Mid-September Stock Scanning for Most Extended Stocks to Trade

It’s time to update our “Most Over and Under-Extended Stock Scans” for the month of September!

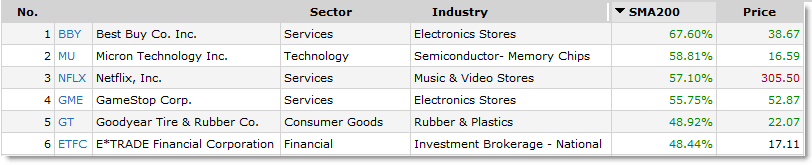

Let’s start our search with the top six stocks most over-extended (on a percentage basis) up away from their rising 200 day Simple Moving Averages:

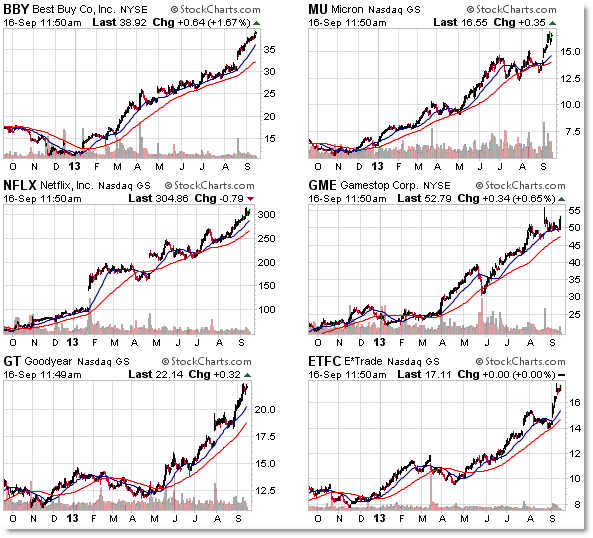

It’s often interesting how a strong stock (or weak stock) can remain in the “top extended list” month after month, and that’s part of the purposes of the scan.

We want to locate strongly trending stocks with incoming money flow and use them either as trading vehicles (buying retracements or ‘flag’ patterns) or investing candidates (holding for as long as possible until the trend structure reverses).

This type of simple scan helps us achieve these goals.

For example, take a look at a few prior updates on GameStop, a stock that has consistently appeared in “top trending” stock lists (along with Best Buy lately):

“Breakouts and Uptrends for GameStop (GME) and Electronic Arts (EA)”

“GameStop (GME): A Strong Stock Getting Stronger”

Back to the current candidates, Best Buy (BBY) tops the list with a 67% reading above its rising 200 day SMA.

Other strong uptrending stocks, as seen in the chart below, include Micron Technologies (MU), popular stock Netflix (NFLX), Goodyear Tires (GT), and E*Trade Financial (ETFC):

Of these six names, BestBuy (BBY), GameStop (GME), and Netflix (NFLX) ranked in the Top Stocks Most Extended to end July 2013 prior post.

The goal of this type of scan is to find powerful pro-trending names to trade (conservative strategy), or candidates to look for aggressive reversals or “fade” trades (not my preferred use of this list).

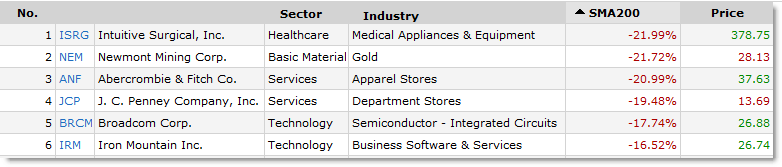

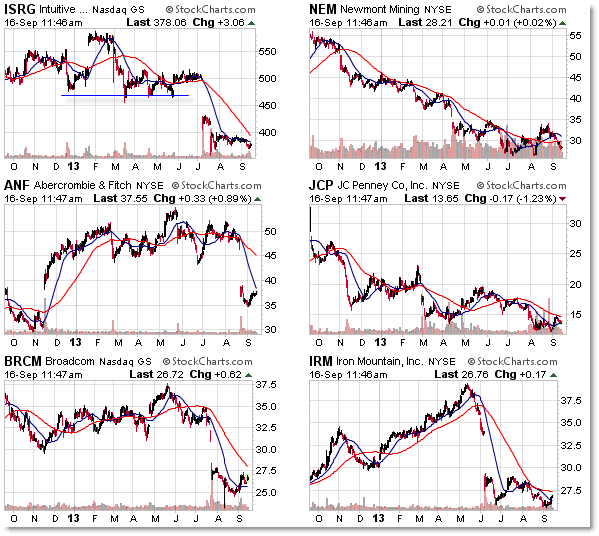

The same logic can be applied to the “Weak and Getting Weaker” stocks most under-extended from their falling 200 day SMA:

Similarly, Intuitive Surgical (ISRG) and Newmont Mining (NEM) carried over from July’s extended stock screen.

Two stocks that have been in the news with multiple bearish headlines – Abercrombie and Fitch (ANF) and JC Penney (JCP) – also appear on the most under-extended (weak and getting weaker) list.

These scans are starting points or launch-pads for you to do other research to see whether trading opportunities exist based on your strategies.

The “Over and Under-Extended Scans” can bring candidates to your attention that may otherwise not show up on other stock screens.

For more information, take a look at prior “Over/Under-Extended” Scan posts:

Over/Under-Extended Stocks from May 2013

Over/Under-Extended Stocks from February 2013

Join fellow members to receive daily commentary and detailed analysis each evening by joining our membership services for daily or weekly commentary, education (free education website), and timely analysis.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s new book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

I quite like reading an article that can make peple think.

Also, thanks for allowing for me to comment!