July 20 Bull Market Continues Market Update and Stock Scan

The short-squeeze and bullish price surge continues in the stock market at the same time gold collapsed to the $1,100 target level.

Let’s scratch the surface and look beyond the headlines to what’s trending today:

The intraday uptrend continued with price breaking through toward the 2,130 target level on a possible journey toward fresh new all-time highs (which have already been achieved in the NASDAQ Index).

Ultimately we focus on the uptrend and intraday moving averages as spots to buy retracements into this ongoing short-squeeze bullish movement.

See this morning’s update on Apple (AAPL) with respect to the Bear Trap and Bullish Pathway.

Love it or hate it, this bull market simply continues indefinitely into a new key level – the 2,130/2,135 pivot.

Follow along with members for more precise daily planning, analysis, and education.

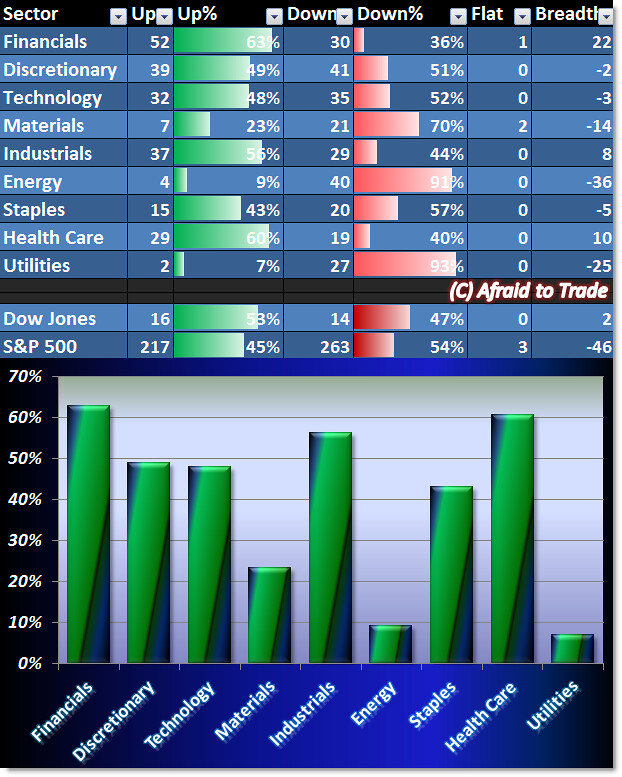

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Despite the nearness to new all-time highs, most sectors aren’t super bullish today.

Three sectors trade above the 50% Breadth line (meaning 50% of stocks in the sector are positive) and those are Financials, Industrials, and Health Care.

Two sectors are showing sub-10% Breadth: Energy and Utilities.

While not a resounding endorsement of fresh new all-time stock market highs, Breadth is sending a bullish-but-cautious signal right now.

Do be careful here.

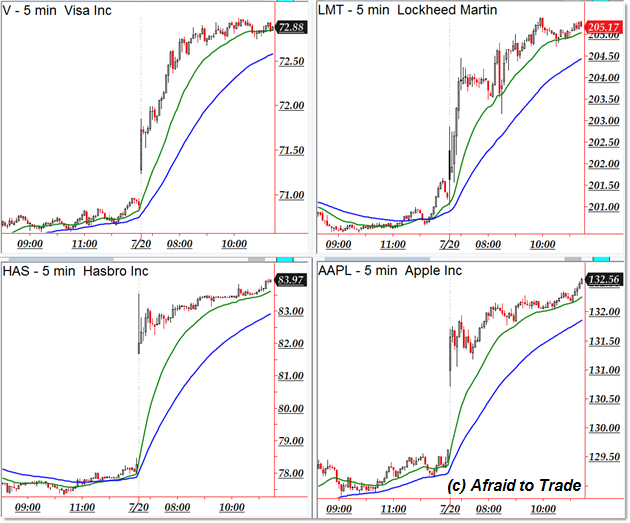

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Visa (V), Lockheed Martin (LMT), Hasbro (HAS), and Apple (AAPL)

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Stratasys (SSYS), Altera (ALTR), Occidental Petroleum (OXY), and Royal Gold (RGLD – along with Randgold GOLD).

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

Nice blog…

Good analysis/data Tips. Thanks for sharing.