke down, triggered a short-sell signal, and then instantly reversed ahead of the likely target, we have a BEAR TRAP outcome.

Bear Traps tend to produce explosive movements in the opposite direction as traders are trapped and forced to liquidate positions that are losing money rapidly.

In this case, both short-sellers capitulated on the return ABOVE the $122 breakdown level, triggering an aggressive buy signal with a price pathway toward the prior high.

We can’t predict in advance when buyers will spring a Bear Trap (or sellers spring a Bull Trap), but we as traders can adapt in two important ways:

- Exit Positions that we put on after a trap (meaning – plan and take stops when triggered… don’t hold on)

- Enter NEW Positions on a Trap Outcome

Know what a Trap is, know what likely happens AFTER a Trap occurs, and adjust accordingly.

It’s a spot to limit losses immediately, because small losses can become huge losses if we fight the price and hold on to a trap outcome.

By the same token, we can enter a new aggressive position on the trap outcome, reaping instant profits on the “bigger movement in the opposite direction” as one side of the market is thrown rapidly off balance.

Nevertheless, Apple gives one of many real-world examples of the importance of planning – without bias – and reacting (as soon as possible) to unexpected outcomes like traps.

Here’s the Weekly Chart to provide prospective and remind us of the powerful uptrend in place:

Despite small divergences – all of which have produced small pullbacks (retracements) to the rising 20 week EMA – Apple shares continue to trend powerfully higher.

The recent Trap scenario set in motion another aggressive buy opportunity on a path to new highs.

At this point, we’re monitoring the prior highs above the $132.00 per share level.

We look to prior retracements – drawn above – for the potential for extended highs in price yet to come.

That’s the basis of any bullish breakout and pro-trend strategies in Apple.

One final thought – bears/sellers had their chance to push price lower… and they failed.

At this time, bears are becoming bulls via the rapid triggering of their stop-losses at the same time bulls are becoming more aggressive.

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

This is a decent chance to go for sell, but we need to be careful with money management, if we take wrong step with high lot size then we might find our self into huge losses, so that’s why manageable lot size is very crucial to everyone’s chance as a broker and my chance is completely bullish with OctaFX broker’s low spread of 0.2 pips for all major pairs that I have used so far while there is no hidden charges or fees.