SP500 Market Internals Turn Unstable to Start October

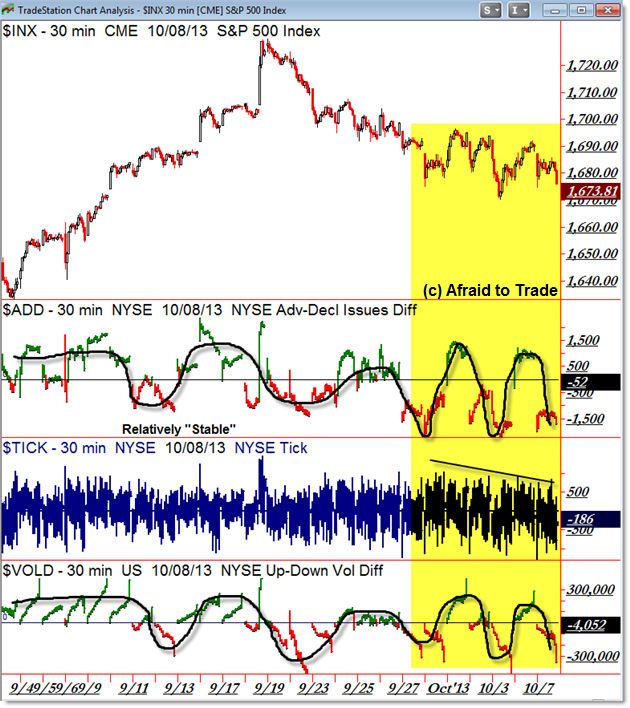

When assessing Market Internals, it’s helpful to classify the current state of internals as “stable” or “unstable” as I’ve shown in prior updates.

The last week has shown a period of instability or “chaos” in Market Internals due to the recent volatile price action surprisingly continued within a clear trading range.

Let’s update the “Big Three” internals and then note the recent shift to instability in internals:

Mainly we use Market Internals for two factors:

1. Confirmation – Price makes a new high while internals also make a new high (suggests continuity)

2. Non-Confirmation – Price makes a new high while internals form a lower high (divergence suggests reversal)

In a stable environment, these factors become clear and help us plan our bull/bear bias and intraday trading decisions.

However, in unstable environments, the signal is muted by noise or ‘chaos’ from rapidly shifting values.

On the $ADD (Breadth) and $VOLD (Volume Difference of Breadth), I connected the daily values with a black line to show a rhythmic progression or “stability” in internals.

The recent movement through October shows gaps, large/extreme values, and day-to-day shifts all in the context of a relatively flat market in a trading range.

Let’s zoom-in on Breadth specific to the SP500 to see the shift clearly:

The Fed-inspired breakout of September 18th was NOT confirmed with market internals (Breadth formed a visual lower high) which served as an active non-confirmation of the new all-time high.

Price subsequently fell from the peak (internals were helpful in forecasting the probabilities for a reversal).

The positive market internal divergence from September 23 to 26th did not result in a short-term trend reversal into October which was the first sign something may be ‘amiss’ with internals.

From there – in the highlighted region – internals have been useless or ineffective in providing either confirmation or non-confirmation/divergence signals.

In other words, focus your trading decisions on price, not internals, while we remain in this ‘unstable’ (highly news-driven) environment or until we see a clean breakout from the trading range between 1,675’s support and 1,695’s resistance.

For additional insights and information on “Stability and Instability” in internals, please see the following:

Market Internals Move from “Stability to Instability”

Three Quick Indicators to Measure Volatility

March 6 Structure and Triangle Update (unstable internals)

February 20: Market Structure and Internals after Sell-off

February 13: Divergent Market Internals and Triangle

A Lesson on Silver, Stability and the Sell-off

Join fellow members to receive daily commentary and detailed analysis each evening by joining our membership services for daily or weekly commentary, education (free education section), and timely analysis.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s new book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

Yes indeed, the market is unstable as you relate “The Fed-inspired breakout of September 18th was NOT confirmed with market internals (Breadth formed a visual lower high) which served as an active non-confirmation of the new all-time high”

On Tuesday, October 8, 2013, Inverse Volatility, XIV, plummeted, as Volatility, ^VIX, rose strongly again today, sending Volatility ETNs/ETFs XVZ, TVIX,VIXY,VIXM, seen in this Finviz Screener, soaring higher, on the extinguishment of Nation Investment, EFA.

Thus destabilizing liberalism’s nation state sovereignty and banker seigniorage, on investor’s fears of a US Default. The new economic and political paradigm of authoritarianism, will rise out of sovereign insolvency and banking insolvency, as foretold in Revelation 13:3-4, that being a Minsky Moment, where regional nannycrats will be appointed sovereign, and provide public private partnership seigniorage, as they issue diktat for regional security, stability, and sustainability.

Liberalism was characterized by trust in bankers, stock brokers, and asset managers, to the point of being insestious, through US Fed and other world central bank monetary policies such as POMO. But authoritarianism will be characterized by trust in the word, will and way of the regional nannycrats; so much so that the Apostle Paul wrote in Revelation 13:3-4, that All the world marveled and followed the beast; so they worshiped the dragon who gave authority to the beast; and they worshiped the Beast.

