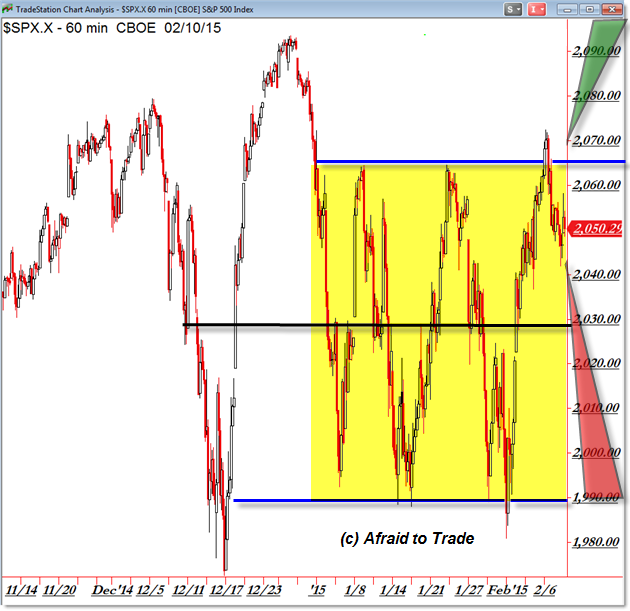

SP500 Still Playing the Range Ping Pong Game

We’re still waiting on your breakout, Mr. Market.

Until then, we’ll keep playing the brief game of Ping-Pong you’ve set-up within the clearly defined trading range.

Let’s update our short-term S&P 500 planning and get ready for the breakout… or simply more of the same.

Be sure to take a look at January 26th’s “Plotting the Current Range and Future Breakout for the S&P 500” post which STILL is applicable today.

Simply stated, the market has NOT yet broken out of its clear range and the “IF/THEN” game-planning stands.

We’ll keep playing “Ping-Pong Bearish” down away from the clear resistance line at 2,065 and “Ping-Pong Bullish” off of the 1,990 support trendline.

Here’s a tighter view of the price action:

From a planning standpoint, we’ll label our “Dominant Thesis” as the “Pattern Continuity” thesis which simply calls for bearish short-term trades as the market continues moving down away from 2,065 perhaps toward 2,000 then 1,990.

However, our “Alternate Thesis” will be the “Breakout” thesis which will trigger at this point above 2,070.

A clean and sustained trigger break above 2,070 suggests that the market will trade up toward 2,100 (new all-time highs).

Notice that BOTH sides of the market – under 1,990 and now above 2,060 – have experienced a TRAP outcome and thus thrust the market back inside the well-defined trading range.

Sometimes the simplest things work in terms of trading strategies.

Incorporate these levels – and the plan – into your trading decisions.

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

When we are trading in such highly risky things than ping pong is likely to happen and that’s why it’s highly important to get proper education first on these before trading them. I am doing scalping mainly on these things but that too only because I get excellent support from OctaFX broker, it has low spread of just 0.2 pips, high leverage up to 1.500 and many other fantastic advantages that really make things easy and smooth for us gain results.