October 21 Scanning for Stocks with the Most Consecutive Upside Daily and Weekly Closes

Which stocks have closed the most days to the upside for the prior few weeks and also days? How might we trade these stocks?

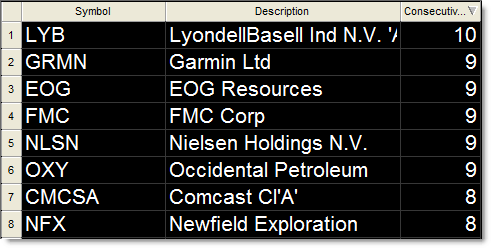

Let’s take a look at the “Most Consecutive Closes to the Upside,” starting with the Weekly Chart Scan:

Using TradeStation data and screener, we find the following stocks have closed 8, 9, or 10 weeks in a row to the upside.

We’re scanning for “persistence of uptrend” or “extended runs” for relative strength.

Garmin (GRMN) is a selected stock which we can see has closed nine weeks in a row to the upside:

There’s two ways we use this type of stock screen which is similar to how we use the “Screening for Stocks Most Extended from their 200 day SMA.”

Trend following or pro-trend traders can identify the stocks as the “strongest and getting stronger” category for potential pullback (retracement or bull flag) entry trades with the expectation of a future higher price high (trend continuation).

Fade or Reversal style traders instead can await for an immediate sell-signal (such as a break in a rising trendline or intraday reversal pattern) to establish a short-sale/fade (or reversal) aggressive trade.

Depending on your risk-tolerance and preferred trading style, you’re either ‘betting’ on an “extended stock to get more extended” or an “extended stock to retrace/reverse” lower to end the extended run.

Here’s the same type of scan using Daily Chart data:

Popular stock Apple (AAPL) joined the “Eight Club” of stocks that have traded eight days in a row to the upside:

As is often the case, we tend to see extended runs after a breakout or consolidation formation as a stock enters a “positive feedback loop” where buyers enter new positions and short-sellers buy-back to cover old (pre-established) positions via stop-losses.

Best Buy (BBY) is another “Strong and Getting Stronger” stock that I initially mentioned on a “Stocks Most Extended from their 200d SMA” screen from July 2013 – it continues to be strong and getting stronger.

Technology giant Microsoft (MSFT) also tops today’s list of extended runs along with financial companies Charles Schwab (SCHW) and Legg-Mason (LM).

Use these names and the “consecutive close” scans as a simple way to find stocks that may not otherwise show up on more advanced stock screens.

I’ll be discussing breakout, retracement, and reversal trading tactics live at the Las Vegas Traders Expo on November 22 – join me and your fellow traders at the free expo!

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s new book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).