Nation Investment, EFA, traded lower o0.6% lower on fears of US Default, and on awareness that the US Fed’s monetary policies no longer stimulate global growth and trade, and have actually turned” money good” investments bad. The BRICS, EEB, traded 1.6%, lower, Emerging Markets, EEM, 1.0%, lower and US Stocks, VTI, 1.3% lower. Global Industrial Producers, FXR, traded 1.3% lower. Nations trading lower included the following:

Greece, GREK 4.9%, on the strong trade lower in the National Bank of Greece, NBG

Turkey, TUR, 2.5

India, INP, 2.2 and India Small Caps, SCIN, 2.2, on the strong trade lower in India Banks, IBN, HDB

German Small Caps, EWGS, 2.2

Philippines, EPHE, 2.1

Mexico, EWW 1.9

Norway, NORW 1.7

Ireland, EIRL, 1.6

Argentina, ARGT 1.6

US Small Caps, that is the Russell 2000, IWM 1.6

US Stocks, VTI, 1.3

Canada, EWC, 1.3

UK, EWU, 1.3 and UK Small Caps, EWUS, 2.2

Argentina, ARGT, 1.3

The strong fall lower in Risk Assets, as well as a broad number of sectors communicates that the Great Bear Market of October 2013, has commenced; sectors trading lower included the following:

Automobile Dealerships, 4.6%; this includes PAG, SAH, ABG, KAR, AN, KMX, LAD.

Biotechnology, IBB, 4.2%

Nasdaq Internet, PNQI, 4.1

Internet Retail, FDN, 3.4

IPOs, FPX, 3.0

Media, PBS 2.4

Software, IGV 2.3

Homebuilding, ITB 2.2

Solar, TAN 2.2

Pharmaceuticals, PJP 2.1

Retail, XRT 2.0

Investment Bankers, KCE, 1.9

Stockbrokers, IAI, 1.8

Transportation, XTN, 1.9

Small Cap Pure Value, RZV 1.9

Metal Manufacturing, XME, 1.8

Stock Brokers, IAI 1.6

US Infrastructure, PKB 1.6, with Specialty Chemical Manufacturer, PPG, 3.0

Networking, IGN 1.6

Semiconductors, SMH, 1.5

Small Cap Energy, PSCE 1.5 and Energy Production, XOP, 2.0

Too Big To Fail Banks, RWW, 1.5

On Tuesday October 7, 2013, the chart of the S&P 500, SPY, closed at 165.48, at the middle of a broadening top pattern, that goes back to May 13, 2013, immediately before May 21, 2013, when the Interest Rate on the US Interest Rate, ^TNX, turned higher to 2.1%, which sent Emerging Markets, EEM, plummeting, before they recovered and rallied higher, and now once again turned lower on September 20, 2013, as Jesus Christ acting in dispensation, that is in the administrative plan of God for the fulfillment of every age, Ephesians 1:10, has pivoted the world from liberalism into authoritarianism.

September 20, 2013, marked an Elliott Wave 5 High in the S&P 500, SPY; and the rise higher to 169 on October 1, 2013, marked an Elliott Wave 2 High, from which the S&P 500 has been in an Elliott Wave 3 Down; these are the most aggressive of all economic waves, creating the bulk of wealth on the way up, and destroying most of wealth on the way down.

Fiat money died Friday September 20, 2013, when World Stocks, VT, Major World Currencies, DBV, and Emerging Market Currencies, CEW, traded lower, terminating the sovereignty of democratic nation states and terminating the seigniorage of the world central banks. Confirmation of such is seen in the Too Big To Fail Banks, RWW, and Regional Banks, KRE, trading lower in value, the Market Off ETN, OFF, rising in value, and Volatility, XVZ, soaring.

Competitive currency devaluation has commenced on the exhaustion of the world central banks’ monetary authority, as investors are coming to realize that the US Fed’s monetary policies have crossed the Rubicon of sound monetary policy, and have made “money good” investments bad.

With both the Transports, XTN, and the Industrials, FXR, XLI, PSCI, trading strongly lower in value, we have Dow Theory concept that the financial markets have turned from bull to bear. The rise in the Stockcharts.com chart !BEARS communicates that The Great Bear Market of 2013, commenced on October 7, 2013.

Gold, GLD, and Silver, SLV, traded unchanged; but Gold Miners, GDX, fell 3.1% lower, and Silver Miners, SIL, 3.5%, lower, leading Uranium Miners, URA, 2.0%, Copper Miners, COPX, 1.6%, Coal Miners, KOL, 1.4%, Industrial Miners, PICK, 1.3%, Rare Earth Miners, REMX, 1.2%, lower, on Monday August 7, 2013; all on the awareness of the exhaustion of the US Fed’s monetary authority.

Yield Bearing Sectors trading lower included the following:

European Financials, EUFN, 1.3, led lower by the National Bank of Greece, NBG, and Ireland’s IRE.

Shipping Stocks, SEA, 1.3

The chart of the AUD/JPY, showed a close somewhat higher at 91.40; nevertheless, Australia, EWA, traded 0.4% lower, and Australia Small Caps, KROO, 0.8% lower … The chart of the EUR/JPY, closed somewhat higher at 131.54, but Eurozone Stocks, EZU, traded 0.7% lower … The trade lower in Asia Excluding Japan, EPP, and European Stocks, VGK, comes on the exhaustion of the US Fed’s monetary authority.

A portfolio of Market Vane ETFs, these being OFF, STPP, UUP, JGBS, XVZ, GLD, JGBD, FSG, seen in this Finviz Screener, and as a group traded 0.2% higher; these could be used as a basis for margin in a short selling portfolio; their upturn, which began October 7, 2013, communicates that financial marketplace trading has turned from Risk On investing to Risk Off disinvestment, and that credit is failing, and gold is rising as the means of developing and sustaining wealth.