SPY Option Strike Clusters for Friday Expiration

As many of you are aware – especially given the interesting intraday trading outcomes of Tuesday – this week marks not just a standard “Options Expiration Friday,” but a Quadruple Witching Options Expiration (which includes equity index futures).

We’re already seeing strange action intraday, such as continual moves higher on declining momentum, internals, and volume. Because funds have to rotate and adjust positions, classic chart patterns are less effective in ‘working,’ and there tends to be more “noise” to signal, though it all still comes down to supply and demand.

Nevertheless, it can be helpful to take a look at underlying open interest in options contracts set to expire on Friday – particuarly in the major market ETFs – to get a sense of where the most options reside, and thus where traders expect – or are positioned – to see the market close on Friday.

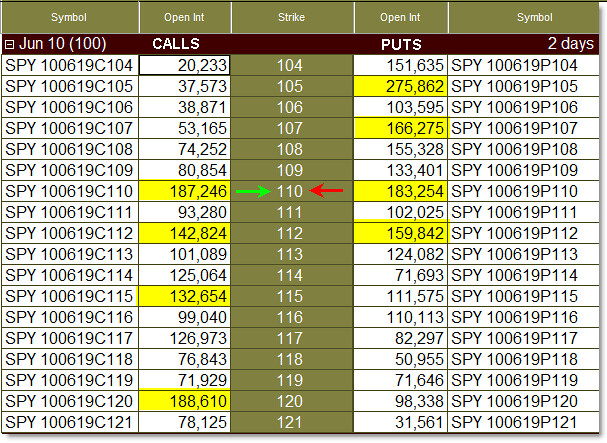

Let’s take a look at the Open Interest of SPY options – captured prior to Wednesday’s market close:

What we’re seeing is the Options data screen from TradeStation, with respect to SPY Calls (left) and Puts (right) and strike prices (middle) of the SPY.

I’ve highlighted the top four strikes in terms of current open interest to see where the options are ‘clustered.’

As of now, both open put and call options are clustered at the $110 strike, with around 185,000 contracts each.

Generally, professionals are net sellers of options while the retail public are net buyers of options, thus – if possible – the big funds would prefer the market to settle at options expiration near the largest cluster of options so the professionals get the money they took in by selling the options at those levels while the public’s options expire – unfortunately – worthless.

There’s of course a lot more to it than that, and I am by no means an options trading expert, but it can be helpful at least from a sentiment standpoint to see where open interest is clustered in leading stocks and index ETFs.

One could expect a down-move to $110 by Friday, though the second largest ‘cluster’ of options remains at the $112 level (140k calls to 160k puts).

These would be the clear levels to watch for a potential move down – or stagnation here (the SPY is at $112.00 at the time of this writing).

If anything, it’s just another way to see positions in the options market.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Somehow a comment didn't post so I'm reposting it:

acrowder wrote:

Thoughts on the days ahead: http://www.crowderoptions.com/options-blog/

Thanks Corey for this most helpful and timely article.

The lever on the S&P of late, has been the euro-yen carry trade. The S&P has been bouyant of the euro-yen carry trade, meaning it has been getting a lift or bounce up from the EUR/JPY. So a move in the S&P, SPY, up from today’s 111.96, will come mostly, from the carry traders going long the EURJPY from 112.46. Likewise, a move down in the S&P will come from those financed by the 0.25% interest Bank of Japan loans, going short the Euro, FXE, relative to the Yen, FXY.

For a chart article on deft deflation please use the link below

http://theyenguy.wordpress.com/2010/06/16/stren…